Trending US Stocks: Top Performers and Investment Insights

author:US stockS -

In the dynamic world of the stock market, staying ahead of the curve is key to successful investing. As the year unfolds, several US stocks have emerged as top performers, capturing the attention of both seasoned investors and newcomers alike. This article delves into the trending US stocks and provides valuable insights into why they are making waves in the financial sector.

Top Trending US Stocks

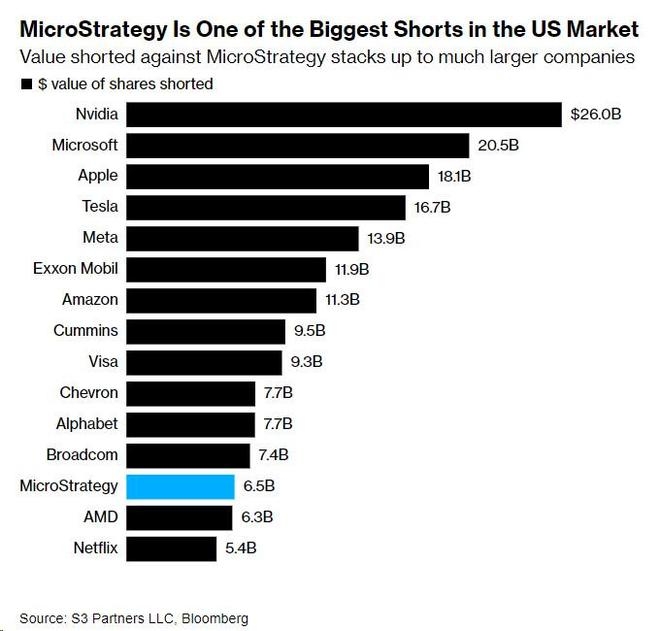

Tesla (TSLA): As the leader in electric vehicles (EVs), Tesla has been a consistent performer over the years. The company's recent advancements in battery technology and expansion into new markets have further bolstered its position in the industry.

Amazon (AMZN): The e-commerce giant has continued to dominate the retail landscape, expanding its offerings beyond online shopping to include cloud computing, streaming services, and even groceries. Amazon's robust growth and innovation have made it a favorite among investors.

Apple (AAPL): The tech giant's relentless pursuit of innovation has propelled it to the forefront of the technology sector. Apple's impressive revenue growth, strong product pipeline, and robust ecosystem have made it a top-performing stock.

NVIDIA (NVDA): As a leader in the semiconductor industry, NVIDIA has seen significant growth due to the increasing demand for AI, gaming, and data center technologies. The company's cutting-edge graphics processing units (GPUs) have played a crucial role in its success.

Facebook (META): Despite facing regulatory challenges, Facebook's parent company, Meta, has continued to thrive. The company's investment in virtual reality (VR) and augmented reality (AR) technologies has positioned it for future growth.

Investment Insights

Understanding the factors driving the performance of these trending US stocks is crucial for investors. Here are some key insights:

Innovation: Companies that continuously innovate and adapt to changing market trends tend to outperform their peers. Tesla's advancements in EV technology and Apple's relentless pursuit of innovation are prime examples.

Market Leader Status: Being a market leader in a high-growth sector can significantly boost a company's stock performance. Amazon's dominance in the e-commerce space and Apple's leadership in the tech industry are testament to this.

Diversification: Diversifying one's portfolio across different sectors and geographies can help mitigate risks. Investing in companies like NVIDIA, which operates in the tech and AI sectors, can provide a hedge against market volatility.

Long-term Perspective: Investing in trending US stocks requires a long-term perspective. While short-term market fluctuations are inevitable, companies with strong fundamentals tend to outperform over the long term.

Case Study: NVIDIA (NVDA)

NVIDIA's success can be attributed to its strategic focus on the high-growth AI and gaming markets. The company's GPUs have become the backbone of many AI applications, while its gaming division has expanded its market share through partnerships with leading game developers.

By consistently investing in research and development, NVIDIA has been able to stay ahead of the curve and maintain its market leadership. This focus on innovation has not only driven the company's stock performance but also solidified its position as a key player in the tech industry.

In conclusion, keeping an eye on trending US stocks can provide valuable insights into market trends and potential investment opportunities. By focusing on innovation, market leadership, diversification, and a long-term perspective, investors can navigate the dynamic world of the stock market and make informed decisions.

us stock market live