Are U.S. Stocks in a Bubble Analysis 2025

author:US stockS -

In the ever-evolving landscape of the financial markets, the question of whether U.S. stocks are in a bubble has been a topic of intense debate. As we delve into 2025, it's crucial to analyze the current state of the market and assess the likelihood of a bubble. This article aims to provide a comprehensive analysis, considering various factors that contribute to the stock market's current state.

Historical Perspective

To understand the current situation, it's essential to look back at historical data. Over the past few decades, the U.S. stock market has experienced several bull and bear markets. While some periods have been characterized by excessive optimism and bubble-like conditions, others have been driven by strong fundamentals and sustainable growth.

Current Market Conditions

As of 2025, the U.S. stock market is facing several factors that could either indicate a bubble or a healthy market. Let's explore some of these key factors:

1. Valuations

One of the primary indicators of a bubble is excessive valuations. Over the past few years, the U.S. stock market has seen a significant rise in valuations, particularly in sectors like technology and real estate. While this growth has been driven by strong fundamentals in some cases, it has also raised concerns about overvaluation.

2. Earnings Growth

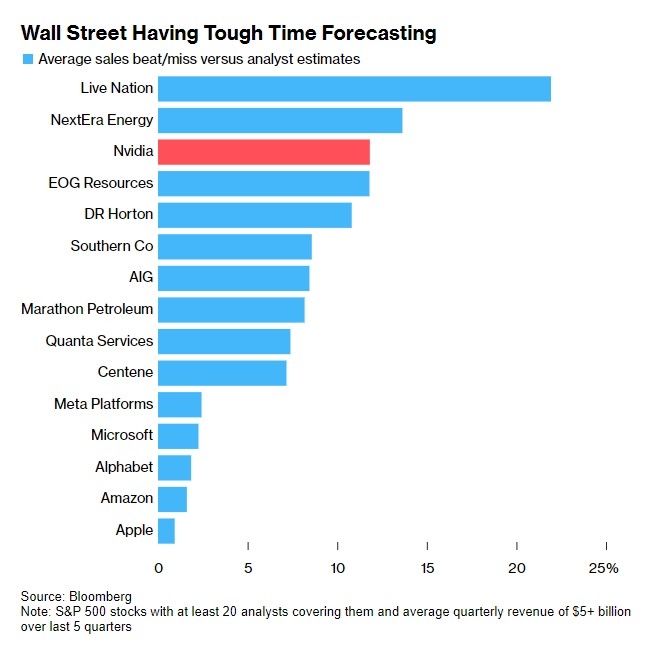

Another crucial factor to consider is earnings growth. In recent years, the U.S. stock market has seen robust earnings growth, driven by factors such as technological advancements and globalization. However, some analysts argue that this growth may not be sustainable in the long term, potentially leading to a bubble.

3. Market Sentiment

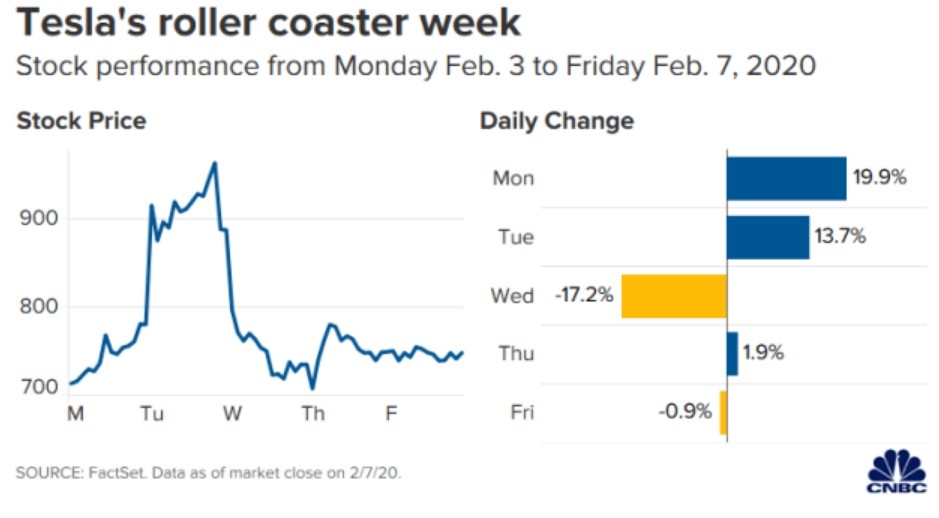

Market sentiment plays a significant role in determining whether a stock market is in a bubble. As of 2025, the U.S. stock market is characterized by a strong bull market sentiment, with investors showing a preference for high-growth stocks. This sentiment, while positive in the short term, could lead to excessive optimism and a bubble-like environment.

4. Economic Factors

Economic factors, such as interest rates and inflation, also play a crucial role in determining the health of the stock market. As of 2025, the U.S. economy is experiencing low interest rates and moderate inflation. While these conditions are generally favorable for stock market growth, they could also contribute to a bubble-like environment if not properly managed.

Case Studies

To further understand the current state of the U.S. stock market, let's consider a few case studies:

1. Tech Stocks

Tech stocks have been a significant driver of the U.S. stock market's growth over the past few years. Companies like Apple, Microsoft, and Amazon have seen their stock prices soar, leading to concerns about overvaluation. While these companies have strong fundamentals, the rapid growth in their stock prices has raised questions about a potential bubble.

2. Real Estate Stocks

Real estate stocks have also experienced significant growth, driven by factors such as low interest rates and strong demand for rental properties. While this growth has been positive for investors, some analysts argue that the real estate sector may be approaching bubble-like conditions.

Conclusion

In conclusion, as of 2025, the U.S. stock market is facing several factors that could indicate a bubble or a healthy market. While valuations and market sentiment are concerning, strong fundamentals and economic conditions suggest that the market may not be in a bubble. However, it's crucial for investors to remain vigilant and stay informed about the latest market developments.

toys r us stocks