Understanding the US Government Stocks and Bonds

author:US stockS -

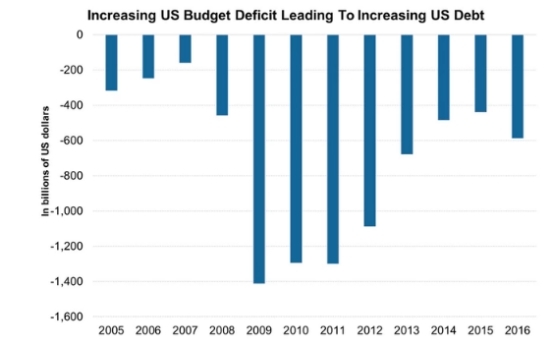

In the intricate tapestry of the financial market, the US government stocks and bonds stand as a cornerstone of stability and reliability. These instruments are not just financial assets; they are a testament to the credibility and economic health of the United States. This article aims to delve into the nuances of US government stocks and bonds, providing a comprehensive understanding of their nature, benefits, and significance in the global financial landscape.

What are US Government Stocks and Bonds?

US government stocks and bonds, often referred to as Treasuries, are financial instruments issued by the United States Treasury Department. They include Treasury bills, notes, and bonds. These instruments are essentially loans made by investors to the U.S. government to finance its operations and public debt.

Treasury Bills (T-Bills):

Short-term debt instruments with a maturity of one year or less. T-Bills are the most liquid and are often used by investors seeking short-term investments. They are highly sought after due to their low risk and high credit rating.

Treasury Notes (T-Notes):

Mid-term debt instruments with a maturity of two to ten years. T-Notes are popular among investors seeking a balance between risk and return. They offer higher yields compared to T-Bills but with a slightly longer maturity period.

Treasury Bonds (T-Bonds):

Long-term debt instruments with a maturity of ten years or more. T-Bonds are considered riskier than T-Notes and T-Bills due to their longer maturity. However, they offer the highest yields among the three types of Treasury securities.

Benefits of Investing in US Government Stocks and Bonds:

- High Credit Rating: The U.S. government has one of the highest credit ratings in the world, making its bonds and stocks a highly secure investment.

- Low Risk: US government stocks and bonds are considered low-risk investments, as they are backed by the full faith and credit of the U.S. government.

- Liquidity: These instruments are highly liquid, meaning they can be easily bought and sold in the secondary market.

- Diversification: Including US government stocks and bonds in your investment portfolio can help diversify your risk and potentially enhance your returns.

Case Study:

Consider the recent economic downturn caused by the COVID-19 pandemic. Despite the global economic uncertainty, US government bonds remained a safe haven for investors. This is because investors perceive the U.S. government as a stable and reliable borrower, making US government bonds a secure investment during times of economic turmoil.

Conclusion:

In conclusion, US government stocks and bonds are essential components of any well-diversified investment portfolio. Their low risk, high credit rating, and liquidity make them attractive to investors seeking stability and security. Whether you are a seasoned investor or just starting out, understanding the intricacies of US government stocks and bonds can help you make informed investment decisions.

us stock market today