Trading US Stocks from Dubai: A Comprehensive Guide

author:US stockS -

In today's interconnected global market, Dubai has emerged as a financial hub that offers investors from around the world, including those from the Middle East, a gateway to the lucrative US stock market. Trading US stocks from Dubai presents unique opportunities and challenges. This article delves into the essentials of trading US stocks from Dubai, providing a comprehensive guide for aspiring investors.

Understanding the US Stock Market

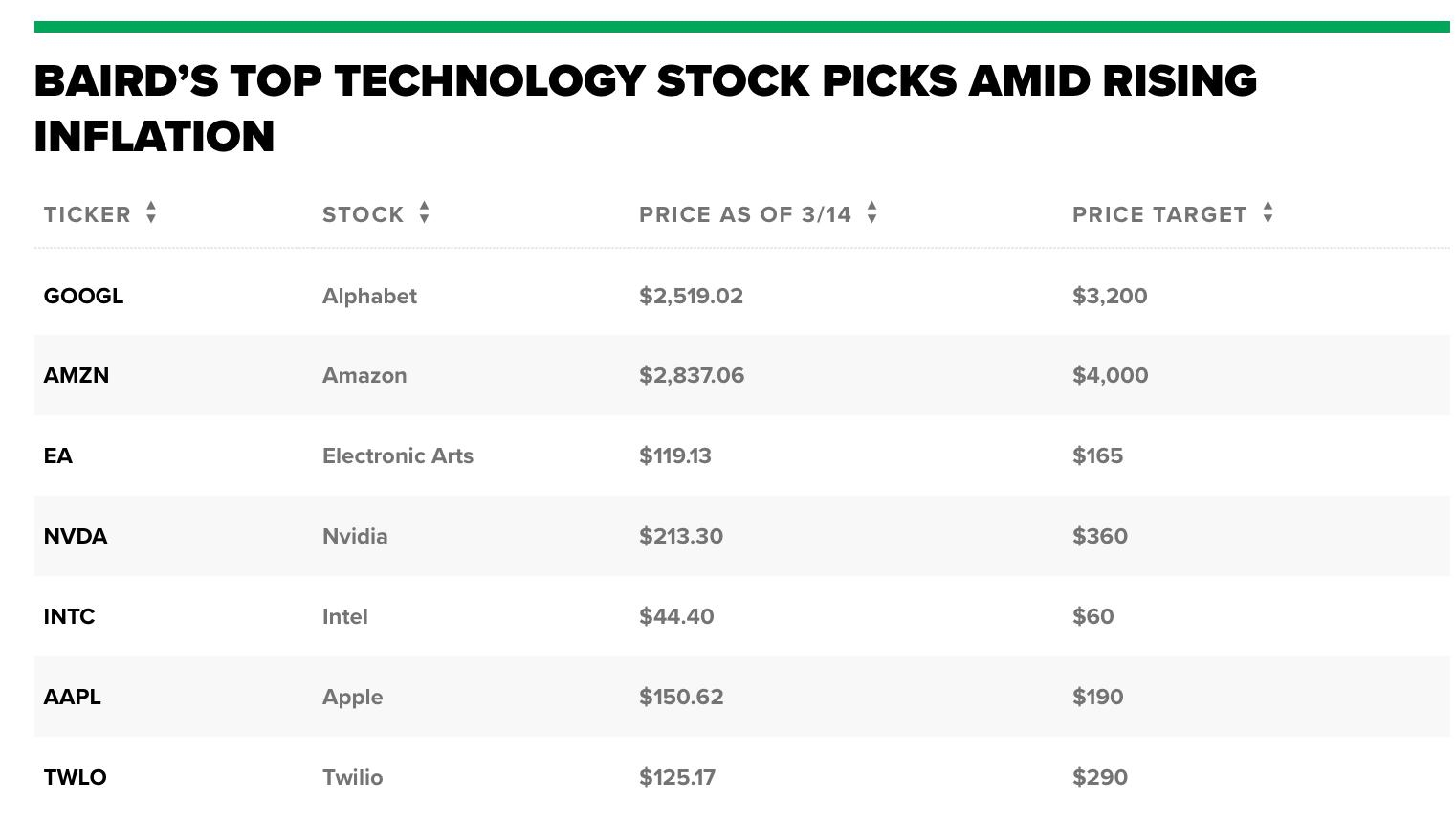

The US stock market is the largest and most liquid in the world, home to iconic companies like Apple, Google, and Microsoft. It offers a wide range of investment options, including stocks, bonds, and exchange-traded funds (ETFs). Understanding the basics of the US stock market is crucial for anyone looking to trade US stocks from Dubai.

Opening a Trading Account

To trade US stocks from Dubai, you need to open a trading account with a reputable brokerage firm. Several international brokers offer services to Dubai-based investors. When choosing a broker, consider factors such as fees, commission structure, and customer support. It's essential to select a broker that is regulated by a reputable financial authority.

Understanding Risk and Reward

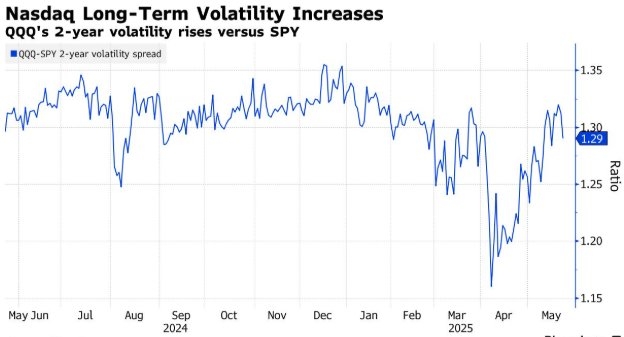

Trading stocks involves risk and reward. While the potential for high returns is significant, so is the risk of losing your investment. Risk management is a crucial aspect of trading, and investors should be aware of their risk tolerance before investing.

Tax Implications

When trading US stocks from Dubai, it's important to understand the tax implications. Dubai has a zero-tax policy for residents, but non-residents, including expatriates, are subject to taxes on income earned from investments. It's advisable to consult a tax professional to ensure compliance with tax regulations.

Using Online Trading Platforms

Online trading platforms have made it easier than ever to trade US stocks from Dubai. These platforms offer real-time market data, advanced charting tools, and the ability to execute trades quickly and efficiently. Some popular online trading platforms include TD Ameritrade, E*TRADE, and Charles Schwab.

Diversifying Your Portfolio

Diversification is a key strategy for managing risk in your investment portfolio. By investing in a variety of stocks across different sectors and geographical regions, you can reduce the impact of market volatility on your portfolio.

Case Study: Dubai-Based Investor's Success Story

Consider the case of Sarah, a Dubai-based investor who decided to trade US stocks after conducting thorough research. She opened an account with a reputable brokerage firm, diversified her portfolio, and implemented a disciplined risk management strategy. Over time, her investments grew significantly, and she achieved her financial goals.

Conclusion

Trading US stocks from Dubai offers exciting opportunities for investors looking to diversify their portfolios and capitalize on the global market. By understanding the basics of the US stock market, opening a trading account, managing risk, and using online trading platforms, investors can achieve their financial goals. As always, it's essential to do thorough research and consult with a financial advisor before making investment decisions.

us stock market today