Investment Watch Blog: US Stocks Are the Most Overvalued Ever

author:US stockS -Blog(1)Stocks(1218)Watch(17)INVESTMENT(16)A(28)

In the ever-evolving world of investments, it's crucial to stay informed about the market's trends and valuations. One of the most alarming developments in recent years is the overvaluation of US stocks. This article delves into the reasons behind this phenomenon and its potential implications for investors.

Understanding Overvaluation

Overvaluation refers to a situation where the price of an asset, in this case, US stocks, significantly exceeds its intrinsic value. This discrepancy can occur due to various factors, including excessive optimism, speculative trading, and market manipulation.

Reasons for Overvaluation

Low Interest Rates: The Federal Reserve's low-interest-rate policy has been a significant factor contributing to the overvaluation of US stocks. With low borrowing costs, companies have been able to borrow at a cheaper rate, leading to increased investment and stock prices.

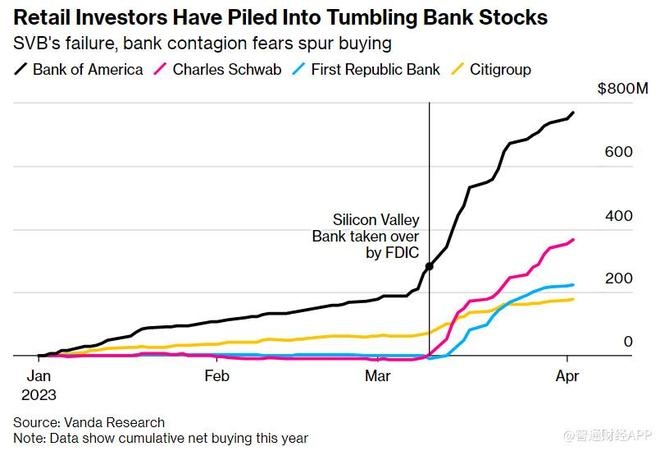

Speculative Trading: The rise of retail trading platforms like Robinhood has led to a surge in speculative trading. Investors are buying stocks without a clear understanding of their underlying value, driving prices higher.

Economic Stimulus: The government's economic stimulus measures, including the COVID-19 relief packages, have provided a significant boost to the stock market. However, this stimulus may not be sustainable in the long run.

Tech Stocks: The tech sector, which accounts for a significant portion of the US stock market, has seen a dramatic rise in valuations. Companies like Apple, Amazon, and Google have seen their stock prices soar, contributing to the overall overvaluation of the market.

Implications for Investors

The overvaluation of US stocks poses several risks for investors:

Market Volatility: Overvalued markets tend to be more volatile. Even a slight correction can lead to significant losses for investors.

Long-Term Underperformance: Overvalued stocks often underperform in the long run. Investors who buy at these high prices may find themselves with a depreciating asset.

Speculative Bubbles: The current market conditions may be setting the stage for a speculative bubble, similar to the dot-com bubble of the late 1990s.

Case Studies

Tech Stocks: The rise of tech stocks, particularly in the past few years, has been a significant driver of the overvaluation of US stocks. Companies like Tesla and NVIDIA have seen their stock prices soar, despite their high valuations.

Retail Trading Platforms: The rise of retail trading platforms has contributed to the speculative trading that has driven up stock prices. The "meme stock" phenomenon, where retail investors drive up the prices of otherwise undervalued stocks, is a prime example.

Conclusion

The overvaluation of US stocks is a concerning trend that investors should be aware of. While the market may continue to rise in the short term, the long-term risks are significant. It's crucial for investors to conduct thorough research and consider diversifying their portfolios to mitigate these risks.

toys r us stocks