Should You Invest in the US Stock Market?

author:US stockS -

Are you contemplating whether to invest in the US stock market? This is a significant decision that can have long-term implications for your financial future. In this article, we will explore the factors you should consider before making this investment decision.

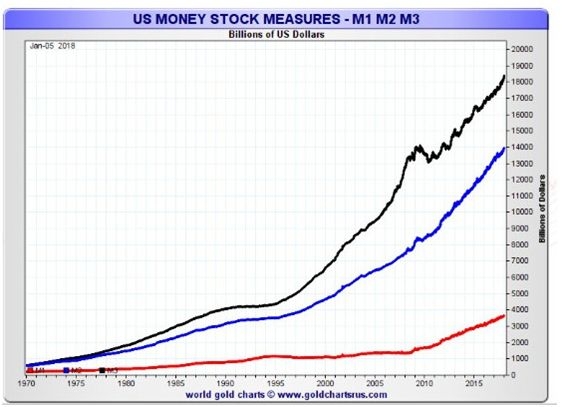

Understanding the US Stock Market

The US stock market is one of the largest and most influential in the world. It includes a wide range of companies across various industries, from tech giants like Apple and Google to traditional industries like energy and finance. Investing in the US stock market can offer several benefits, including potential for high returns, diversification, and liquidity.

Benefits of Investing in the US Stock Market

Potential for High Returns: The US stock market has historically provided higher returns than other investment options, such as bonds or savings accounts. This is due to the high growth potential of many US companies, especially in technology and healthcare sectors.

Diversification: Investing in a mix of stocks can help reduce your risk by spreading your investments across different industries and market segments.

Liquidity: The US stock market is highly liquid, meaning you can buy and sell stocks relatively quickly without significantly impacting their price.

Factors to Consider Before Investing

Risk Tolerance: Your risk tolerance is a crucial factor in determining whether investing in the US stock market is suitable for you. If you are risk-averse, you may prefer more conservative investment options like bonds or certificates of deposit.

Investment Goals: Your investment goals should guide your decision. If you are investing for short-term goals, such as buying a house in the next few years, the stock market may not be the best option due to its volatility. However, if you are investing for long-term goals, such as retirement, the stock market can be a valuable tool.

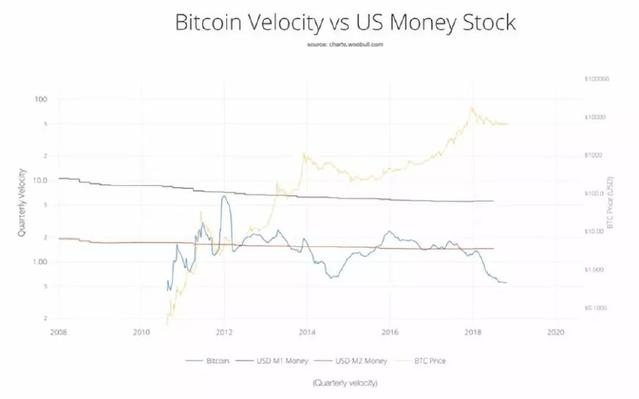

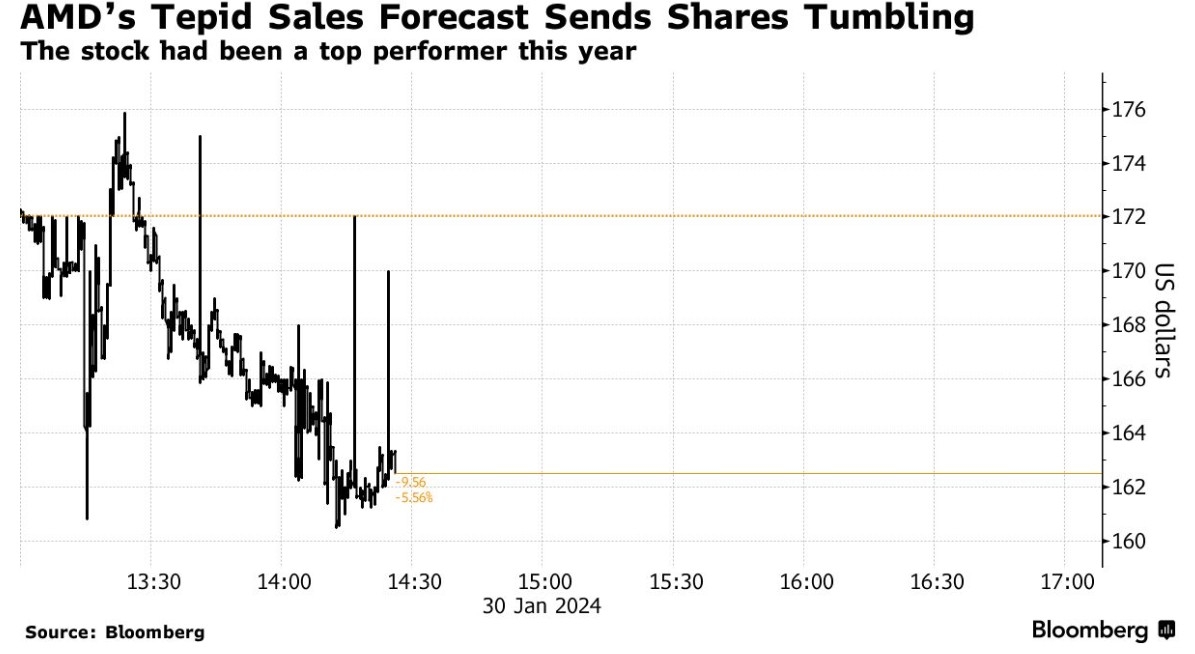

Market Conditions: It's essential to consider the current market conditions before investing. While the US stock market has historically provided good returns, it has also experienced periods of volatility and downturns.

Case Studies

Apple Inc.: Apple is a prime example of a company that has provided significant returns over the long term. Since its initial public offering (IPO) in 1980, Apple's stock has increased by over 50,000%.

Tesla Inc.: Tesla has been a highly volatile stock, but it has also provided substantial returns. Since its IPO in 2010, Tesla's stock has increased by over 1,000%.

Conclusion

Investing in the US stock market can be a valuable strategy for achieving your financial goals, but it's essential to consider your risk tolerance, investment goals, and market conditions. By doing thorough research and consulting with a financial advisor, you can make an informed decision that aligns with your financial objectives.

us stock market today