2019 International Stock vs US Stock: A Comprehensive Analysis

author:US stockS -

In the dynamic world of investing, the decision between international stocks and US stocks can significantly impact your portfolio's performance. This article delves into a comprehensive analysis of the two, highlighting key differences, performance trends, and potential risks in 2019. Whether you are a seasoned investor or just starting out, understanding the nuances between international and US stocks is crucial for making informed decisions.

Performance Trends in 2019

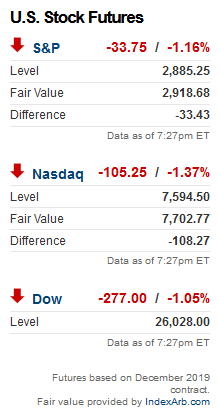

In 2019, the global stock market experienced a rollercoaster ride, with various factors influencing its performance. While the US stock market, represented by indices like the S&P 500, saw substantial growth, international stocks also delivered impressive returns. However, it is essential to analyze the specific sectors and regions to gain a deeper understanding of the performance trends.

US Stock Market Performance

The US stock market, particularly the S&P 500, experienced a strong rally in 2019. Factors such as the Federal Reserve's accommodative monetary policy, strong corporate earnings, and a robust economic outlook contributed to this growth. Key sectors like technology, healthcare, and consumer discretionary outperformed, driving the overall market's upward trend.

International Stock Market Performance

On the other hand, international stocks, particularly those from emerging markets, experienced mixed results in 2019. While some regions like Asia and Europe delivered robust returns, others like Latin America and Africa faced challenges due to geopolitical tensions and economic uncertainties. The performance of international stocks was influenced by factors such as currency fluctuations, trade wars, and political instability.

Differences in Market Composition

One of the key differences between international and US stocks lies in their market composition. The US stock market is dominated by large-cap companies, while international stocks offer a broader range of market capitalizations, including small and mid-cap companies. This diversity in market composition provides investors with various investment opportunities and potential for high growth.

Risk Factors

Investing in international stocks carries certain risks that are not present in the US stock market. These risks include currency fluctuations, political instability, and economic uncertainties. Additionally, the regulatory framework and corporate governance practices may differ significantly, which can impact the overall performance of international stocks.

Case Studies

To illustrate the differences between international and US stocks, let's consider a few case studies:

Technology Sector: In 2019, the technology sector experienced significant growth in both the US and international markets. While US tech giants like Apple and Microsoft delivered impressive returns, international companies like Tencent and Samsung also performed well, showcasing the global nature of the technology industry.

Healthcare Sector: The healthcare sector, represented by companies like Johnson & Johnson in the US and Novartis in Europe, saw strong growth in 2019. While the US market offered stability and predictable returns, international stocks provided exposure to emerging markets and potential for higher growth.

Conclusion

In conclusion, the choice between international and US stocks in 2019 was influenced by various factors, including market composition, performance trends, and risk factors. While the US stock market delivered strong returns, international stocks provided exposure to diverse markets and potential for high growth. Investors should carefully analyze their investment goals, risk tolerance, and market trends before making informed decisions.

us stock market today