US Shale Stock Price: A Comprehensive Guide

author:US stockS -

In recent years, the US shale oil and gas industry has experienced significant growth, leading to a surge in investor interest. One key aspect that investors often focus on is the stock price of shale companies. This article aims to provide a comprehensive guide to understanding the factors that influence US shale stock prices.

Understanding Shale Stock Prices

Shale stock prices are influenced by a variety of factors, including market conditions, company performance, and industry trends. Here are some of the key factors to consider:

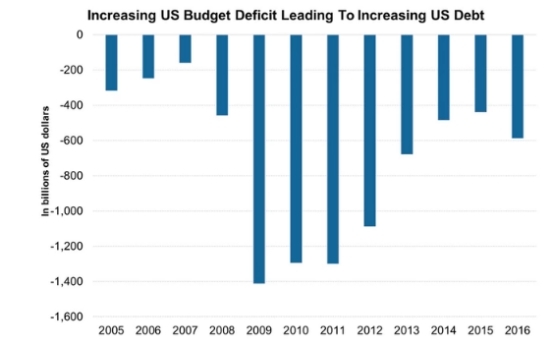

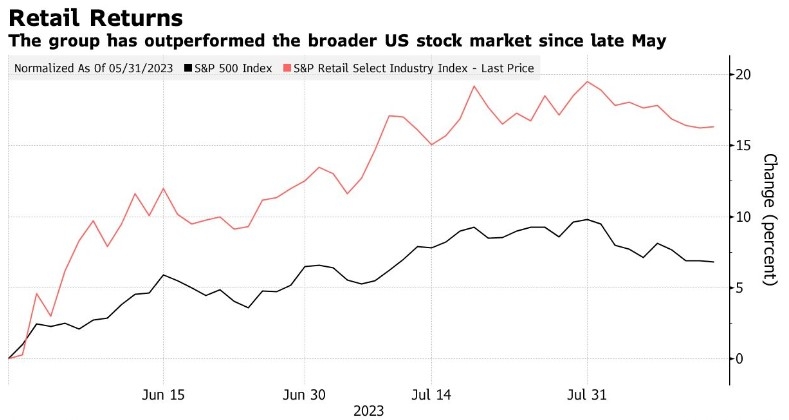

- Market Conditions: The overall market conditions play a crucial role in determining shale stock prices. Factors such as interest rates, inflation, and global oil prices can significantly impact investor sentiment and stock prices.

- Company Performance: The financial performance of individual shale companies is a critical factor in determining their stock prices. This includes metrics such as revenue, profitability, and debt levels.

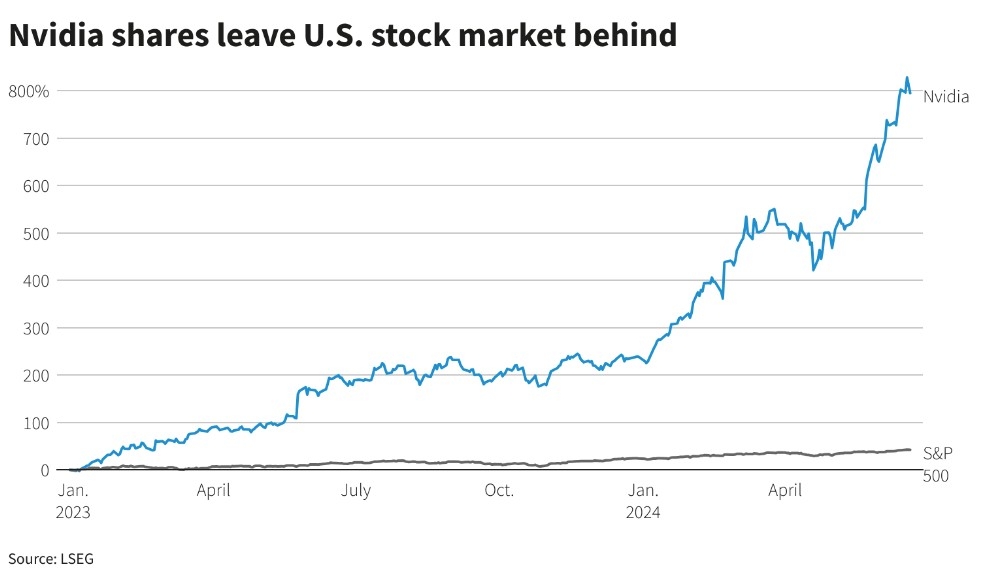

- Industry Trends: Trends in the shale industry, such as technological advancements and regulatory changes, can also influence stock prices. For example, the development of new extraction technologies can increase production efficiency and lower costs, leading to higher stock prices.

Market Conditions

Market conditions can have a significant impact on US shale stock prices. For instance, during periods of low oil prices, shale companies may face financial strain, leading to a decline in stock prices. Conversely, when oil prices rise, investor confidence typically increases, resulting in higher stock prices.

Case Study: Oil Price Volatility

Consider the case of Chesapeake Energy, one of the largest shale companies in the United States. During the oil price crash of 2014-2015, Chesapeake's stock price plummeted from over

Company Performance

The financial performance of shale companies is a key driver of stock prices. Companies with strong revenue growth, high profitability, and low debt levels tend to have higher stock prices. Conversely, companies with poor financial performance may see their stock prices decline.

Case Study: Schlumberger's Performance

Schlumberger, a leading provider of technology services to the oil and gas industry, has demonstrated the impact of strong company performance on stock prices. Over the past five years, Schlumberger has consistently reported strong revenue growth and profitability, leading to a significant increase in its stock price.

Industry Trends

Industry trends, such as technological advancements and regulatory changes, can also impact US shale stock prices. For example, the development of hydraulic fracturing (fracking) technology has revolutionized the shale industry, leading to increased production and lower costs. As a result, companies that have successfully implemented these technologies often see higher stock prices.

Conclusion

Understanding the factors that influence US shale stock prices is crucial for investors looking to invest in this sector. By considering market conditions, company performance, and industry trends, investors can make more informed decisions and potentially achieve higher returns.

us stock market today