Jamie Dimon Warns of Inflated US Stock Market Prices

author:US stockS -Jamie(1)Dimon(1)Warns(1)Inflated(1)Sto(91)

In a recent interview, Jamie Dimon, the esteemed CEO of JPMorgan Chase, has issued a stark warning about the inflated prices of the US stock market. Dimon, a respected figure in the financial world, has long been known for his insightful analysis and cautionary outlook. In this article, we delve into Dimon's concerns and explore the potential implications for the stock market.

Dimon's Concerns

Dimon expressed his concerns regarding the stock market's current valuation, noting that it is significantly overvalued. He pointed to several factors contributing to this inflated state, including low interest rates, excessive corporate borrowing, and a lack of economic growth.

One of Dimon's primary concerns is the low-interest-rate environment. With the Federal Reserve keeping rates near historic lows, investors have been flocking to the stock market in search of higher returns. This influx of capital has driven up stock prices, creating an environment where valuations have become increasingly stretched.

Additionally, Dimon highlighted the excessive corporate borrowing that has taken place in recent years. Companies have been taking advantage of the low-interest-rate environment to borrow money at historically low rates and invest in growth initiatives. While this has been beneficial for corporate earnings, it has also contributed to the stock market's inflated prices.

Furthermore, Dimon expressed concerns about the lack of economic growth. With global economic conditions remaining uncertain, and the US facing potential challenges such as rising inflation and trade tensions, Dimon believes that the stock market is at risk of a significant correction.

Potential Implications

Dimon's warnings have sparked a heated debate among investors and economists. While some argue that the stock market is still undervalued, others believe that Dimon's concerns are well-founded and that a correction could be on the horizon.

One potential implication of Dimon's warnings is a decrease in investor confidence. As investors become more cautious about the stock market's overvalued state, they may start to pull back from their investments, leading to a sell-off and a subsequent drop in stock prices.

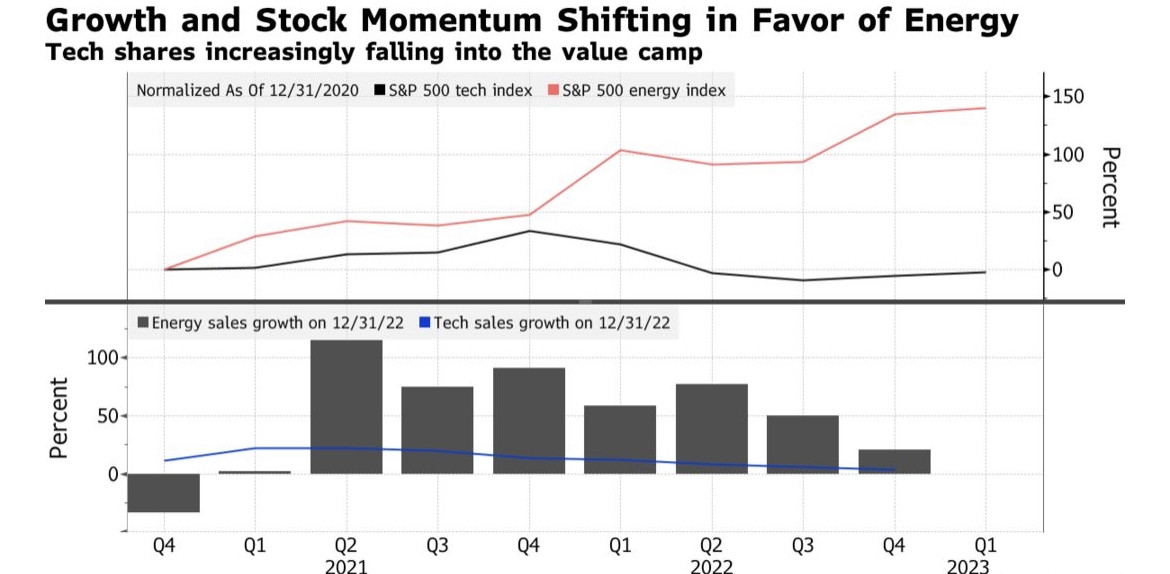

Another potential implication is a shift in investment strategy. With Dimon's concerns in mind, investors may start to focus more on value stocks and dividend-paying companies, which tend to be less volatile and offer more stability during times of market uncertainty.

Case Studies

To illustrate the potential impact of Dimon's warnings, let's consider a few historical examples. In the late 1990s, the tech bubble reached its peak, with stock prices soaring to unprecedented levels. As the bubble eventually burst, investors lost billions of dollars, and the stock market experienced a significant correction.

Similarly, in the early 2000s, the housing market bubble led to the financial crisis of 2008. As the bubble burst, the stock market plummeted, causing widespread economic turmoil.

While these examples are not direct parallels to the current market conditions, they serve as reminders of the potential risks associated with overvalued stock markets.

Conclusion

In conclusion, Jamie Dimon's warnings about the inflated US stock market prices should not be taken lightly. As a respected figure in the financial world, Dimon's insights are worth considering. Investors and policymakers should remain vigilant and be prepared for the potential implications of a market correction.

toys r us stocks