The Biggest Losers: US Stocks in a Market Tumble

author:US stockS -

The stock market is often unpredictable, and with the rapid shifts in the economy, some companies can face severe setbacks. In this article, we delve into the "biggest losers" among US stocks, exploring the factors that led to their dramatic falls and what these declines can teach us about the volatile nature of the market.

The Downfall of Tech Giants

One of the most striking examples of market losers in recent years has been the tech industry. Companies like Facebook (now Meta) and Amazon have faced significant stock declines, largely due to a variety of factors. Facebook's struggles have been primarily tied to privacy concerns and declining user engagement, while Amazon has faced increased competition and rising labor costs.

For instance, Facebook's stock plummeted by more than 50% in the aftermath of the Cambridge Analytica scandal in 2018. This incident, along with growing regulatory scrutiny, has put a strain on the company's reputation and financial performance.

Similarly, Amazon's stock has faced challenges, despite being a market leader in e-commerce and cloud services. The company has faced criticism over its labor practices, rising prices for consumer goods, and increasing competition from both traditional retailers and tech giants like Google and Microsoft.

Impact of the Pandemic

The COVID-19 pandemic has further exacerbated the plight of some US stocks. The initial outbreak caused widespread panic, leading to a significant sell-off across the market. While many stocks recovered, some never regained their pre-pandemic value.

For example, Wynn Resorts faced a particularly harsh decline due to the pandemic's impact on the travel and hospitality industries. The stock fell by nearly 75% as lockdowns and travel restrictions severely curtailed its revenue.

Learning from the Losers

The declines of these companies can offer valuable lessons for investors and market analysts. One key lesson is the importance of diversification. Investing in a single stock can be risky, as demonstrated by the significant losses suffered by companies like Facebook and Amazon.

Additionally, staying informed about potential risks is crucial. Factors such as privacy concerns, increased competition, and economic downturns can all lead to sudden declines in stock prices.

Case Studies: A Closer Look

Let's take a closer look at a few case studies that illustrate the decline of US stocks:

Walmart: While not traditionally considered a "biggest loser," Walmart's stock faced significant challenges in the face of the pandemic. The company's stock fell by approximately 30% before gradually recovering.

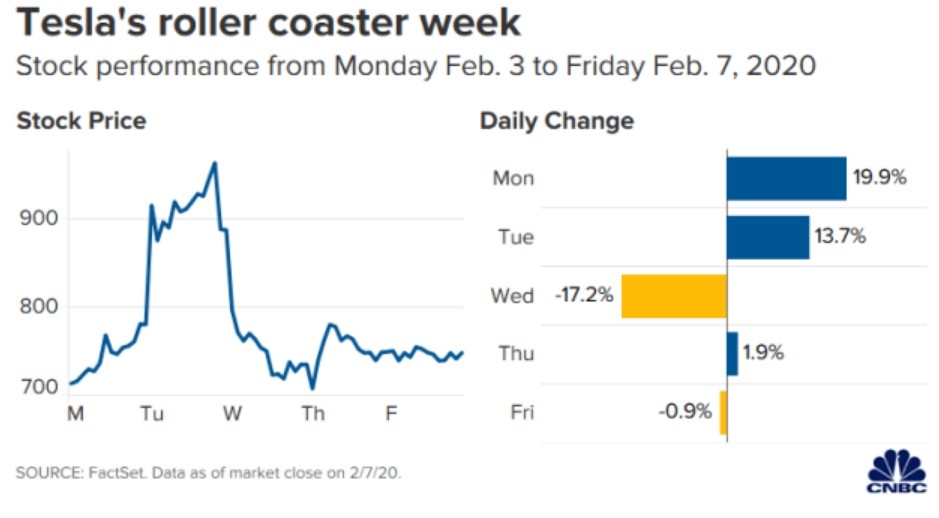

Tesla: Despite being one of the most popular electric vehicle manufacturers, Tesla's stock has experienced substantial volatility. In 2021, the stock fell by over 50% after reaching an all-time high just a few months earlier.

Dow Jones: The overall decline in the Dow Jones Industrial Average in 2020, triggered by the pandemic, serves as a stark reminder of how quickly market sentiment can change and impact major indices.

In conclusion, the "biggest losers" among US stocks offer a valuable insight into the risks and rewards of the stock market. As investors and market watchers, it's crucial to stay informed, diversified, and ready to adapt to the ever-changing landscape.

toys r us stocks