Overconcentration in the US Stock Market: Risks and Implications

author:US stockS -

The US stock market has long been considered a beacon of economic stability and growth. However, recent trends indicate a concerning level of overconcentration within the market. This article delves into the risks and implications of this overconcentration, examining the factors contributing to it and the potential consequences for investors and the broader economy.

What is Overconcentration?

Overconcentration in the stock market refers to an excessive concentration of investments in a limited number of companies or sectors. This can lead to several risks, including increased volatility, reduced diversification, and a lack of economic resilience.

Factors Contributing to Overconcentration

Several factors have contributed to the overconcentration of the US stock market:

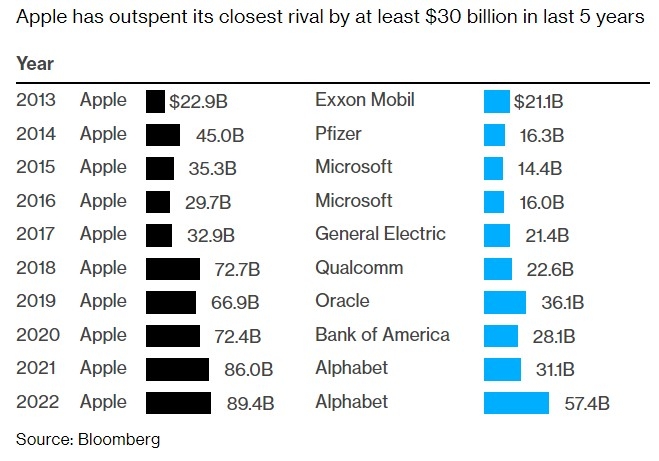

- Tech Sector Dominance: The technology sector, particularly companies like Apple, Amazon, Google, and Microsoft, has seen significant growth in recent years. This has led to an increased focus on tech stocks, overshadowing other sectors.

- Index Funds and ETFs: The rise of index funds and ETFs has made it easier for investors to invest in a broad market without diversifying their portfolios. This has led to a concentration of capital in a few popular stocks.

- Hedge Fund Strategies: Some hedge funds have adopted strategies that focus on a limited number of stocks, further contributing to overconcentration.

Risks of Overconcentration

The risks of overconcentration in the US stock market are significant:

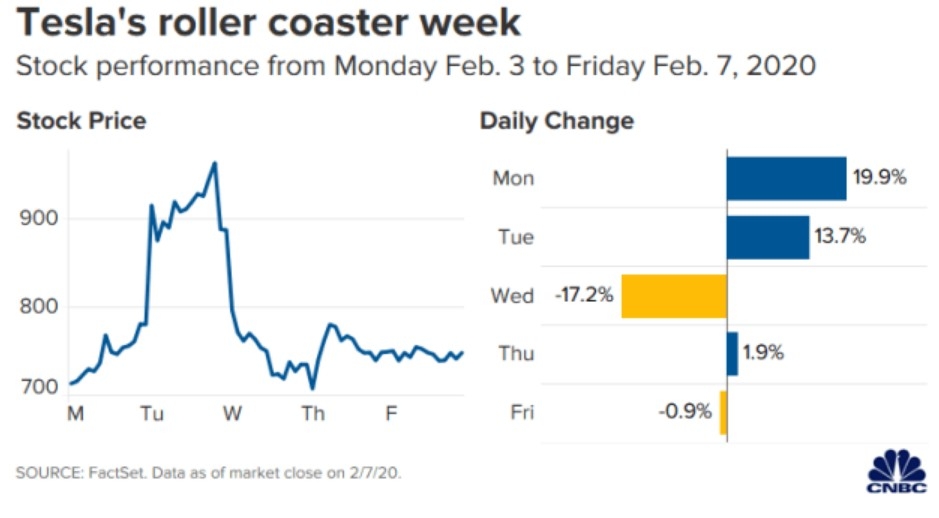

- Volatility: Overconcentration can lead to increased volatility, as a small number of companies can have a disproportionate impact on the market.

- Lack of Diversification: Investors who are overconcentrated in a few stocks are more vulnerable to market downturns and economic shocks.

- Economic Resilience: An overconcentrated market may lack the resilience to withstand economic downturns, as the performance of a few companies can significantly impact the overall market.

Case Study: The Tech Bubble of 2000

One of the most notable examples of overconcentration in the US stock market is the tech bubble of 2000. The tech sector accounted for a significant portion of the market, with investors heavily invested in companies like Yahoo! and AOL. When the bubble burst, the market experienced a sharp decline, leading to significant losses for investors.

Conclusion

The overconcentration in the US stock market poses significant risks for investors and the broader economy. It is crucial for investors to diversify their portfolios and avoid overconcentration in a few sectors or companies. By doing so, they can mitigate risks and achieve more stable and sustainable investment returns.

us stock market today