Investing in Stocks: How Non-US Citizens Can Participate

author:US stockS -

Have you ever wondered how non-US citizens can invest in stocks, considering the geographical restrictions? Well, you're not alone. Many individuals from around the world aspire to invest in the US stock market, driven by its potential for growth and diversification. In this article, we'll explore the various options available to non-US citizens for investing in stocks, ensuring you have a comprehensive understanding of the process.

Understanding the US Stock Market

The US stock market, known as the NASDAQ and the New York Stock Exchange (NYSE), is one of the largest and most influential in the world. It offers a wide range of investment opportunities across various sectors, including technology, finance, healthcare, and consumer goods. Non-US citizens can benefit from investing in the US stock market due to its liquidity, transparency, and attractive returns.

Eligibility for Non-US Citizens

To invest in stocks in the US, non-US citizens must first establish their eligibility. This involves having a valid passport, an active bank account in the US, and a tax identification number (TIN) or social security number (SSN) if applicable.

Options for Non-US Citizens to Invest in Stocks

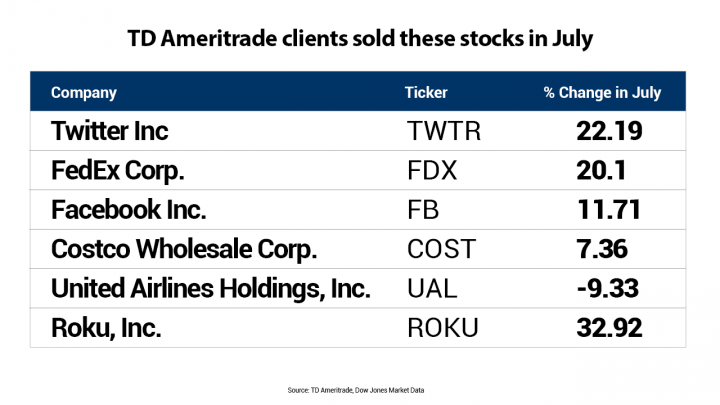

Stockbroker Services: One of the most common methods for non-US citizens to invest in US stocks is through a reputable stockbroker. Brokers like TD Ameritrade, Charles Schwab, and Fidelity offer services tailored to international investors. They provide access to a wide range of US stocks, bonds, and mutual funds, as well as international markets.

Brokerage Platforms: Online brokerage platforms, such as E*TRADE and Robinhood, offer easy access to the US stock market for non-US citizens. These platforms typically require an account setup and a minimum deposit to start investing.

Mutual Funds: Non-US citizens can invest in mutual funds that hold shares of US stocks. Many mutual funds cater specifically to international investors and offer exposure to the US market while managing currency risks.

Exchange-Traded Funds (ETFs): ETFs are a popular choice for international investors due to their low fees, diversification, and liquidity. They track specific indices, sectors, or asset classes and provide exposure to the US stock market.

Direct Stock Purchase Plans (DSPs): DSPs allow non-US citizens to purchase individual stocks directly from the company, without the need for a stockbroker. This method offers convenience and cost savings, but it may not be available for all US companies.

Tax Considerations for Non-US Citizens

It's crucial for non-US citizens to understand the tax implications of investing in the US stock market. Here are some key points to consider:

Taxation: Non-US citizens are subject to taxes on their investment income, including dividends, interest, and capital gains. However, tax treaties between the US and some countries can reduce or eliminate certain taxes.

Reporting Requirements: Non-US citizens must report their US investment income on their annual tax returns. This includes filing Form 1040NR (U.S. Nonresident Alien Income Tax Return) or Form 1040 (U.S. Individual Income Tax Return) if applicable.

Withholding Tax: The US government may withhold a portion of your investment income as a tax. However, this can be offset by the taxes you pay in your home country.

Conclusion

Investing in stocks as a non-US citizen is not only possible but also offers numerous benefits. By understanding the available options and considering the tax implications, you can take advantage of the US stock market's potential for growth and diversification. Whether you choose to work with a stockbroker, invest in mutual funds, or explore DSPs, make sure to do your research and consult with a financial advisor to align your investment strategy with your goals.

us stock market live