Navigating the Current Stock Market Index: A Comprehensive Guide

author:US stockS -

The stock market index is a vital tool for investors and traders seeking to gauge the overall health and performance of the market. Understanding the current stock market index can provide valuable insights into market trends and potential investment opportunities. This article delves into the nuances of the current stock market index, offering a comprehensive guide for investors to navigate the dynamic landscape of the financial markets.

Understanding the Stock Market Index

A stock market index is a statistical measure of the value of a selection of stocks representing a particular market or sector. The most well-known index is the S&P 500, which tracks the performance of 500 large companies listed on the stock exchanges in the United States. Other popular indexes include the Dow Jones Industrial Average (DJIA), the NASDAQ Composite, and the Russell 2000.

Factors Influencing the Stock Market Index

Several factors can influence the stock market index, including economic indicators, corporate earnings reports, geopolitical events, and market sentiment. It's essential for investors to stay informed about these factors to make informed decisions.

Economic Indicators: Economic indicators such as GDP growth, unemployment rates, and inflation can have a significant impact on the stock market index. For example, if the GDP growth rate is strong, it may indicate a healthy economy, which can boost stock prices.

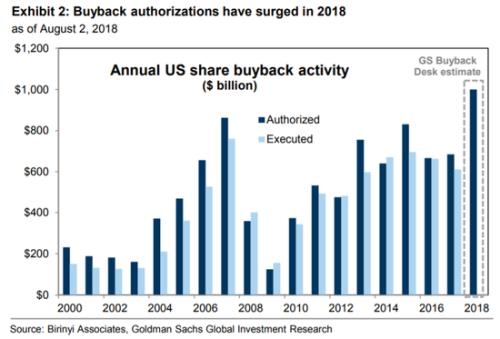

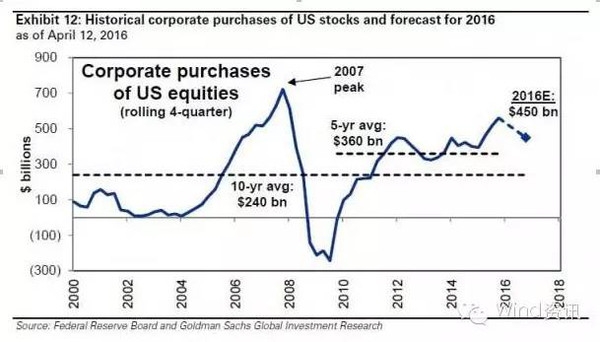

Corporate Earnings Reports: Corporate earnings reports are crucial for investors as they provide insights into the financial performance of individual companies. Positive earnings reports can drive stock prices higher, while negative reports can lead to declines.

Geopolitical Events: Geopolitical events, such as elections, trade wars, or political instability, can create uncertainty in the market, leading to volatility in the stock market index.

Market Sentiment: Market sentiment refers to the overall attitude of investors towards the market. If investors are optimistic, they may be more willing to buy stocks, pushing the index higher. Conversely, if investors are pessimistic, the index may decline.

Analyzing the Current Stock Market Index

Analyzing the current stock market index involves examining various indicators and trends. Here are some key factors to consider:

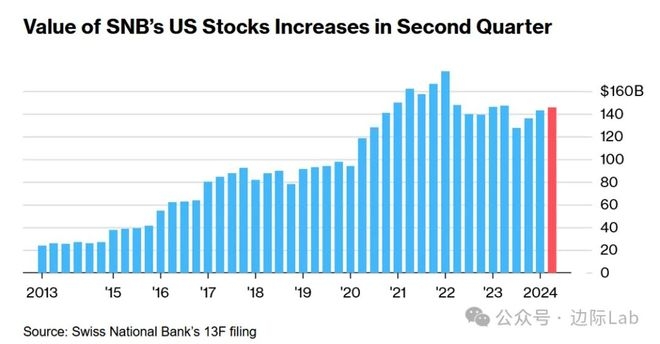

*Historical Performance: Comparing the current index level with historical levels can provide insights into market trends. For example, if the index is at a higher level than it was a year ago, it may indicate a strong market.

*Dividend Yield: The dividend yield is the percentage of a company's annual dividend payments to its stock price. A higher dividend yield may indicate a more stable investment, while a lower yield may suggest higher growth potential.

*Volatility: Volatility measures the degree of price fluctuation in the stock market index. High volatility can indicate uncertainty and risk, while low volatility may suggest a more stable market.

Case Study: The S&P 500

To illustrate the impact of the stock market index, let's consider the S&P 500. In 2020, the S&P 500 experienced significant volatility due to the COVID-19 pandemic. However, by the end of the year, the index had recovered and even reached new highs. This example demonstrates the importance of staying informed about the stock market index and being prepared for market fluctuations.

Conclusion

Understanding the current stock market index is crucial for investors seeking to make informed decisions. By analyzing factors such as economic indicators, corporate earnings reports, geopolitical events, and market sentiment, investors can gain valuable insights into market trends and potential investment opportunities. Stay informed, stay vigilant, and navigate the dynamic landscape of the financial markets with confidence.

toys r us stocks