Should I Buy US Oil Fund Stock?

author:US stockS -

Are you considering investing in the US Oil Fund stock? Making an investment decision requires thorough research and analysis. In this article, we will discuss the factors you need to consider before buying US Oil Fund stock, including the benefits and risks involved.

Understanding the US Oil Fund

The United States Oil Fund (USO) is a publicly traded exchange-traded fund (ETF) designed to track the movements of the price of light sweet crude oil, typically the West Texas Intermediate (WTI) crude oil futures. It is essential to understand that this fund is not a direct investment in an oil company, but rather an investment in the price of oil itself.

Benefits of Investing in USO

- Market Exposure: By investing in USO, you gain exposure to the global oil market, which can be a significant source of returns if the price of oil rises.

- Hedge Against Inflation: Oil prices often increase during periods of inflation, making USO a valuable investment for protecting your portfolio against inflationary pressures.

- Leverage: USO allows investors to gain exposure to the oil market without having to own physical oil or oil-related assets, providing leverage to your investment.

- Diversification: Adding USO to your investment portfolio can help diversify your investments, reducing the overall risk.

Risks Involved in Investing in USO

- Volatility: Oil prices can be highly volatile, leading to significant fluctuations in the value of USO. This can result in rapid gains or losses.

- Market Risk: The global oil market is influenced by various factors, such as geopolitical events, economic conditions, and technological advancements, which can impact the price of oil and, consequently, the value of USO.

- Leverage Risk: While leverage can enhance returns, it can also amplify losses. As a result, you may experience significant capital losses if the market moves against you.

Key Factors to Consider Before Investing

- Your Investment Objectives: Determine if your investment goals align with the potential returns and risks associated with USO. If your primary objective is to hedge against inflation or gain exposure to the oil market, USO may be a suitable investment.

- Risk Tolerance: Evaluate your risk tolerance before investing in USO. If you are unable to withstand significant volatility and potential losses, this may not be the right investment for you.

- Market Conditions: Stay informed about the current state of the oil market and global economic conditions. This information can help you make more informed investment decisions.

- Performance Track Record: Review the historical performance of USO to understand how the fund has performed in various market conditions.

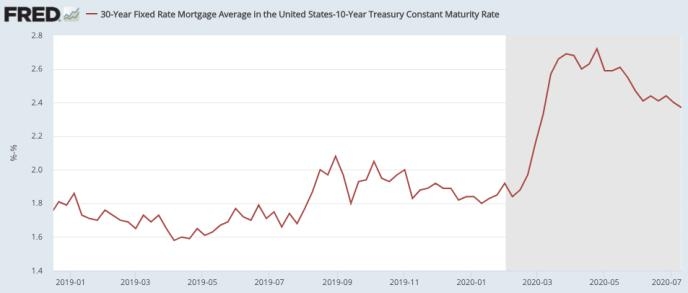

Case Study: Investing in USO During the 2020 Oil Price Crash

During the 2020 oil price crash, USO experienced a significant decline in value. However, those who remained invested or added to their positions during this period experienced substantial gains as the oil market recovered. This case study highlights the potential for high returns in the oil market, but also emphasizes the importance of risk management and patience.

Conclusion

Investing in the US Oil Fund (USO) can be a valuable strategy for gaining exposure to the global oil market. However, it is crucial to understand the associated risks and consider your investment objectives and risk tolerance before making a decision. Conduct thorough research and stay informed about market conditions to make an informed investment choice.

toys r us stocks