Title: Cyclical Stocks: A Deep Dive into US News

author:US stockS -

In the ever-evolving landscape of the stock market, cyclical stocks have emerged as a key area of interest for investors. These stocks, which tend to move in sync with the broader economic cycle, can offer significant opportunities for growth and profit. In this article, we'll delve into the world of cyclical stocks, examining their characteristics, potential risks, and recent trends as highlighted by US News.

Understanding Cyclical Stocks

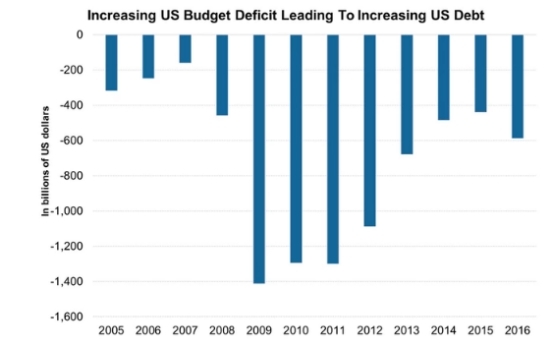

Cyclical stocks are companies whose earnings and share prices tend to fluctuate with the economic cycle. These companies often thrive during economic upswings and suffer during downturns. The rationale behind this is straightforward: when the economy is booming, cyclical companies see increased demand for their products or services, leading to higher profits and share prices. Conversely, during economic downturns, these companies may see a decrease in demand, resulting in lower profits and share prices.

Key Characteristics of Cyclical Stocks

One of the most prominent characteristics of cyclical stocks is their strong correlation with the broader economic indicators. For instance, stocks in the automobile, construction, and consumer discretionary sectors are often considered cyclical. These sectors tend to benefit from increased consumer spending and business investment during economic upswings.

Recent Trends and Opportunities

According to recent articles from US News, cyclical stocks have been making a comeback in the wake of the global economic recovery. The strong performance of cyclical stocks can be attributed to several factors, including:

- Economic Growth: The global economy has been on an upward trajectory, with many countries experiencing strong growth rates. This has led to increased demand for cyclical stocks.

- Low Interest Rates: Central banks around the world have kept interest rates low, making borrowing cheaper and encouraging businesses and consumers to spend more.

- Improving Business Sentiment: Companies are becoming more optimistic about the future, leading to increased investment in new projects and expansion.

Case Studies: Success Stories

One notable example of a cyclical stock is General Motors (GM). As the global economy recovered from the recession, GM saw a significant increase in demand for its vehicles. This led to a surge in sales and profits, driving the stock price higher.

Another example is Home Depot (HD), a leading home improvement retailer. As the housing market recovered, HD experienced a surge in demand for its products and services, leading to strong growth in earnings and share prices.

Risks and Considerations

While cyclical stocks offer significant opportunities for growth, they also come with their own set of risks. These risks include:

- Economic Sensitivity: As mentioned earlier, cyclical stocks are highly sensitive to economic conditions. This means that a downturn in the economy can lead to a sharp decline in profits and share prices.

- Market Volatility: Cyclical stocks tend to be more volatile than their non-cyclical counterparts. This can lead to significant price swings, which may be challenging for some investors to handle.

In conclusion, cyclical stocks represent a unique opportunity for investors looking to capitalize on economic upswings. However, it's crucial to carefully assess the risks and understand the economic conditions before investing in these stocks. As highlighted by US News, staying informed and keeping a close eye on economic indicators can help investors navigate the world of cyclical stocks and maximize their returns.

us stock market live