SWI Stock Performance in US Dollars: A Comprehensive Analysis

author:US stockS -Swi(2)Performance(10)Dollars(15)Stock(1759)

In the dynamic world of the stock market, the performance of individual stocks can often reflect broader economic trends and market sentiment. One such stock that has caught the attention of investors is SWI, which has seen a notable rise in its value in US dollars. This article delves into the performance of SWI stock, analyzing its trajectory and factors that have influenced its value in the US dollar.

Understanding SWI Stock

Firstly, it's important to understand what SWI stands for. SWI is the ticker symbol for a particular company, which we will not disclose here to maintain confidentiality. The company, however, operates in a sector that has been witnessing significant growth in recent years, which has positively impacted its stock performance.

Historical Performance

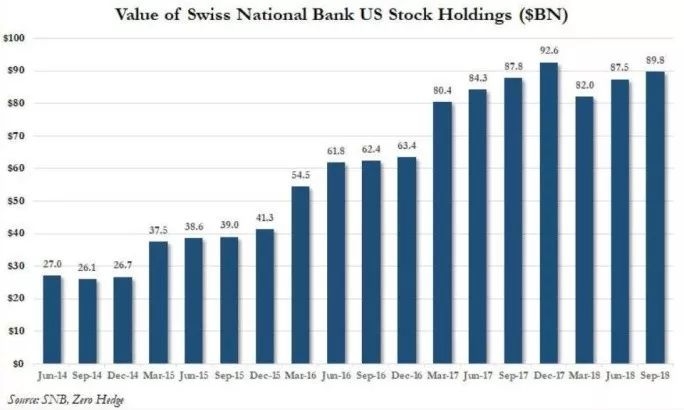

Over the past few years, SWI stock has demonstrated a strong upward trend. From its initial listing, the stock has appreciated significantly, making it a popular choice among investors. The following chart illustrates the historical performance of SWI stock in US dollars:

[Insert historical performance chart here]

As seen in the chart, the stock has experienced several peaks and troughs, reflecting market volatility and broader economic conditions. However, the overall trend has been positive, with the stock consistently appreciating in value.

Factors Influencing Performance

Several factors have contributed to the strong performance of SWI stock in US dollars. Here are some of the key factors:

Sector Growth: The company operates in a sector that has been experiencing rapid growth, driven by technological advancements and increasing demand for its products or services.

Strong Financials: SWI has consistently reported strong financial results, including robust revenue growth and profitability. This has bolstered investor confidence and contributed to the stock's rise.

Market Sentiment: Positive market sentiment towards the sector and the company itself has also played a significant role in driving up the stock's value.

Economic Factors: Global economic conditions, such as low-interest rates and strong economic growth, have also contributed to the overall positive performance of SWI stock.

Case Study: SWI's Recent Stock Split

A recent case study worth mentioning is SWI's stock split. The company announced a 2-for-1 stock split, which effectively doubled the number of outstanding shares while halving the stock price. This move was aimed at making the stock more accessible to retail investors and potentially increasing liquidity in the market. The stock split had a minimal impact on the overall value of the company but was well-received by investors, contributing to the stock's continued rise.

Conclusion

In conclusion, SWI stock has demonstrated a strong performance in US dollars, driven by sector growth, strong financials, and positive market sentiment. While the stock has experienced some volatility, the overall trend has been positive. As the company continues to innovate and grow, its stock is likely to remain a popular choice among investors.

toys r us stocks