How Does the Stock Market Affect the US Economy?

author:US stockS -

The stock market is a critical component of the U.S. economy, playing a pivotal role in shaping economic trends and influencing the well-being of individuals and businesses alike. Understanding how the stock market affects the U.S. economy is essential for investors, policymakers, and the general public. This article delves into the various ways in which the stock market impacts the U.S. economy, providing insights into its role in job creation, corporate growth, and overall economic stability.

1. Corporate Growth and Investment

The stock market serves as a primary source of capital for corporations. Companies issue stocks to raise funds for expansion, research and development, and other business initiatives. When the stock market is performing well, companies can attract more investors, thereby increasing their access to capital. This capital injection enables businesses to grow, create jobs, and contribute to the overall economic growth of the country.

For instance, during the dot-com boom in the late 1990s, the stock market experienced a significant surge, leading to increased investments in technology companies. This surge in investment fueled the growth of the tech industry, creating numerous jobs and contributing to the U.S. economy's expansion.

2. Consumer Confidence and Spending

The stock market's performance has a direct impact on consumer confidence. When the stock market is on the rise, individuals feel wealthier due to the increase in the value of their investments. This boost in confidence often translates into higher consumer spending, as people are more willing to make purchases and investments.

Conversely, during periods of stock market downturns, consumer confidence tends to decline. This can lead to reduced spending, which, in turn, can negatively impact businesses and the overall economy.

3. Job Creation

The stock market's performance is closely linked to job creation in the U.S. economy. As companies grow and expand due to increased access to capital from the stock market, they often need to hire more employees to meet the growing demand for their products and services. This job creation can have a ripple effect throughout the economy, as new workers contribute to increased consumer spending and further stimulate economic growth.

4. Economic Indicators and Policy Decisions

The stock market serves as a barometer for the overall health of the U.S. economy. Policymakers and investors closely monitor stock market trends to gauge economic conditions. For example, during the 2008 financial crisis, the stock market's collapse served as a warning sign of the impending economic downturn.

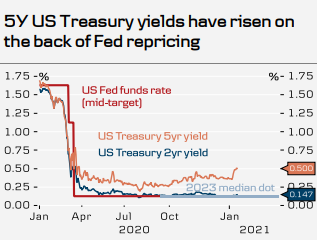

The Federal Reserve and other regulatory agencies often use stock market data to inform their policy decisions. For instance, during periods of economic growth, the Federal Reserve may raise interest rates to prevent inflation. Conversely, during economic downturns, the Fed may lower interest rates to stimulate growth.

5. International Trade and Competitiveness

The stock market's performance can also impact the U.S. economy through its influence on international trade and competitiveness. A strong stock market can attract foreign investment, leading to increased exports and a trade surplus. Conversely, a weak stock market can deter foreign investment, leading to a trade deficit and decreased competitiveness.

In conclusion, the stock market plays a vital role in the U.S. economy by fostering corporate growth, influencing consumer confidence, creating jobs, guiding policy decisions, and impacting international trade. Understanding the interconnected nature of these factors is crucial for anyone seeking to comprehend the overall health of the U.S. economy.

toys r us stocks