Understanding the US Capital Stock Age: A Comprehensive Guide

author:US stockS -

In the ever-evolving landscape of the American economy, the concept of "US capital stock age" plays a crucial role in assessing the health and efficiency of businesses. This article delves into what the capital stock age is, its significance, and how it impacts the overall economic landscape.

What is the US Capital Stock Age?

The US capital stock age refers to the average age of the physical assets, such as machinery, equipment, and buildings, that businesses use in their operations. It is a measure of the age of the capital stock in a country's economy. By understanding the age of these assets, policymakers, investors, and businesses can gain insights into the state of the economy and make informed decisions.

Significance of the US Capital Stock Age

Economic Growth: A younger capital stock age often indicates a growing economy. Newer assets are more efficient, productive, and capable of generating higher output. This can lead to increased economic growth and job creation.

Productivity: The age of capital stock is closely linked to productivity. Older assets tend to be less efficient and more prone to breakdowns, leading to reduced productivity. Conversely, newer assets can significantly boost productivity, leading to higher profits and competitiveness.

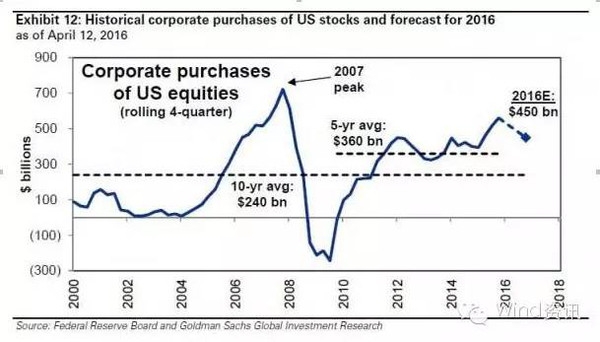

Investment: The capital stock age provides valuable information to investors. A younger capital stock age suggests that businesses are investing in new technologies and equipment, which can be a positive sign for future growth and profitability.

Innovation: A younger capital stock age often correlates with higher levels of innovation. Businesses with newer assets are more likely to adopt new technologies and practices, leading to innovation and improved competitiveness.

Impact of the US Capital Stock Age on the Economy

Manufacturing: The manufacturing sector is heavily reliant on capital stock. A younger capital stock age in this sector can lead to increased production capacity, higher quality products, and improved efficiency.

Technology: The technology sector is characterized by rapid innovation. A younger capital stock age in this sector can lead to the development of new products, services, and business models.

Energy: The energy sector's capital stock age can impact energy production and efficiency. Upgrading older assets can lead to increased energy output and reduced emissions.

Case Studies

Apple Inc.: Apple is known for its focus on innovation and investing in new technologies. Its younger capital stock age has allowed the company to maintain its position as a market leader in the technology sector.

General Electric (GE): GE has faced challenges due to its aging capital stock. The company has been investing in new technologies and upgrading its assets to improve efficiency and competitiveness.

Conclusion

Understanding the US capital stock age is crucial for assessing the health and efficiency of businesses and the overall economy. By focusing on upgrading and investing in new technologies, businesses can drive economic growth, improve productivity, and maintain a competitive edge.

new york stock exchange