General Electric US Manufacturing Stocks: A Comprehensive Guide

author:US stockS -

In the dynamic world of US manufacturing, General Electric (GE) stands out as a leading player. Its diverse portfolio of manufacturing stocks has made it a crucial component for investors looking to capitalize on the industry's growth. This article delves into the intricacies of GE's manufacturing stocks, providing an in-depth analysis and offering valuable insights for potential investors.

Understanding General Electric's Manufacturing Sector

General Electric's manufacturing sector is a cornerstone of the company's operations. This division encompasses a wide range of industries, including aviation, healthcare, power, and renewable energy. By focusing on these key areas, GE has established itself as a global leader in manufacturing technology and innovation.

Aviation: A Pivotal Industry for GE

One of the most significant segments of GE's manufacturing portfolio is aviation. The company's aircraft engines, components, and services are integral to the aviation industry. With a strong focus on efficiency and reliability, GE's aviation division continues to be a key driver of the company's growth.

Healthcare: Revolutionizing Patient Care

GE's healthcare division is another vital component of its manufacturing operations. By leveraging advanced technologies, GE has developed innovative medical imaging systems, diagnostic equipment, and patient monitoring solutions. These products have significantly improved patient care and have become essential tools for healthcare providers worldwide.

Power and Renewable Energy: Driving Sustainable Growth

The power and renewable energy sector of GE's manufacturing division is committed to providing sustainable energy solutions. From gas turbines and wind turbines to grid solutions and energy management systems, GE is at the forefront of the transition to a cleaner, more sustainable energy landscape.

Investing in General Electric's Manufacturing Stocks

Investing in General Electric's manufacturing stocks offers several advantages. Firstly, the company's diverse portfolio provides exposure to various industries, reducing the risk associated with investing in a single sector. Secondly, GE's strong position in key industries like aviation and healthcare ensures consistent revenue streams and growth potential.

Key Factors to Consider When Investing in GE's Manufacturing Stocks

When considering an investment in General Electric's manufacturing stocks, it's crucial to keep the following factors in mind:

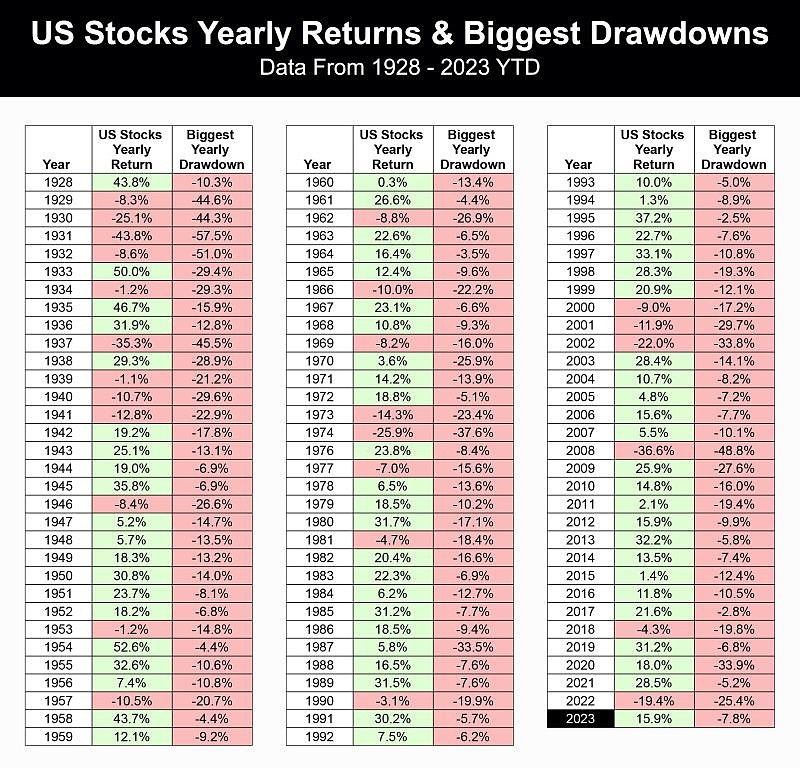

- Market Trends: Staying informed about the latest market trends in the manufacturing sector is essential for making informed investment decisions.

- Financial Health: Assessing GE's financial health, including revenue growth, profitability, and debt levels, is vital for understanding the company's long-term potential.

- Competitive Position: Analyzing GE's competitive position within its industries can provide valuable insights into its growth prospects.

Case Study: GE's Acquisition of Current, powered by GE Lighting

A notable example of GE's commitment to innovation and growth is its acquisition of Current, powered by GE Lighting. This move solidified GE's position as a leader in the smart LED lighting industry and provided a platform for further expansion into connected products and solutions.

Conclusion

Investing in General Electric's manufacturing stocks presents a unique opportunity for investors seeking exposure to the dynamic US manufacturing sector. With a diverse portfolio of industries and a strong focus on innovation, GE is well-positioned for continued growth and success. By considering key factors such as market trends, financial health, and competitive position, investors can make informed decisions and potentially reap the rewards of investing in GE's manufacturing stocks.

toys r us stocks