Name a Stock Market Indicator in the US

author:US stockS -

The stock market is a complex and dynamic entity, brimming with various indicators that help investors gauge market trends and make informed decisions. When it comes to naming a stock market indicator in the US, there are several key metrics that stand out. This article delves into the significance of these indicators and why they are crucial for both seasoned investors and novices alike.

The S&P 500 Index

One of the most well-known and widely followed stock market indicators in the US is the S&P 500 Index. This index tracks the performance of 500 large-cap companies across various sectors, representing approximately 80% of the total market capitalization of all publicly traded companies in the US. The S&P 500 is a benchmark for the US stock market and serves as a key indicator of market trends and economic health.

For instance, when the S&P 500 reaches a new all-time high, it suggests that the overall market is performing well, and investors are confident in the economy. Conversely, a drop in the index may indicate concerns about the economy or a particular sector.

The Dow Jones Industrial Average

Another prominent stock market indicator is the Dow Jones Industrial Average (DJIA). This index comprises 30 large-cap companies from various sectors, including financials, technology, and consumer goods. The DJIA has been a benchmark for the US stock market since 1896 and is widely followed by investors and media alike.

The DJIA provides insights into the performance of the largest and most influential companies in the US. Similar to the S&P 500, a rise in the DJIA suggests a strong market, while a decline may indicate market concerns.

The Nasdaq Composite Index

The Nasdaq Composite Index is another significant stock market indicator in the US. This index tracks the performance of all companies listed on the Nasdaq Stock Market, including high-growth technology companies. The Nasdaq is particularly popular among tech investors and is often considered a bellwether for the technology sector.

Over the past few decades, the Nasdaq has experienced significant growth, reflecting the rise of the technology industry in the US. An upward trend in the Nasdaq indicates a strong performance in the tech sector, which can have a positive impact on the overall market.

The Consumer Price Index (CPI)

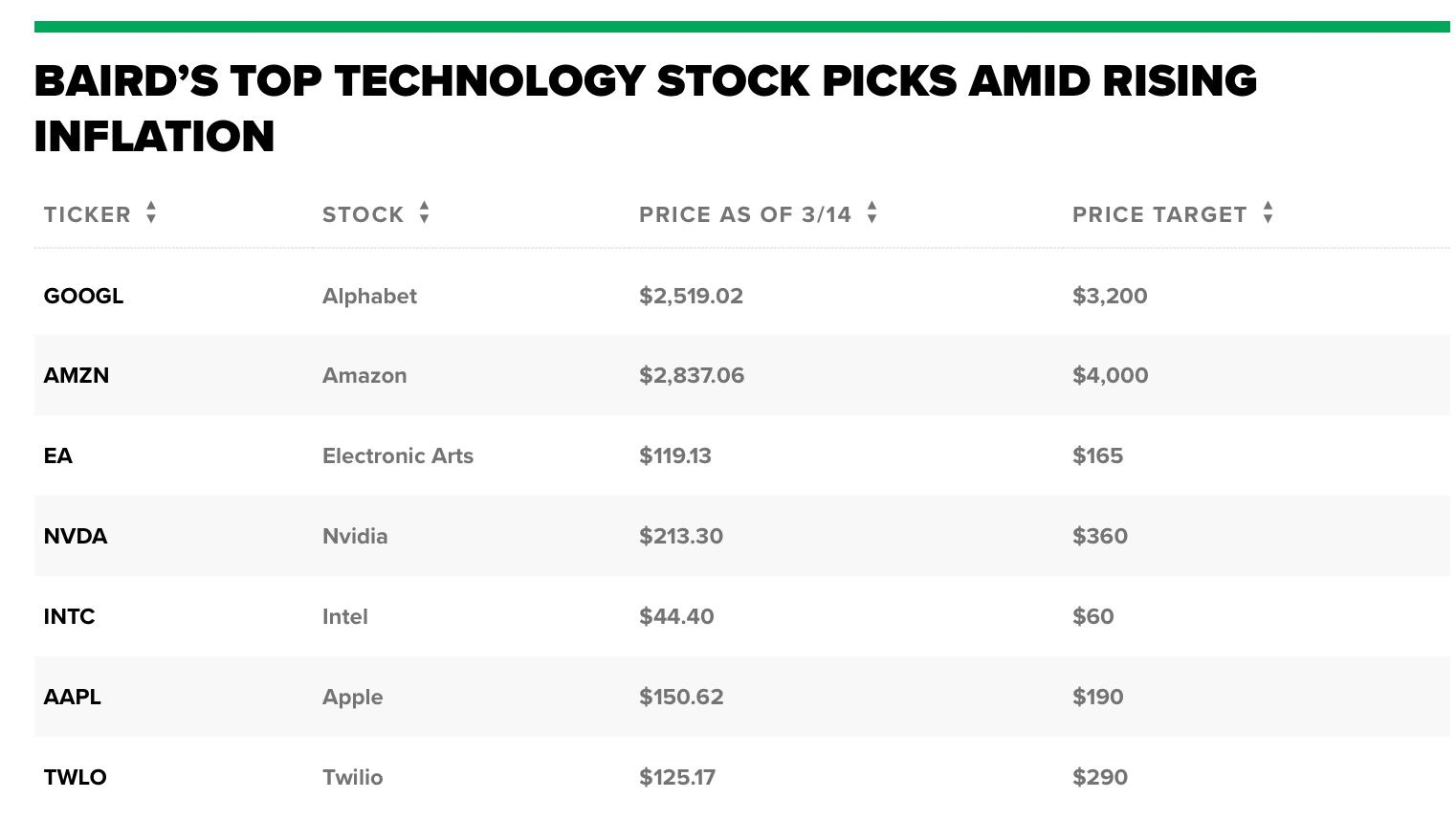

While not a stock market index per se, the Consumer Price Index (CPI) is a crucial indicator of inflation and economic health. The CPI measures the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services.

A rise in the CPI can indicate inflationary pressures, which may lead to higher interest rates and a potential decline in stock prices. Conversely, a low CPI suggests stable inflation, which is generally beneficial for the stock market.

Case Study: The S&P 500 and the Tech Bubble

One notable example of how stock market indicators can influence market trends is the Tech Bubble of the late 1990s. During this period, the Nasdaq Composite Index skyrocketed, driven by rapid growth in the technology sector. However, the S&P 500 remained relatively flat.

When the bubble burst in 2000, the Nasdaq experienced a massive decline, while the S&P 500 held up relatively well. This example highlights the importance of considering multiple indicators when analyzing the stock market.

In conclusion, there are several key stock market indicators in the US that investors should be familiar with. The S&P 500, DJIA, Nasdaq Composite, and CPI are just a few examples of these metrics. By understanding the significance of these indicators and staying informed, investors can make more informed decisions and navigate the complex world of the stock market.

us stock market live