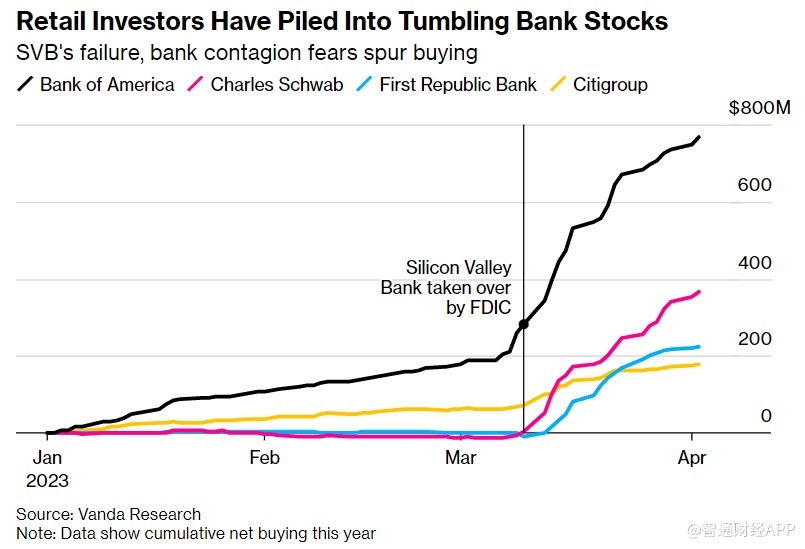

Regional US Bank Stocks: A Strategic Investment Opportunity

author:US stockS -

In the vast landscape of the American financial sector, regional US bank stocks often fly under the radar compared to their national counterparts. However, these stocks present a unique and potentially lucrative investment opportunity for those who understand their potential. This article delves into the world of regional US bank stocks, highlighting their distinct advantages and providing insights into how investors can capitalize on this niche market.

Understanding Regional Banks

Regional banks, as the name implies, are financial institutions that primarily operate within a specific geographic region of the United States. Unlike national banks, which have a broader footprint and are subject to more stringent federal regulations, regional banks often have a more localized focus and can offer unique insights into the economic conditions of their specific markets.

The Advantages of Investing in Regional Bank Stocks

- Strong Local Relationships: Regional banks typically have a deep understanding of the local economy and its residents. This allows them to offer tailored financial services and products that better meet the needs of their customers.

- Potential for Higher Growth: Due to their more focused approach, regional banks often have greater growth potential compared to larger, more diversified institutions. This is particularly true in areas experiencing economic growth or development.

- Lower Regulatory Burdens: Regional banks often operate under less stringent federal regulations compared to national banks. This can lead to lower costs and higher profitability.

Key Factors to Consider When Investing in Regional Bank Stocks

- Financial Health: Before investing in a regional bank stock, it is crucial to assess its financial health. Look for strong profitability, low loan-loss provisions, and a solid capital position.

- Market Conditions: The economic conditions of the region in which the bank operates can significantly impact its performance. Pay attention to factors such as unemployment rates, real estate markets, and local business climate.

- Management Team: The quality of the management team is crucial for the long-term success of a regional bank. Look for experienced leadership with a proven track record of success.

Case Study: SunTrust Banks, Inc.

A prime example of a successful regional bank is SunTrust Banks, Inc., which operates primarily in the southeastern United States. Despite the challenges posed by the 2008 financial crisis, SunTrust has managed to maintain a strong financial position and has consistently delivered solid returns to its shareholders.

One key factor contributing to SunTrust's success is its focus on building strong relationships with its customers. The bank has a reputation for offering personalized financial services and products, which has helped it maintain a loyal customer base.

Conclusion

Investing in regional US bank stocks can be a rewarding opportunity for investors looking to diversify their portfolios and capitalize on the unique strengths of these institutions. By carefully evaluating financial health, market conditions, and management teams, investors can identify attractive opportunities in this niche market.

us stock market live