Title: China Buy US Stocks: The Increasing Trend and Its Implications

author:US stockS -Stocks(1218)The(937)Buy(216)INC(14)China(17)Title(519)

Introduction: The global financial landscape has been witnessing a remarkable trend in recent years: China's increasing investment in US stocks. This article delves into the reasons behind this trend, its implications, and how it might shape the future of the global market.

Understanding the Trend:

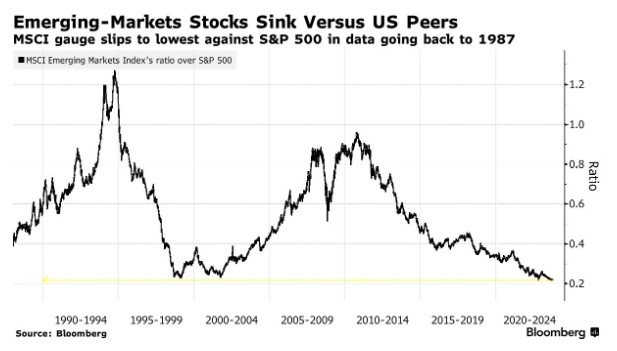

Over the past decade, China has emerged as a significant player in the global financial market, especially in the US. The growing economic ties between the two nations have led to an influx of Chinese investments in the US, with stocks being one of the most preferred investment avenues.

Reasons for the Increased Investment:

- Strong Economy: China's economy has been growing at a rapid pace, making it one of the most attractive destinations for foreign investments.

- Diversification: The Chinese investors aim to diversify their portfolio by investing in US stocks, which offer a wide range of opportunities.

- Market Confidence: The stability and growth potential of the US stock market have made it an appealing choice for Chinese investors.

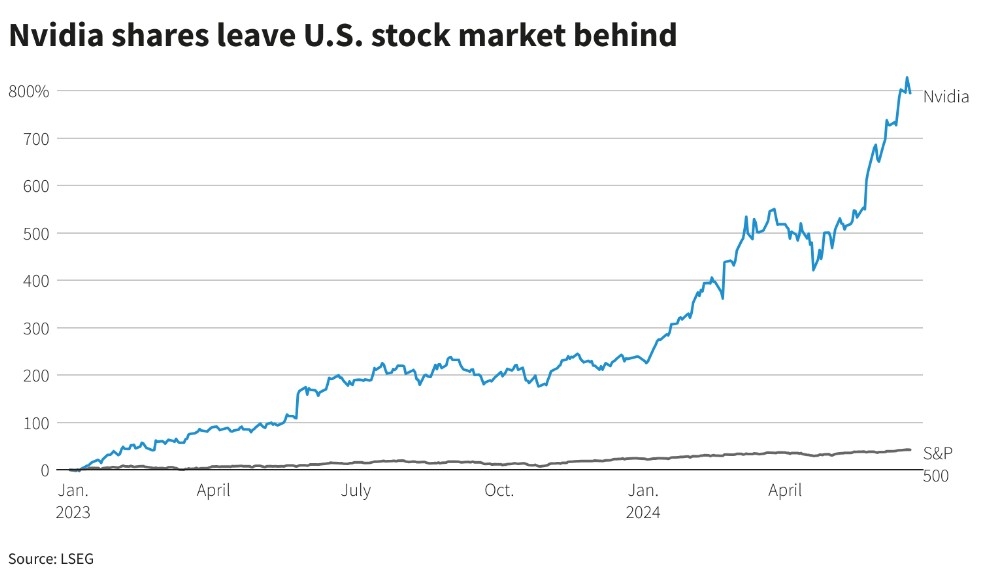

- Technological Advancements: The rise of technology in the US has created numerous opportunities for investment, luring Chinese investors towards US stocks.

Implications of the Trend:

- Increased Market Liquidity: The influx of Chinese investments has added liquidity to the US stock market, making it more accessible for other investors.

- Growth in US Stocks: The increased demand for US stocks has contributed to their growth and stability.

- Strategic Partnerships: The growing Chinese investments have opened doors for strategic partnerships between US and Chinese companies.

- Economic Ties: The increasing investments have further strengthened the economic ties between the two nations.

Case Studies:

- Baidu's Investment in US Stocks: The Chinese search engine giant, Baidu, has been actively investing in US stocks, including tech giants like Apple and Microsoft. This investment has not only helped Baidu diversify its portfolio but has also strengthened its global presence.

- Tsinghua Unigroup's Investment: China's largest semiconductor manufacturer, Tsinghua Unigroup, has been investing heavily in US tech companies. This investment is aimed at acquiring advanced technology and fostering innovation.

Conclusion:

China's increasing investments in US stocks is a testament to the growing economic ties between the two nations. While it offers numerous opportunities, it also comes with its own set of challenges. As the trend continues to evolve, it will be interesting to see how it shapes the global financial landscape.

toys r us stocks