European Gas Network: Impact on US Stocks

author:US stockS -

In recent years, the European gas network has emerged as a crucial factor affecting the global energy market and, in turn, the stock market in the United States. This article delves into the significance of the European gas network and how it influences US stocks.

Understanding the European Gas Network

The European gas network is a vast infrastructure that connects various countries across the continent, facilitating the transportation and distribution of natural gas. It is an essential component of the European energy market, enabling countries to import and export gas to meet their energy demands. The network is characterized by its interconnected pipelines, which span thousands of miles, allowing for the seamless flow of gas across borders.

Impact on Energy Prices

One of the primary ways the European gas network affects the US stock market is through its influence on energy prices. As the European gas network becomes more integrated, the cost of energy in Europe can have a ripple effect on global energy markets, including the United States. Fluctuations in energy prices can impact the profitability of companies in the energy sector, ultimately affecting stock prices.

Influence on Energy Companies

Several energy companies in the United States have direct or indirect exposure to the European gas network. For instance, companies involved in natural gas exploration, production, and distribution can be significantly affected by changes in European energy prices. When the European gas network experiences supply disruptions or increased demand, these companies may experience higher operating costs, which could negatively impact their financial performance and, consequently, their stock prices.

Case Study: BP and Shell

To illustrate the impact of the European gas network on US stocks, let’s consider two major oil and gas companies, BP and Shell. Both companies have substantial operations in Europe, where they rely heavily on the gas network for their energy supply. During the 2019-2020 European gas shortage, these companies experienced increased operational costs due to higher energy prices. As a result, their stock prices took a hit, highlighting the vulnerability of energy companies to changes in the European gas network.

Investment Opportunities

Despite the risks associated with the European gas network, there are also investment opportunities for US investors. Companies with a strong presence in Europe and the ability to adapt to changing market conditions may offer attractive investment opportunities. By carefully analyzing the performance of these companies, investors can identify potential winners in the European gas market.

Conclusion

In conclusion, the European gas network plays a critical role in the global energy market and, consequently, has a significant impact on the US stock market. While the interconnectedness of the energy markets creates risks for energy companies, it also presents investment opportunities for astute investors. Understanding the dynamics of the European gas network is essential for investors looking to navigate the complexities of the energy sector and make informed investment decisions.

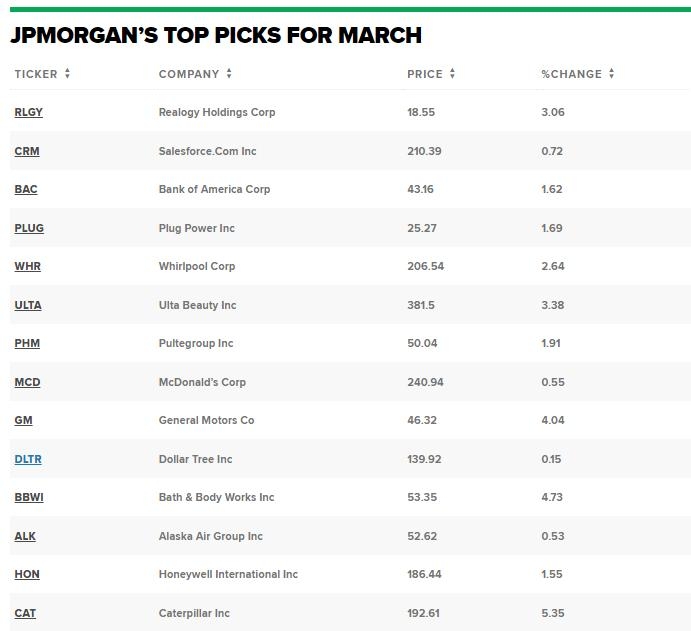

us stock market live