Gold, US Money, Stock: The Ultimate Investment Triangle

author:US stockS -Gold(11)The(937)Ultimate(70)Money(16)Stock(1759)

In the intricate world of investments, finding the perfect blend of assets can be a daunting task. However, when it comes to diversifying your portfolio, the triangle formed by gold, US money, and stocks stands out as a powerful and stable foundation. This article delves into the significance of this trio, offering insights into how they can work together to provide a robust investment strategy.

Understanding the Gold Market

Gold has long been considered a safe haven for investors during times of economic uncertainty. Its intrinsic value, limited supply, and historical role as a currency make it an attractive asset class. Gold has a unique quality of acting as a hedge against inflation and market volatility. Investing in gold can be done through physical gold, gold stocks, or gold exchange-traded funds (ETFs).

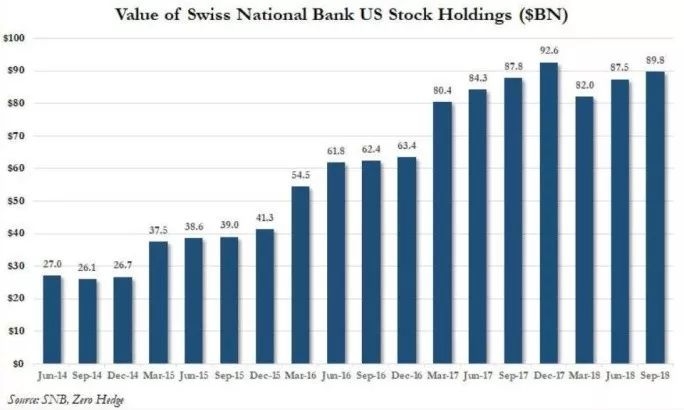

The Strength of US Money

The US dollar is the world's primary reserve currency, making it a cornerstone of global finance. Its stability and liquidity make it a preferred store of value for investors worldwide. US money can be invested in various forms, including US Treasury bills, bonds, and certificates of deposit (CDs). These instruments offer a certain level of security and predictable returns, making them ideal for conservative investors.

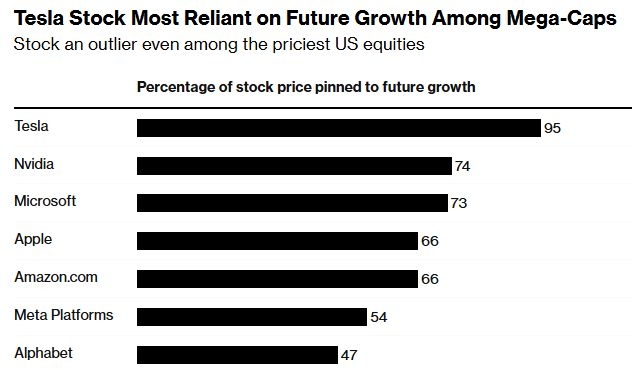

Stocks: The Growth Engine

Stocks represent ownership in a company and are typically seen as a way to participate in the company's growth and profitability. The stock market has historically provided higher returns than other asset classes over the long term. Investing in stocks allows investors to benefit from the potential growth of the underlying companies and the overall market.

The Power of the Triangle

When combined, gold, US money, and stocks create a powerful investment strategy that can help mitigate risk and maximize returns. Here's how they work together:

- Gold serves as a stabilizing force, protecting your portfolio from market downturns.

- US money provides a secure base for your investments, offering liquidity and predictable returns.

- Stocks act as the growth engine, potentially generating high returns over the long term.

Case Study: The 2008 Financial Crisis

One notable example of the effectiveness of this investment triangle is the 2008 financial crisis. During this period, the stock market plummeted, but gold and US money held their value. Investors who had a diversified portfolio that included these assets were better positioned to weather the storm and recover their investments more quickly.

How to Build Your Triangle

To build a strong investment triangle, consider the following steps:

- Assess Your Risk Tolerance: Determine how much risk you're willing to take on. This will guide the allocation of your assets among gold, US money, and stocks.

- Diversify Your Portfolio: Allocate a portion of your portfolio to each asset class to reduce risk.

- Stay Informed: Keep up-to-date with market trends and economic indicators to make informed investment decisions.

- Review and Adjust: Regularly review your portfolio to ensure it aligns with your investment goals and risk tolerance.

By understanding the roles of gold, US money, and stocks, and how they can complement each other, you can create a well-rounded investment strategy that stands the test of time. Remember, diversification is key to long-term financial success.

toys r us stocks