How Many People Own Stocks in the US?

author:US stockS -

In the vast landscape of the United States, the ownership of stocks has become a significant aspect of personal finance and investment. With the stock market being one of the most influential forces in the global economy, it's essential to understand who owns stocks and the implications it has on the financial landscape. In this article, we will delve into the topic of stock ownership in the US, highlighting key figures and providing insights into the evolving landscape of stock investment.

The Stock Ownership Landscape

The United States has a diverse population with varying levels of financial literacy and investment experience. According to a study by the Federal Reserve, approximately 54% of American adults owned stocks in 2020. This figure includes direct ownership of individual stocks, mutual funds, and exchange-traded funds (ETFs).

Direct Stock Ownership

Direct stock ownership is when individuals purchase shares of a company. This form of investment allows individuals to participate in the company's growth and profitability. According to a report by the Investment Company Institute, the number of US households owning individual stocks increased from 45.7 million in 2010 to 53.4 million in 2020.

Mutual Funds and ETFs

The majority of stock ownership in the US is through mutual funds and ETFs. These investment vehicles pool money from multiple investors to purchase a diversified portfolio of stocks, bonds, or other securities. The convenience and diversification offered by mutual funds and ETFs have made them popular among investors. According to the Investment Company Institute, the total assets in US mutual funds and ETFs reached $35.4 trillion as of 2020.

Retirement Accounts

Retirement accounts, such as 401(k)s and IRAs, are significant contributors to stock ownership in the US. These accounts allow individuals to invest in a wide range of stocks, bonds, and other securities while enjoying tax advantages. According to the Employee Benefit Research Institute, the total assets in US retirement accounts reached $30.4 trillion as of 2020.

Demographics of Stock Ownership

The demographics of stock ownership in the US reflect the country's diverse population. Generally, higher-income households and those with higher levels of education are more likely to own stocks. However, there has been a growing trend of stock ownership among younger investors, particularly through platforms like Robinhood, which cater to the millennial generation.

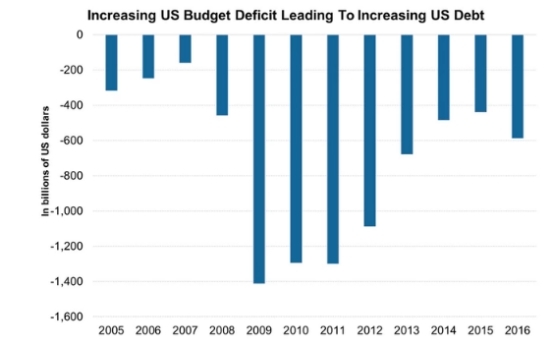

Case Study: The Great Recession

The Great Recession of 2008-2009 had a profound impact on stock ownership in the US. As the stock market plummeted, many investors lost a significant portion of their investments. This event highlighted the importance of diversification and risk management in stock investment. Since then, the stock market has recovered, and the number of stock owners has continued to rise.

Conclusion

Stock ownership in the US has become a widespread phenomenon, with millions of individuals and households participating in the stock market. The increasing popularity of mutual funds, ETFs, and retirement accounts has made it more accessible for individuals to invest in stocks. As the stock market continues to evolve, it's essential for investors to stay informed and make educated decisions to achieve their financial goals.

us stock market live