US Bank ETF Stock Price: A Comprehensive Analysis"

author:US stockS -

In the ever-evolving world of financial markets, understanding the stock price of US Bank ETFs is crucial for investors. This article delves into the factors that influence the stock price of US Bank ETFs, offering insights into the investment landscape. By analyzing historical data and current market trends, we aim to provide a comprehensive understanding of the US Bank ETF stock price.

Understanding US Bank ETFs

Firstly, let's clarify what US Bank ETFs are. An ETF (Exchange-Traded Fund) is a type of investment fund that trades on a stock exchange, much like a stock. US Bank ETFs are specifically designed to track the performance of U.S. banks and financial institutions. These funds are popular among investors looking to gain exposure to the financial sector without directly investing in individual stocks.

Factors Influencing US Bank ETF Stock Price

The stock price of US Bank ETFs is influenced by several key factors:

Economic Indicators: Economic data, such as GDP growth, unemployment rates, and inflation, play a crucial role in determining the stock price. Strong economic indicators often lead to higher stock prices, while weak indicators can cause prices to fall.

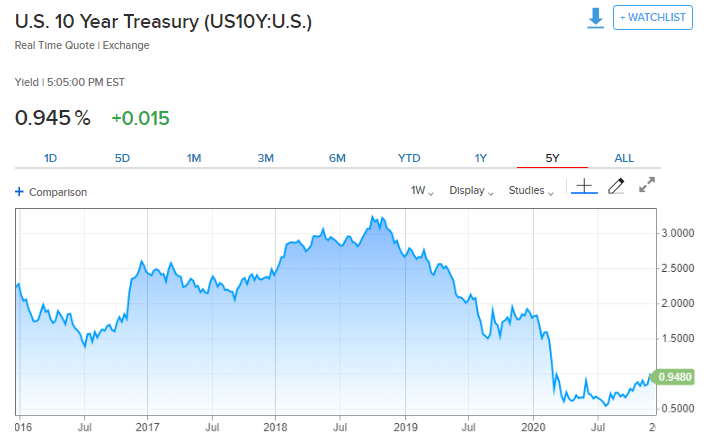

Interest Rates: The Federal Reserve's decisions on interest rates significantly impact the financial sector. Lower interest rates can boost stock prices, as they make borrowing cheaper for banks and financial institutions. Conversely, higher interest rates can put downward pressure on stock prices.

Market Sentiment: The overall sentiment in the market can greatly influence the stock price. Positive news, such as regulatory changes or strong earnings reports, can drive stock prices higher, while negative news, such as financial scandals or economic downturns, can cause prices to fall.

Individual Bank Performance: The performance of individual banks within the ETF can also impact the stock price. Strong performance from key banks can lead to higher prices, while poor performance can cause prices to decline.

Historical Analysis

A historical analysis of US Bank ETF stock prices reveals several interesting trends. For instance, during the 2008 financial crisis, the stock price of US Bank ETFs plummeted. However, as the economy recovered, the stock price gradually increased. This highlights the cyclical nature of the financial sector.

Current Market Trends

In recent years, the financial sector has seen a steady recovery, driven by factors such as low interest rates and strong economic growth. As a result, the stock price of US Bank ETFs has generally trended upward. However, it's important to note that the stock price can still be volatile, especially in response to unexpected economic events or market sentiment shifts.

Case Study: Vanguard Financials ETF (VFINX)

To illustrate the impact of various factors on the stock price, let's take a look at Vanguard Financials ETF (VFINX), a popular US Bank ETF. In early 2020, the stock price of VFINX fell sharply due to the COVID-19 pandemic and subsequent economic downturn. However, as the economy began to recover, the stock price started to rise again, driven by positive economic indicators and strong bank performance.

Conclusion

Understanding the stock price of US Bank ETFs is essential for investors looking to invest in the financial sector. By analyzing factors such as economic indicators, interest rates, market sentiment, and individual bank performance, investors can make more informed decisions. As always, it's important to do thorough research and consider seeking advice from a financial advisor before making any investment decisions.

toys r us stocks