International vs. US Stocks in 2025: A Comprehensive Analysis

author:US stockS -

In the ever-evolving global financial landscape, investors are constantly seeking opportunities to diversify their portfolios. As we approach 2025, the debate between investing in international stocks versus US stocks has become more pertinent than ever. This article delves into the key factors that investors should consider when making this crucial decision.

Understanding the Global Market

The global market has witnessed significant growth over the past decade, with emerging markets like China and India leading the charge. International stocks offer exposure to diverse economies, allowing investors to benefit from different market cycles and growth patterns. On the other hand, US stocks have traditionally been seen as a safe haven, offering stability and innovation.

Growth Prospects

One of the primary reasons investors are attracted to international stocks is the potential for higher growth. Emerging markets are often characterized by rapid economic development and increasing consumer demand. For instance, China's middle class is expected to grow significantly by 2025, presenting a vast opportunity for companies operating in sectors like technology, consumer goods, and healthcare.

In contrast, the US stock market has seen steady growth over the years, but it may not offer the same level of potential as emerging markets. However, the US market's strong regulatory framework and technological advancements make it an attractive option for investors seeking stability and innovation.

Risk and Return

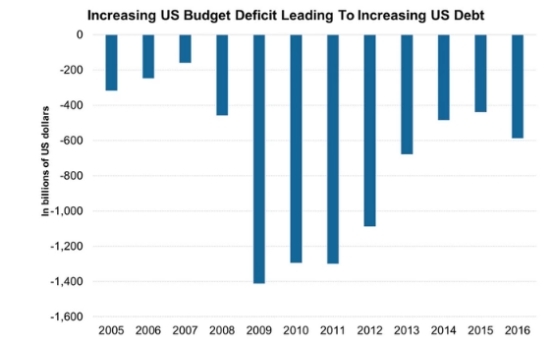

Investing in international stocks comes with its own set of risks, including political instability, currency fluctuations, and regulatory challenges. While these risks can be mitigated through diversification and thorough research, they are still a significant factor to consider.

On the other hand, US stocks are generally considered to be less risky due to the country's stable political environment and strong regulatory framework. However, this does not mean that US stocks are without risk. The tech sector, for example, has seen significant volatility in recent years.

Dividends and Yield

Another important factor to consider is dividends and yield. International stocks often offer higher dividend yields compared to US stocks, making them an attractive option for income-seeking investors. However, it is crucial to conduct thorough research to ensure that the companies you are investing in have a strong track record of paying dividends.

Case Studies

To illustrate the differences between international and US stocks, let's consider two companies: Alibaba Group Holding Limited (BABA) and Apple Inc. (AAPL).

Alibaba Group Holding Limited is a Chinese e-commerce giant that has seen significant growth in recent years. Its strong presence in the Chinese market and expansion into other emerging markets make it an attractive investment for those looking to capitalize on the global growth trend.

Apple Inc., on the other hand, is a US-based technology company that has become a global leader in innovation. Its strong brand and product portfolio have made it a favorite among investors seeking stability and growth.

Conclusion

As we approach 2025, the decision between investing in international stocks versus US stocks depends on various factors, including your investment goals, risk tolerance, and market outlook. While international stocks offer potential for higher growth, US stocks provide stability and innovation. Conducting thorough research and seeking professional advice can help you make an informed decision that aligns with your investment strategy.

toys r us stocks