US Mid Cap Stock: A Strategic Investment Choice

author:US stockS -

In the vast landscape of the U.S. stock market, mid-cap stocks stand as a unique blend of potential growth and stability. These companies, with market capitalizations that fall between small-cap and large-cap stocks, often offer investors a middle ground between high-risk, high-reward small-caps and the more mature, less volatile large-caps. This article delves into the world of U.S. mid-cap stocks, exploring their characteristics, benefits, and potential as an investment choice.

Understanding Mid-Cap Stocks

Mid-cap stocks are generally defined as companies with a market capitalization between

Benefits of Investing in Mid-Cap Stocks

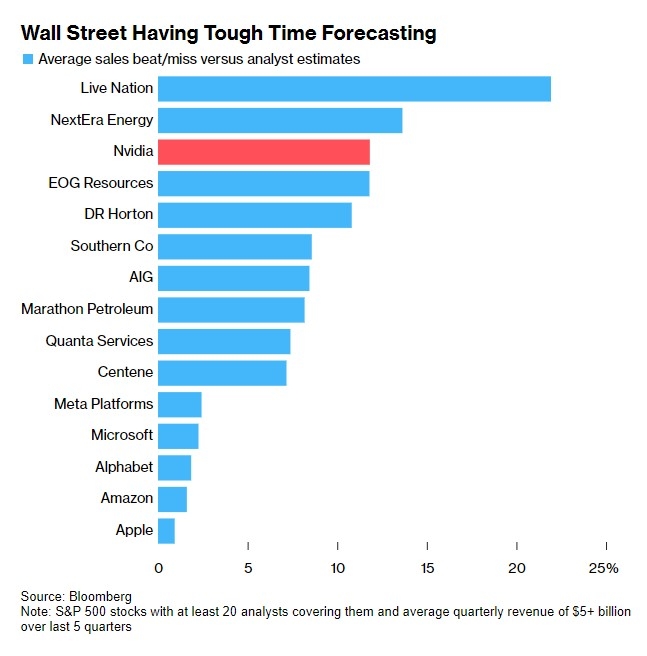

1. Growth Potential: One of the primary attractions of mid-cap stocks is their growth potential. These companies are typically in the expansion phase of their lifecycle, with the potential to grow significantly over time.

2. Stability: Unlike their smaller counterparts, mid-cap stocks are often more stable and have a lower risk of going out of business. They also tend to have more resources and a larger customer base, which can provide a buffer against economic downturns.

3. Attractive Valuations: Mid-cap stocks often offer more attractive valuations compared to their larger peers. This can be due to a variety of factors, including market perception or simply being less widely followed by investors.

