Unlocking the Potential of the US Stock Market

author:US stockS -

In the vast landscape of global financial markets, the US stock market stands out as a beacon of opportunity and innovation. As the largest and most influential stock market in the world, it offers investors a plethora of options and the potential for significant returns. This article delves into the intricacies of the US stock market, highlighting key aspects that every investor should be aware of.

Understanding the US Stock Market

The US stock market is a place where companies issue shares to the public, allowing investors to buy and sell these shares. The primary exchanges where stocks are traded include the New York Stock Exchange (NYSE) and the NASDAQ. These exchanges are home to a diverse range of companies, from large multinational corporations to small startups.

Key Players and Market Dynamics

The US stock market is dominated by a few key players. The S&P 500, Dow Jones Industrial Average, and NASDAQ Composite are among the most widely followed indices. These indices represent a basket of stocks and provide a snapshot of the overall market's performance.

The market dynamics are influenced by various factors, including economic indicators, corporate earnings reports, and geopolitical events. For instance, interest rate changes can significantly impact the stock market, as they affect borrowing costs and consumer spending.

Investment Opportunities

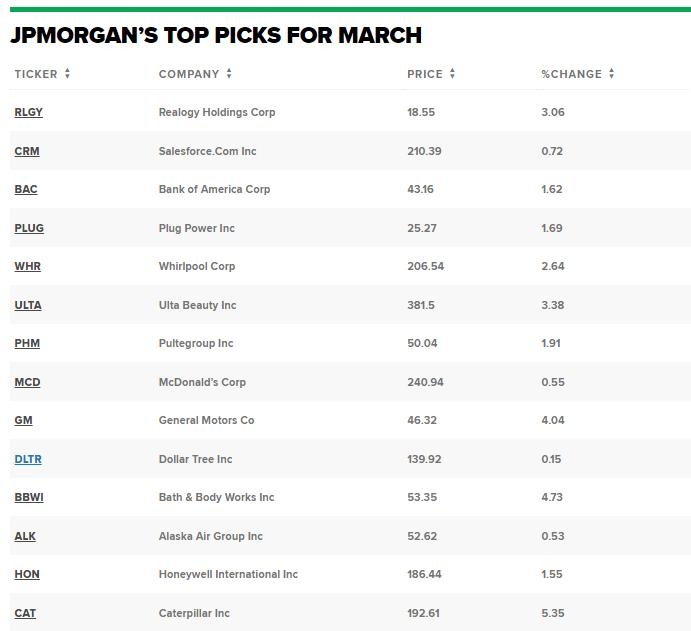

The US stock market offers a wide array of investment opportunities. Investors can choose from various asset classes, including stocks, bonds, ETFs, and mutual funds. Here are some popular investment options:

- Stocks: Investing in individual stocks allows investors to own a piece of a company. It's important to conduct thorough research and analyze the company's financial health, industry position, and growth prospects.

- ETFs: Exchange-Traded Funds (ETFs) are a popular choice for investors seeking diversification. They track a specific index or basket of assets and offer lower fees compared to mutual funds.

- Mutual Funds: Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. They are managed by professional fund managers.

Risk Management

Investing in the stock market carries inherent risks. It's crucial to understand these risks and implement effective risk management strategies. Here are some key risk management techniques:

- Diversification: Spreading investments across different asset classes and sectors can help mitigate risks.

- Stop-Loss Orders: These orders limit potential losses by automatically selling a stock when it reaches a specified price.

- Regular Portfolio Review: Regularly reviewing and rebalancing your portfolio ensures that it aligns with your investment goals and risk tolerance.

Case Studies

Let's consider a hypothetical case study to illustrate the potential of the US stock market. Imagine an investor who invested

This example highlights the potential for significant returns in the US stock market, but it's important to note that past performance is not indicative of future results.

Conclusion

The US stock market is a powerful tool for investors seeking to grow their wealth. By understanding the market dynamics, identifying attractive investment opportunities, and implementing effective risk management strategies, investors can navigate the complexities of the stock market and achieve their financial goals.

toys r us stocks