Total US Stock Value: A Comprehensive Analysis and Outlook

author:US stockS -

In today's rapidly evolving financial landscape, understanding the total value of US stocks is crucial for investors, analysts, and market enthusiasts alike. This article delves into the current state of the US stock market, providing an in-depth analysis of its total value and offering insights into the future outlook.

Understanding the Total US Stock Value

The total value of US stocks, often referred to as the market capitalization, represents the combined worth of all publicly traded companies in the United States. This figure is calculated by multiplying the current share price of each company by its total number of outstanding shares. As of the latest data available, the total US stock value stands at an impressive over $40 trillion.

Factors Influencing the Total US Stock Value

Several factors contribute to the fluctuations in the total US stock value. These include:

- Economic Conditions: Economic indicators, such as GDP growth, inflation rates, and unemployment rates, play a significant role in influencing stock prices and, consequently, the total stock value.

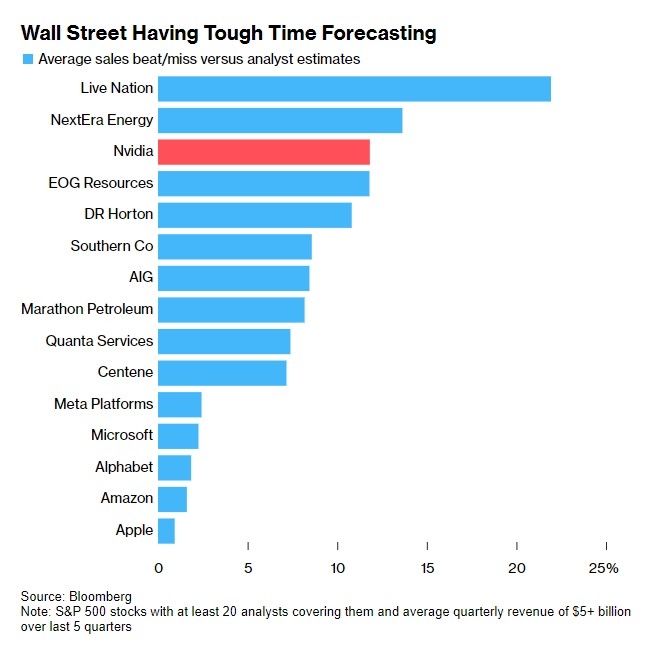

- Market Sentiment: Investor sentiment can significantly impact stock prices. Factors such as geopolitical events, corporate earnings reports, and regulatory changes can sway investor confidence.

- Technological Advancements: The rapid pace of technological innovation continues to reshape various industries, leading to shifts in market capitalization.

- Interest Rates: Changes in interest rates can affect borrowing costs for companies, which, in turn, can impact their profitability and stock prices.

Recent Trends in the Total US Stock Value

Over the past few years, the total US stock value has experienced significant growth. This upward trend can be attributed to several factors:

- Record High Corporate Profits: Corporate earnings have reached record highs, driving up stock prices and, subsequently, the total stock value.

- Robust Economic Growth: The US economy has experienced steady growth, bolstering investor confidence and driving up stock prices.

- Low Interest Rates: The Federal Reserve's low-interest-rate policy has made borrowing cheaper for companies, leading to increased investments and higher stock prices.

Case Studies: Impact of Major Events on the Total US Stock Value

Several major events have had a significant impact on the total US stock value. Here are a few notable examples:

- COVID-19 Pandemic: The outbreak of the COVID-19 pandemic in early 2020 led to a sharp decline in the total US stock value, as investors sold off their stocks in response to the economic uncertainty. However, the stock market quickly recovered, driven by stimulus measures and vaccine developments.

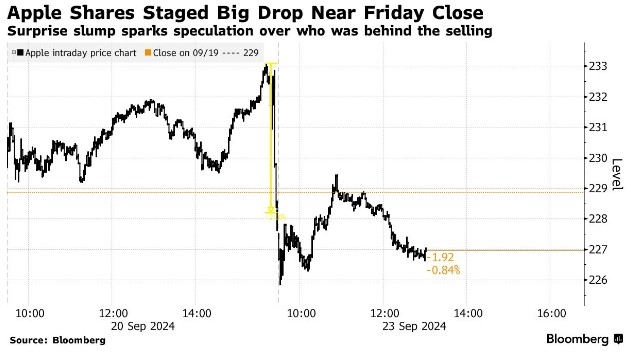

- Tech Stocks Boom: The rise of tech stocks, particularly companies like Apple, Amazon, and Google, has significantly contributed to the growth of the total US stock value.

Outlook for the Total US Stock Value

Looking ahead, several factors could influence the total US stock value:

- Economic Recovery: The pace of economic recovery from the COVID-19 pandemic will play a crucial role in determining the future of the total US stock value.

- Regulatory Changes: Potential regulatory changes in key sectors, such as technology and finance, could impact stock prices and, consequently, the total stock value.

- Geopolitical Events: Global geopolitical events, such as trade tensions and political instability, could lead to market volatility and affect the total US stock value.

In conclusion, the total US stock value is a vital indicator of the health of the US economy and the confidence of investors. By understanding the factors that influence the total stock value, investors can make more informed decisions and navigate the ever-changing financial landscape.

toys r us stocks