Global Stock Markets Tumble on Fears of US Tariffs

author:US stockS -Fe(1)Tumble(2)Global(12)Markets(39)Stock(1759)

The global stock markets have experienced a dramatic downturn in recent weeks, primarily driven by fears of impending US tariffs. As investors grow increasingly concerned about the potential economic impact of these tariffs, the markets have reacted with volatility and uncertainty. This article delves into the reasons behind this sudden decline and examines the potential consequences for the global economy.

The Rising Threat of Tariffs

The US government has been imposing tariffs on a variety of imported goods, including steel, aluminum, and consumer electronics. These tariffs are aimed at protecting American industries and reducing the trade deficit, but they have sparked widespread concern among investors and businesses worldwide.

Impact on Global Stock Markets

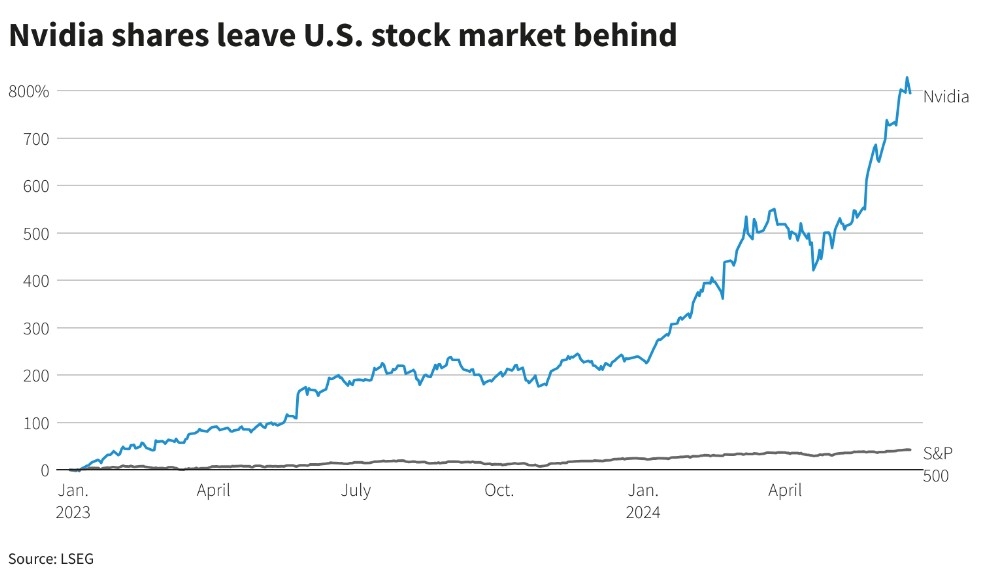

The fear of US tariffs has sent shockwaves through global stock markets. Many companies rely on international trade, and the prospect of higher costs and reduced demand has led to a sell-off in stocks. Key markets, such as the S&P 500 and the NASDAQ, have experienced significant declines, with investors flocking to safer assets like gold and bonds.

Case Study: Apple Inc.

One of the most notable examples of the impact of US tariffs on global stock markets is the case of Apple Inc. The tech giant has warned that the tariffs could lead to higher prices for its products, potentially affecting sales and profits. As a result, Apple's stock has fallen sharply, reflecting the broader concerns about the impact of tariffs on the tech industry.

Economic Consequences

The potential economic consequences of US tariffs are far-reaching. As trade tensions escalate, businesses may face higher costs and reduced demand, leading to a slowdown in economic growth. This could have a ripple effect across the global economy, affecting jobs, wages, and consumer spending.

Alternatives to Tariffs

While tariffs may seem like a straightforward solution to protect American industries, there are alternative approaches that could achieve similar goals without the negative economic consequences. For example, the US could negotiate trade agreements that benefit American businesses while also promoting fair trade practices.

Conclusion

The fear of US tariffs has caused a significant downturn in global stock markets. As investors and businesses grapple with the potential economic impact, it is crucial to consider alternative solutions that promote fair trade and economic stability. The outcome of this ongoing trade dispute will likely have far-reaching consequences for the global economy, and it is essential for policymakers and investors to remain vigilant and proactive in addressing these challenges.

toys r us stocks