US Stock Expensive: Understanding the Market Dynamics

author:US stockS -

In recent years, the U.S. stock market has been a beacon of prosperity for investors. However, the rising valuations have sparked debates about whether U.S. stocks are indeed "expensive." This article delves into the factors contributing to this perception and analyzes the broader implications for investors.

Market Valuations at an All-Time High

The S&P 500, a widely followed index of U.S. large-cap stocks, has seen its valuations soar to new heights. The price-to-earnings (P/E) ratio, a key metric used to gauge market valuation, has been above its long-term average for several years. This has led some investors to question whether the market is overvalued.

Factors Contributing to High Valuations

Several factors have contributed to the expensive nature of U.S. stocks:

- Economic Growth: The U.S. economy has been experiencing strong growth, which has led to higher corporate earnings. This has bolstered stock prices, making them more expensive.

- Low Interest Rates: The Federal Reserve has kept interest rates at historic lows to stimulate economic growth. This has made bonds less attractive, pushing investors towards stocks.

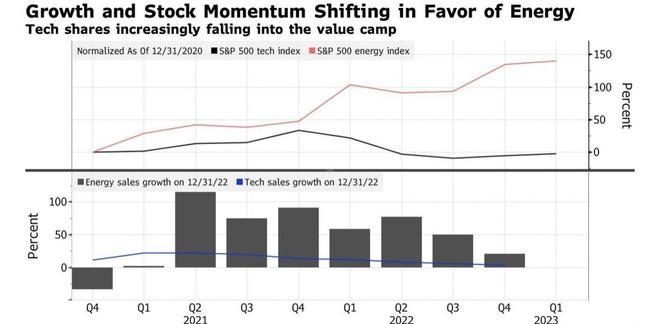

- Technological Advancements: The rise of technology companies has driven the market higher. These companies often have high valuations due to their rapid growth and potential for future earnings.

- Global Capital Flows: With many other markets experiencing slower growth, investors have been pouring money into U.S. stocks, further driving up valuations.

The Risks of Owning Expensive Stocks

While owning expensive stocks can be profitable, it also comes with its own set of risks:

- Overvaluation: When stocks are overvalued, there is a higher risk of a market correction. If earnings do not meet expectations, stock prices could plummet.

- Economic Slowdown: A slowdown in the U.S. economy or a global recession could negatively impact corporate earnings and stock prices.

- Inflation: Rising inflation can erode the purchasing power of stock returns.

Case Studies: Expensive Stocks and Their Performance

To illustrate the risks of owning expensive stocks, let's look at two case studies:

- Facebook (now Meta Platforms, Inc.): When Facebook went public in 2012, it was valued at a P/E ratio of around 100. Since then, the company has faced numerous challenges, including privacy concerns and regulatory scrutiny. As a result, its stock price has dropped significantly, leading to a loss for investors who bought at the peak.

- Tesla, Inc.: Tesla has been one of the most highly valued companies in the world. However, its stock has experienced significant volatility, with periods of rapid growth followed by sharp declines. Investors who bought the stock at its peak have seen their investments soar, but they have also been exposed to substantial risk.

Conclusion

While U.S. stocks may appear expensive at the moment, it's important to consider the factors contributing to this perception. Understanding the risks and opportunities associated with owning expensive stocks can help investors make informed decisions. As always, it's crucial to conduct thorough research and consult with a financial advisor before making any investment decisions.

us stock market live