China-US Stocks: A Comprehensive Guide to Investing Across the Pacific

author:US stockS -

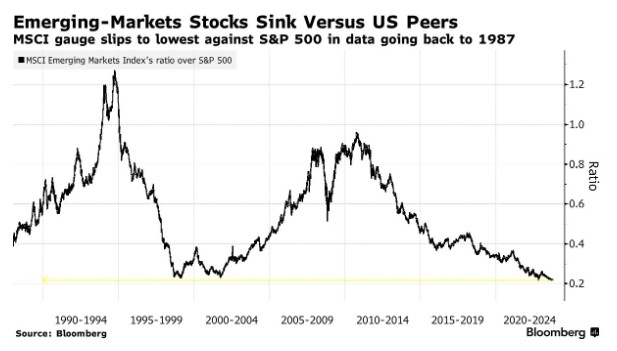

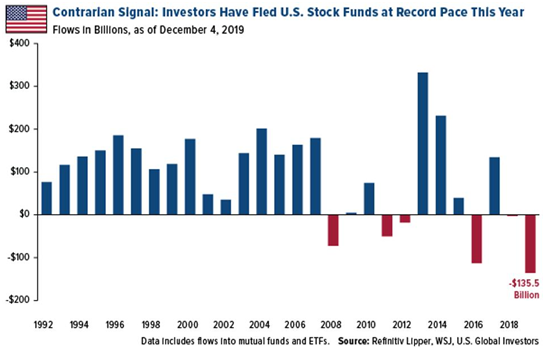

In the ever-evolving global financial landscape, investing in China-US stocks has become a significant opportunity for investors looking to diversify their portfolios. This article delves into the intricacies of investing in Chinese and American stocks, providing a comprehensive guide for those seeking to capitalize on the unique benefits of both markets.

Understanding the China-US Stock Market

The China-US stock market presents a unique blend of opportunities and challenges. Chinese stocks are often associated with high growth potential, driven by the country's rapid economic development and expanding consumer market. US stocks, on the other hand, are known for their stability and innovation, with a plethora of multinational corporations and cutting-edge technologies.

Investing in Chinese Stocks

Investing in Chinese stocks can be a lucrative venture, but it also comes with its own set of complexities. Chinese markets operate differently from those in the United States, and understanding these differences is crucial for successful investing.

- Regulatory Differences: Chinese markets have different regulatory frameworks compared to the US. Investors need to be aware of these differences to avoid legal pitfalls.

- Language Barrier: Chinese financial documents and news can be challenging to understand for non-native speakers. Utilizing reliable translation services is essential.

- Currency Fluctuations: Currency exchange rates can significantly impact returns on investments in Chinese stocks. Keeping an eye on the USD/CNY exchange rate is crucial.

Investing in US Stocks

US stocks offer a stable and diverse investment landscape. Here are some key aspects to consider when investing in US stocks:

- Diversification: US markets are home to a wide range of industries and sectors, making it easier to diversify your portfolio.

- Innovation: The US is a hub for technological innovation, with numerous companies leading the way in various sectors.

- Stability: US markets have a history of stability, making them a safe haven for investors seeking long-term growth.

Top Chinese Stocks to Watch

- Alibaba Group Holding Limited (BABA): A leading e-commerce and cloud computing company in China.

- Tencent Holdings Limited (TCEHY): A dominant player in the Chinese online gaming and social media sectors.

- China Mobile Limited (CHL): The largest mobile telecommunications company in China.

Top US Stocks to Watch

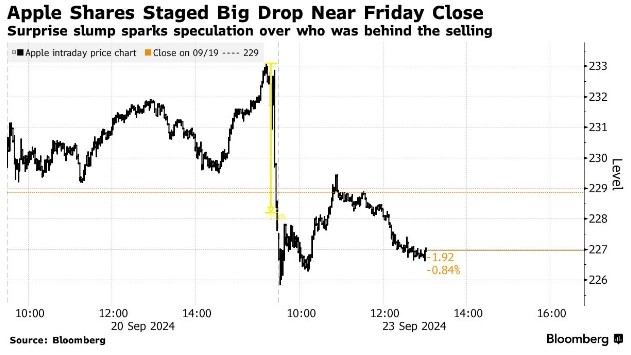

- Apple Inc. (AAPL): A global leader in consumer electronics and software.

- Microsoft Corporation (MSFT): A dominant player in the software and cloud computing industries.

- Amazon.com, Inc. (AMZN): The world's largest online retailer and cloud computing provider.

Conclusion

Investing in China-US stocks can be a rewarding venture, but it requires thorough research and a clear understanding of the unique aspects of both markets. By carefully considering the factors outlined in this article, investors can make informed decisions and potentially capitalize on the growth opportunities presented by both Chinese and American stocks.

toys r us stocks