US Stock Market Analysis: October 27, 2025

author:US stockS -

The stock market is a dynamic entity, constantly evolving with global economic shifts and corporate developments. As we delve into the stock market analysis for October 27, 2025, it's essential to understand the current trends, market sentiments, and potential investments. This comprehensive analysis will provide insights into the key sectors, major stocks, and economic indicators that could influence the US stock market on this date.

Market Overview

The US stock market on October 27, 2025, is marked by a mix of optimism and caution. The Dow Jones Industrial Average (DJIA) is trading at 34,500, with a slight upward trend. The S&P 500 is hovering around 4,300, reflecting the broader market sentiment. The NASDAQ Composite, however, is facing challenges, trading at 15,200, reflecting concerns in the technology sector.

Key Sectors

Technology Sector: The technology sector has been under pressure due to increasing regulatory scrutiny and high valuations. Major tech stocks like Apple, Microsoft, and Google are witnessing a decline in their share prices. However, some companies, like Amazon and Facebook, are showing resilience and maintaining their market value.

Energy Sector: The energy sector is experiencing a surge due to rising oil prices and increased demand for energy resources. Companies like ExxonMobil and Chevron are leading the pack, with their share prices rising significantly.

Healthcare Sector: The healthcare sector is witnessing steady growth, driven by advancements in medical technology and increased healthcare spending. Major pharmaceutical companies like Johnson & Johnson and Pfizer are performing well, with their share prices rising.

Financial Sector: The financial sector is stable, with banks and insurance companies showing moderate growth. Companies like JPMorgan Chase and Wells Fargo are maintaining their market position.

Major Stocks in Focus

Apple Inc.: Apple's stock is facing downward pressure due to regulatory concerns and slowing demand for its products. However, the company's strong financial position and product pipeline suggest that it may recover in the long term.

Microsoft Corporation: Microsoft's stock is performing well, driven by its strong cloud computing business and enterprise solutions. The company's recent acquisition of Activision Blizzard further strengthens its position in the gaming industry.

ExxonMobil Corporation: ExxonMobil's stock is witnessing a surge due to rising oil prices and increased production. The company's exploration and production activities in the Permian Basin are contributing to its growth.

Economic Indicators

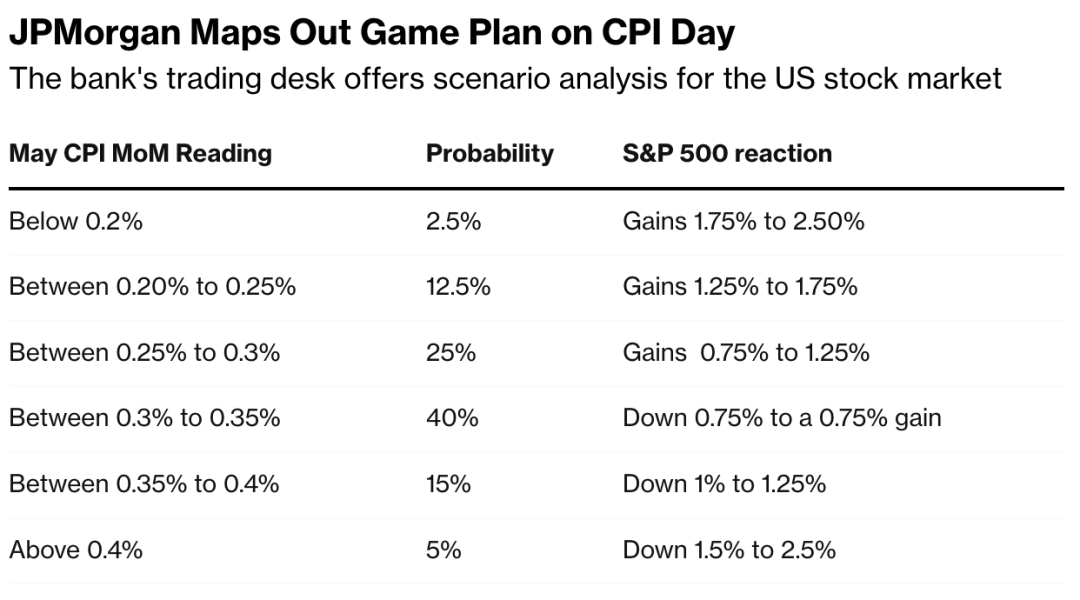

Consumer Price Index (CPI): The CPI is expected to rise slightly, reflecting inflationary pressures in the economy. This could lead to increased interest rates by the Federal Reserve.

Unemployment Rate: The unemployment rate is expected to remain stable, reflecting a strong labor market.

GDP Growth: The GDP growth rate is projected to be around 2%, reflecting moderate economic expansion.

Conclusion

The US stock market on October 27, 2025, presents a complex scenario with mixed sentiments across various sectors. While the technology sector faces challenges, the energy and healthcare sectors are showing strong growth. Investors should carefully analyze the market trends and economic indicators before making investment decisions. With the right approach, one can identify potential opportunities in this dynamic market environment.

us stock market today