US Election Results: How They Impact the Stock Market

author:US stockS -

Introduction

The United States presidential election, often a highly contentious event, has the potential to significantly impact the stock market. As investors and analysts alike closely monitor the polls, it’s essential to understand the potential implications of election results on the market. This article delves into the historical patterns, key indicators, and potential case studies that can shed light on how the stock market reacts to election outcomes.

Historical Patterns

Throughout history, there have been various theories and observations regarding how election results affect the stock market. While it’s challenging to predict the immediate market reaction to election results, historical patterns can provide some insight.

- Dow Jones Industrial Average: Historically, the Dow Jones Industrial Average has shown a tendency to rise during Republican presidencies and decline during Democratic presidencies. However, this pattern is not absolute and can be influenced by various economic factors.

- S&P 500: The S&P 500 has also shown some correlation with election results, with a tendency to perform better under Republican presidents. Yet, this correlation is not as strong as the one observed in the Dow Jones Industrial Average.

Key Indicators

Several key indicators can help predict the potential impact of election results on the stock market:

- Policy Expectations: The stock market tends to react to the expected policies of the incoming administration. For instance, a Republican administration might be seen as more business-friendly, potentially leading to a positive market reaction.

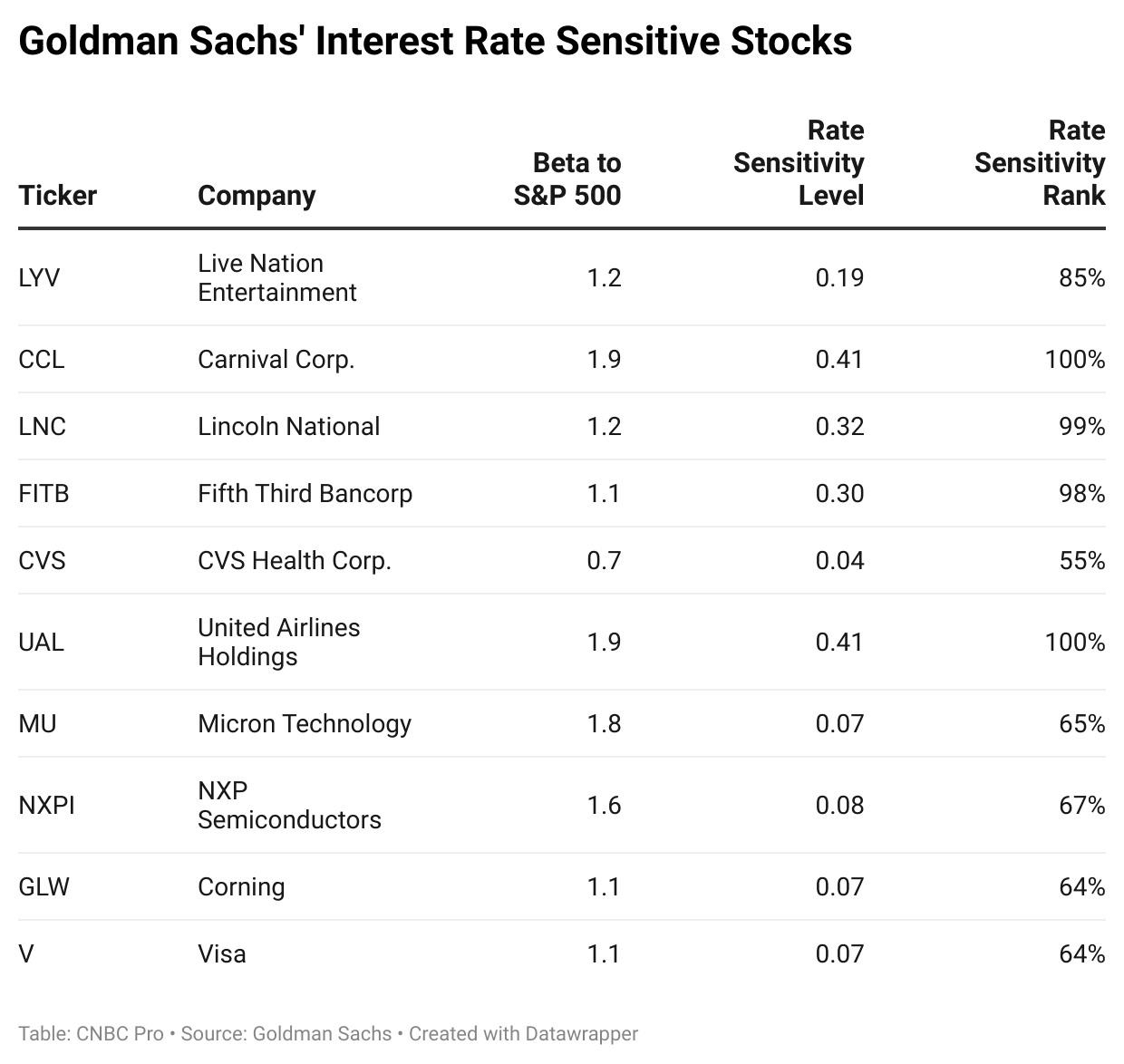

- Interest Rates: The expected changes in interest rates can significantly impact the stock market. A lower interest rate environment is generally seen as favorable for stocks.

- Economic Outlook: The stock market often reacts to the broader economic outlook. A strong economy can lead to increased corporate earnings and a positive market reaction.

Case Studies

Several historical cases illustrate the potential impact of election results on the stock market:

- 2016 Election: In the 2016 election, the stock market experienced a sharp increase following Donald Trump’s victory. This was attributed to the market’s optimism regarding Trump’s pro-growth policies.

- 2008 Election: The 2008 election saw a significant drop in the stock market following Barack Obama’s victory. This was attributed to concerns about the economic downturn and potential tax increases.

Conclusion

While the impact of election results on the stock market is not always predictable, historical patterns and key indicators can provide valuable insights. As the 2024 election approaches, investors and analysts will be closely monitoring the polls and potential policy changes to better understand how election results could impact the stock market. By understanding the historical context and key indicators, investors can make more informed decisions regarding their investments.

us stock market today