US Asset Manager Purchasing Bangladesh Stocks: A Strategic Move

author:US stockS -

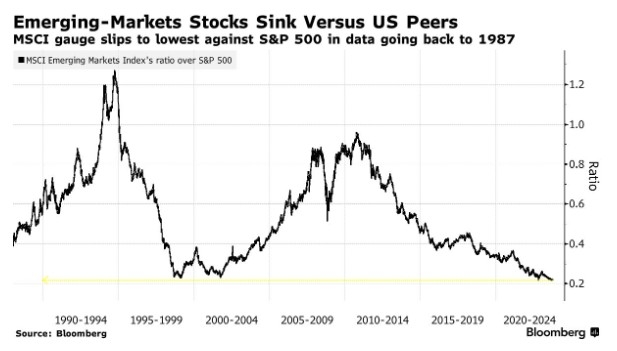

In recent years, the global investment landscape has seen a significant shift. One of the most notable trends is the increasing interest in emerging markets, with Bangladesh emerging as a prime destination for international investors. This article delves into why US asset managers are purchasing Bangladesh stocks, highlighting the strategic advantages and potential returns of this investment move.

Understanding the Investment Trend

The decision by US asset managers to purchase Bangladesh stocks reflects a broader trend in the investment community. These managers are increasingly recognizing the potential of emerging markets, driven by factors such as:

- Economic Growth: Bangladesh's economy has been experiencing robust growth, with a GDP growth rate of around 7% in recent years. This growth is expected to continue, making Bangladesh an attractive destination for investors.

- Young Population: Bangladesh boasts a young and growing population, which is a significant driver of economic growth. This demographic dividend is expected to fuel further expansion in various sectors.

- Low Costs: Bangladesh offers one of the lowest labor costs in the world, making it an attractive destination for businesses looking to outsource their operations.

Strategic Advantages of Investing in Bangladesh

Investing in Bangladesh offers several strategic advantages for US asset managers:

- Diversification: By investing in Bangladesh stocks, US asset managers can diversify their portfolios and reduce their exposure to the volatility of developed markets.

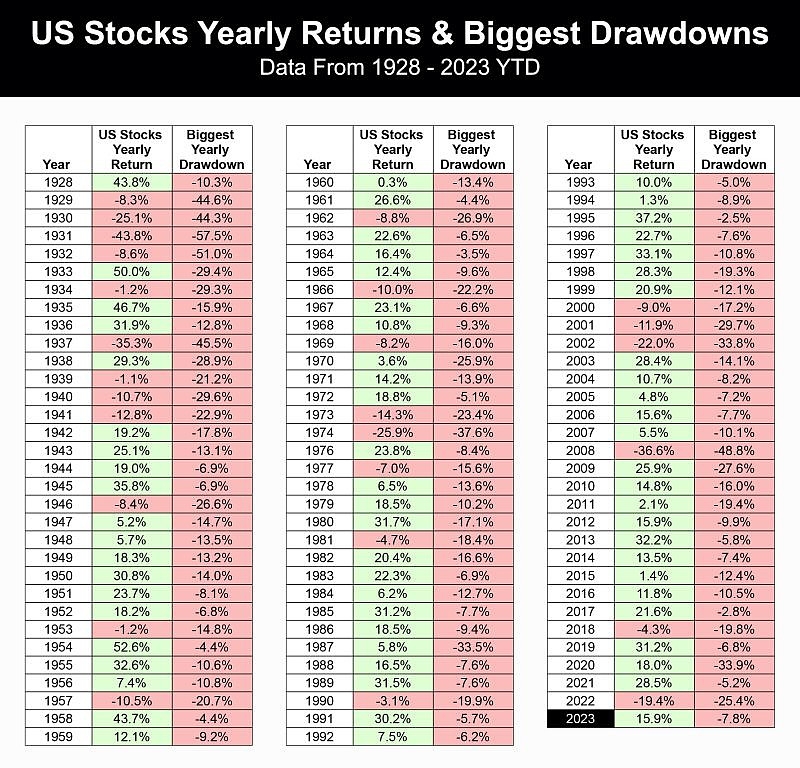

- High Returns: Bangladesh stocks have historically offered higher returns compared to stocks in developed markets. This potential for high returns is a significant draw for investors.

- Low Risk: Despite the country's rapid economic growth, Bangladesh remains relatively stable compared to some other emerging markets. This stability makes it a relatively low-risk investment destination.

Case Studies

Several US asset managers have already made significant investments in Bangladesh stocks. One notable example is BlackRock, which has been actively investing in Bangladesh's stock market for several years. Another example is Vanguard, which has recently launched a new fund focused on investing in Bangladesh stocks.

Conclusion

The decision by US asset managers to purchase Bangladesh stocks is a strategic move that reflects the growing interest in emerging markets. With its robust economic growth, young population, and low costs, Bangladesh offers a promising investment opportunity for international investors. As more US asset managers recognize the potential of Bangladesh stocks, we can expect to see further investment in the country's stock market.

toys r us stocks