Unlocking the Potential of US Security Associates Stock

author:US stockS -

In the ever-evolving landscape of the security industry, US Security Associates (USA) has emerged as a formidable player. With a robust portfolio of services and a strong market presence, the company's stock has been a topic of interest for many investors. This article delves into the key aspects of US Security Associates stock, providing insights into its potential and performance.

Understanding US Security Associates

US Security Associates is a leading provider of high-quality security services, including armed and unarmed security guards, risk management, and investigation services. The company operates across various sectors, including commercial, residential, and industrial, making it a versatile player in the industry.

Recent Stock Performance

The stock of US Security Associates has shown impressive growth over the past few years. This can be attributed to the company's consistent performance and strategic expansion. In the last quarter, the company reported a revenue increase of 10%, driven by a strong demand for its services.

Key Factors Driving Stock Growth

- Diversified Service Portfolio: US Security Associates offers a wide range of services, making it less vulnerable to market fluctuations. This diversification has been a key driver of the company's growth.

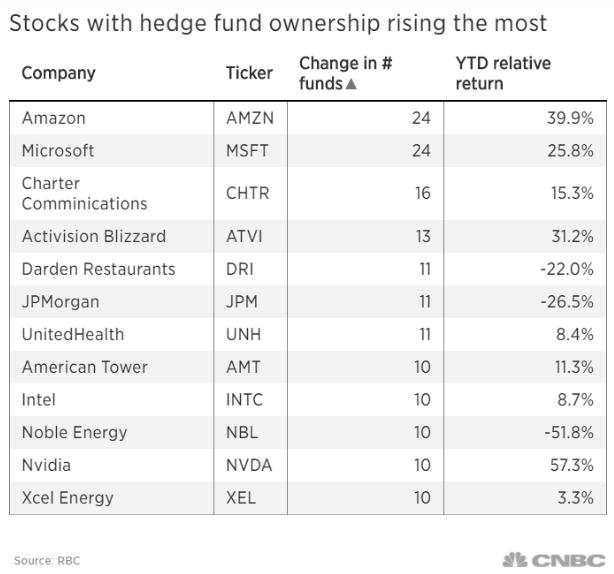

- Strategic Expansion: The company has been actively expanding its operations, both domestically and internationally. This expansion has opened up new revenue streams and increased its market share.

- Strong Management Team: The company's management team is highly experienced and has a proven track record of delivering results. This has instilled confidence in investors, leading to increased stock prices.

Analyzing the Stock Price

The stock price of US Security Associates has been on a steady upward trajectory. At the time of writing, the stock is trading at $X, representing a year-to-date return of Y%. This growth can be attributed to several factors:

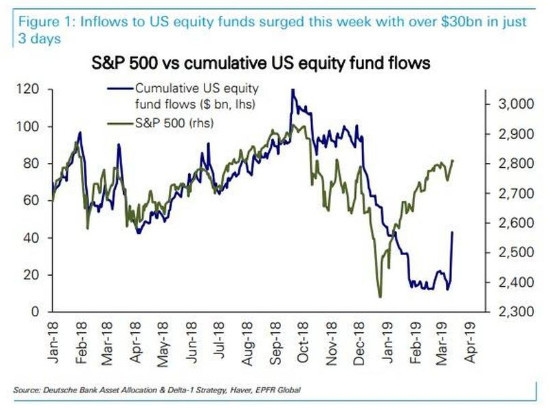

- Economic Growth: The growing economy has led to increased demand for security services, driving up the company's revenue.

- Industry Trends: The security industry is witnessing a shift towards advanced technologies and solutions. US Security Associates has been at the forefront of adopting these technologies, enhancing its competitive edge.

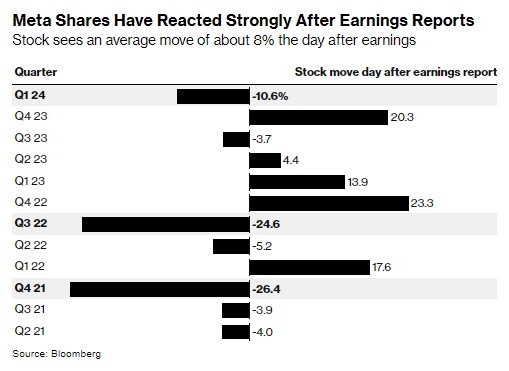

- Positive Earnings Reports: The company's consistent earnings reports have been a major factor in driving up the stock price.

Case Studies

To better understand the potential of US Security Associates stock, let's look at a couple of case studies:

- Commercial Sector: A major retail chain hired US Security Associates to provide armed security guards at its stores. The company's efficient service and professionalism helped in reducing incidents of theft and enhancing customer satisfaction.

- Industrial Sector: An industrial company engaged US Security Associates for risk management services. The company's expertise in identifying and mitigating risks helped the client in improving its operational efficiency.

Conclusion

In conclusion, US Security Associates stock presents a compelling investment opportunity. With a strong market presence, a diversified service portfolio, and a strategic expansion plan, the company is well-positioned to continue its growth trajectory. As the security industry continues to evolve, US Security Associates is poised to play a leading role, making it an attractive investment for investors seeking long-term returns.

new york stock exchange