Maximizing(5)Investme(5)Your(117)Stock(1759)

In the fast-paced world of investing, making informed decisions is crucial for achieving substantial returns. Whether you're a seasoned investor or just starting out, understanding the intricacies of stock picking can significantly impact your financial future. In this article, we will delve into the concept of "et us stock" and provide you with valuable insights to help you make well-informed investment choices.

What is "Et Us Stock"?

The term "et us stock" refers to a strategic approach to stock picking that involves thorough research, analysis, and a keen understanding of market trends. This approach focuses on identifying undervalued or overlooked stocks with high growth potential. By investing in these companies, you can potentially capitalize on market inefficiencies and achieve substantial returns over time.

Key Factors to Consider When Picking Stocks

When engaging in "et us stock," there are several key factors to consider:

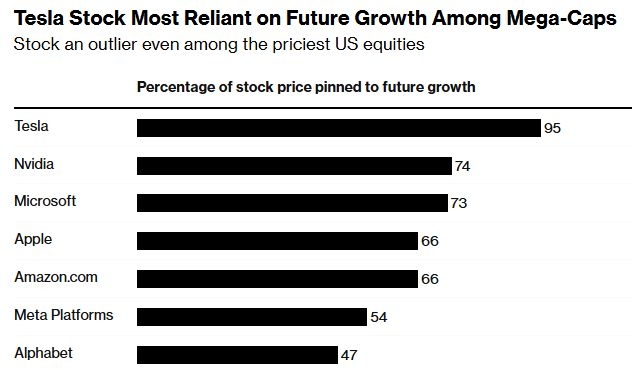

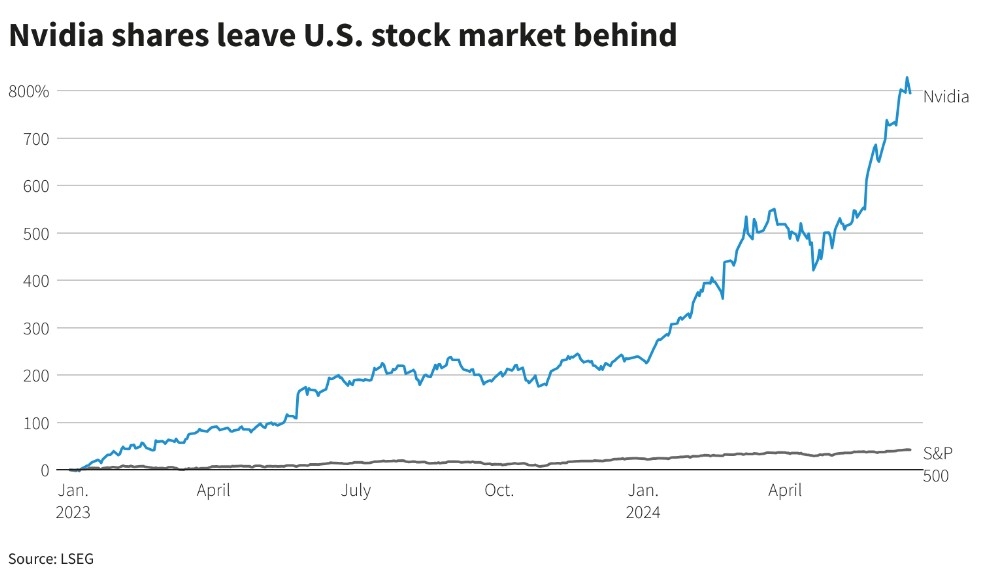

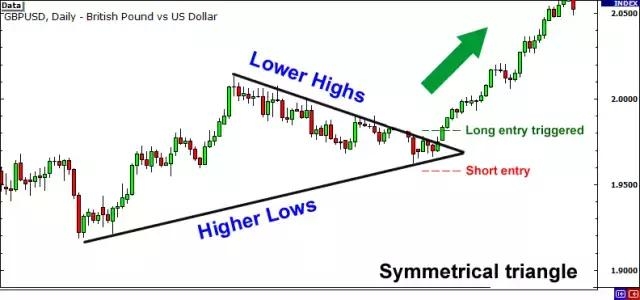

Market Analysis: Understanding the overall market trends is crucial for identifying potential opportunities. By analyzing economic indicators, market sentiment, and industry outlooks, you can gain valuable insights into where the market may be heading.

Company Analysis: Thoroughly researching individual companies is essential for identifying potential investments. This includes analyzing financial statements, revenue growth, profit margins, debt levels, and management quality. Additionally, examining the company's competitive advantage and future growth prospects can provide valuable insights into its long-term potential.

Risk Assessment: Investing always involves risk, so it's crucial to assess the level of risk associated with each potential investment. This includes understanding the company's industry, economic conditions, and regulatory environment. By weighing the potential risks against the potential rewards, you can make more informed decisions.

Strategies for Successful Stock Picking

To maximize your investment potential with "et us stock," consider implementing the following strategies:

Long-Term Investing: Focus on companies with strong fundamentals and long-term growth potential. By investing in these companies, you can ride out short-term market fluctuations and achieve substantial returns over time.

Dividend Investing: Consider investing in companies that consistently pay dividends. Dividends can provide a steady income stream and can be reinvested to potentially increase your investment value.

Diversification: Diversifying your investment portfolio can help reduce risk by spreading your investments across various industries and asset classes. This can help mitigate the impact of market downturns and provide a more stable overall return.

Case Study: Apple Inc.

One notable example of successful "et us stock" picking is Apple Inc. (AAPL). Over the past decade, Apple has consistently demonstrated strong revenue growth, innovative products, and a commitment to shareholder value. By investing in Apple at the right time and holding onto the shares for the long term, investors have seen substantial returns.

In conclusion, "et us stock" is a strategic approach to stock picking that requires thorough research, analysis, and a keen understanding of market trends. By focusing on key factors such as market analysis, company analysis, and risk assessment, you can identify undervalued or overlooked stocks with high growth potential. Implementing strategies such as long-term investing, dividend investing, and diversification can help maximize your investment potential and achieve substantial returns.

toys r us stocks