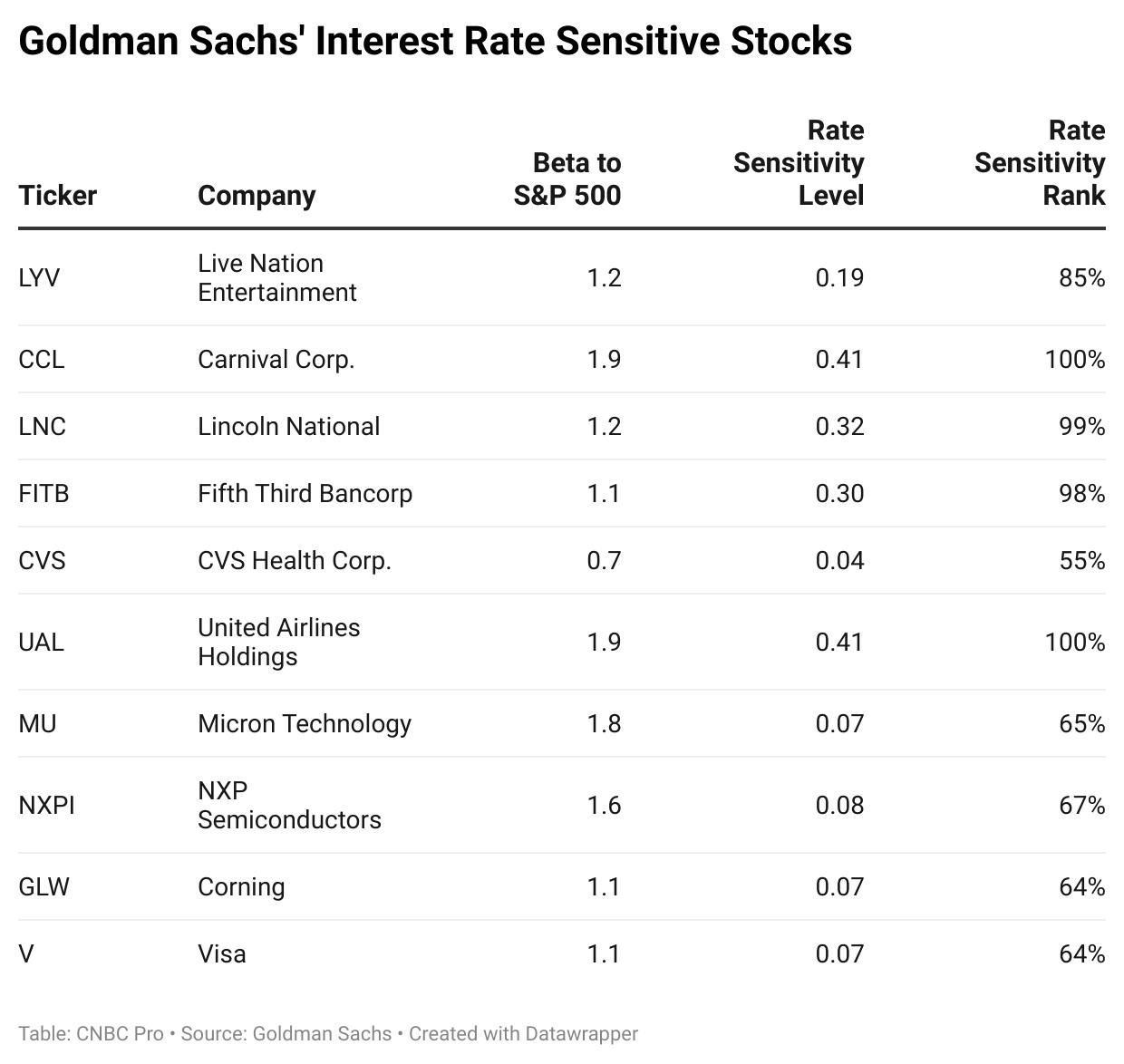

Case Study: Visa Inc.

A prime example of a successful mid-cap stock is Visa Inc., which was once a small-cap company but has grown into a global financial services giant. When Visa went public in 2008, it had a market capitalization of around

Factors to Consider When Investing in Mid-Cap Stocks

1. Industry: It's crucial to research the industry in which the mid-cap stock operates. Some industries, like technology or healthcare, may offer more growth potential, while others, like utilities, may offer stability and steady dividends.

2. Financial Health: Analyze the company's financial statements, including its revenue, profit margins, and debt levels. A strong balance sheet and healthy financials are indicators of a well-managed company.

3. Management: The quality of a company's management team can significantly impact its performance. Look for a team with a track record of success and a clear vision for the future.

4. Valuation: Ensure the stock is not overvalued. Compare its price-to-earnings (P/E) ratio, price-to-book (P/B) ratio, and other valuation metrics to those of its peers and the broader market.

Conclusion

Mid-cap stocks offer a compelling investment opportunity for those looking to balance growth potential with stability. By carefully researching and selecting the right companies, investors can potentially benefit from the strong performance of these stocks. As always, it's essential to do thorough research and consider your own investment goals and risk tolerance before making any investment decisions.

us stock market live