How Could Foreigners Buy U.S. Stocks?

author:US stockS -

Are you curious about how foreigners can invest in U.S. stocks? With the global economy becoming increasingly interconnected, foreign investors are looking for opportunities to diversify their portfolios. In this article, we will explore the process of buying U.S. stocks for foreign investors, highlighting the key steps and considerations to keep in mind.

Understanding the Basics

Before diving into the details, it's essential to understand the basics of U.S. stocks. A stock represents a share of ownership in a company. When you buy a stock, you become a shareholder, and your investment grows as the company's value increases.

Opening a Brokerage Account

The first step for foreign investors is to open a brokerage account. This account will serve as the platform for buying and selling U.S. stocks. Many online brokers offer accounts specifically tailored for international investors, making the process easier.

Choosing a Broker

When selecting a brokerage, consider factors such as fees, customer service, and the availability of research tools. Some popular brokers for foreign investors include TD Ameritrade, E*TRADE, and Charles Schwab.

Understanding U.S. Stock Market Hours

The U.S. stock market operates from 9:30 a.m. to 4:00 p.m. Eastern Time (ET). It's important to note that trading hours may vary depending on the brokerage and the specific stock exchanges.

Currency Conversion

Foreign investors need to consider currency conversion when buying U.S. stocks. The exchange rate between their local currency and the U.S. dollar will affect the cost of purchasing stocks. It's advisable to keep an eye on exchange rates and consider the potential impact on your investment.

Research and Analysis

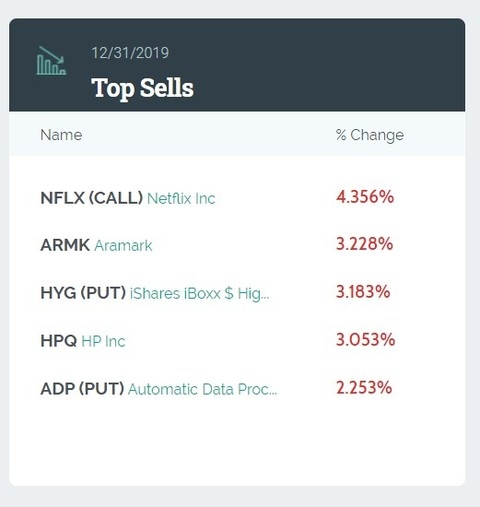

Before investing in U.S. stocks, it's crucial to conduct thorough research and analysis. This includes examining the company's financial statements, industry trends, and market conditions. Many brokers offer research tools and resources to help foreign investors make informed decisions.

Tax Considerations

Foreign investors must be aware of the tax implications of owning U.S. stocks. The U.S. government requires foreign investors to pay taxes on their investment income, including dividends and capital gains. It's advisable to consult with a tax professional to understand the specific tax obligations.

Case Study: John from Japan

Let's consider a hypothetical case involving John, a Japanese investor interested in buying U.S. stocks. John opens a brokerage account with E*TRADE and decides to invest in Apple Inc. (AAPL). After conducting thorough research, he purchases 100 shares of AAPL at

John's investment grows over time, and he decides to sell his shares after one year when the stock price reaches

Conclusion

Buying U.S. stocks as a foreign investor involves several steps and considerations. By understanding the basics, choosing the right brokerage, conducting thorough research, and being aware of tax implications, foreign investors can successfully invest in U.S. stocks. Keep in mind that investing always carries risks, and it's crucial to do your due diligence before making any investment decisions.

us stock market today