US Stock Index Performance: A Comprehensive Analysis

author:US stockS -

In today's fast-paced financial world, understanding the performance of stock indexes is crucial for investors and traders alike. The US stock market, being one of the most influential in the world, offers several key indexes that serve as barometers for the overall market trends. This article provides a comprehensive analysis of the US stock index performance, highlighting the factors that drive these trends and offering insights for investors.

Dow Jones Industrial Average (DJIA): The Blue-Chip Benchmark

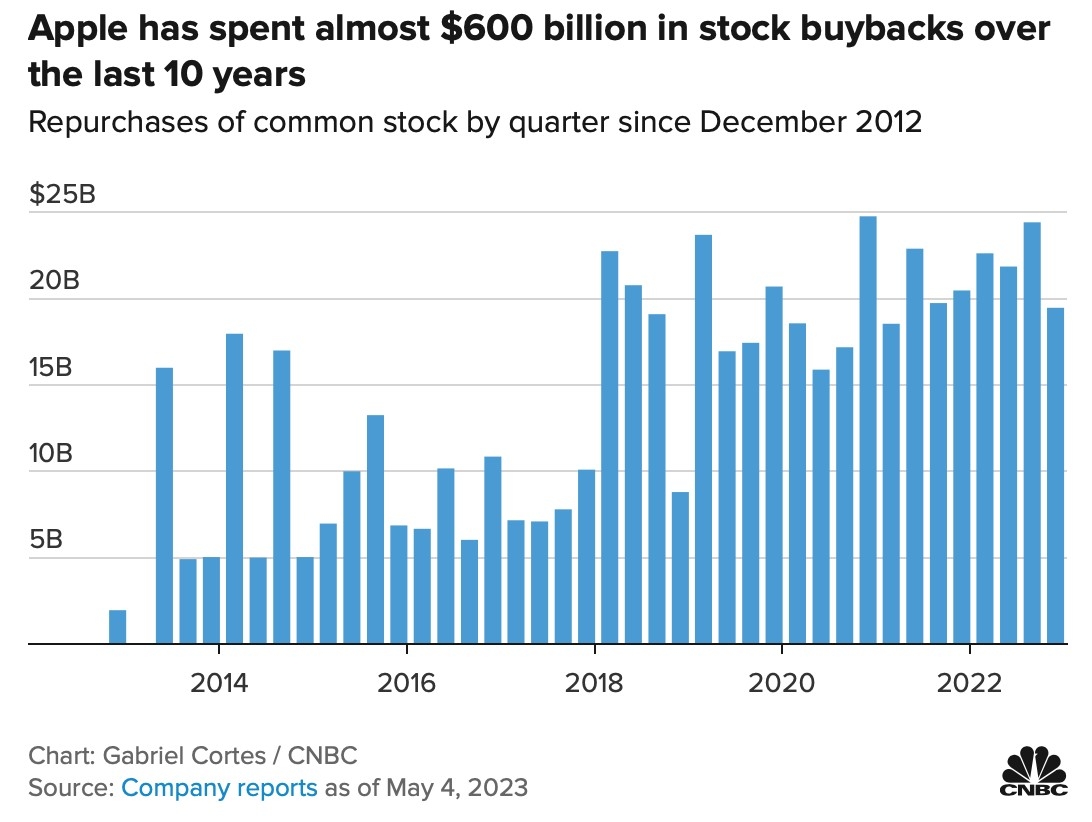

The Dow Jones Industrial Average (DJIA) is one of the most recognized and followed stock indexes in the world. It consists of 30 large, publicly-owned companies across various sectors, including technology, financials, and healthcare. Over the past few years, the DJIA has shown remarkable resilience, with its performance largely driven by the tech sector, particularly giants like Apple and Microsoft.

In 2021, the DJIA reached an all-time high, driven by a strong economic recovery post-pandemic and robust earnings reports from its constituent companies. However, it faced challenges in 2022 due to rising inflation and supply chain disruptions. Despite these headwinds, the DJIA has managed to maintain a positive performance, largely due to its diversified nature.

Standard & Poor's 500 Index (S&P 500): The Broad Market Gauge

The Standard & Poor's 500 Index (S&P 500) is another key indicator of the US stock market's performance. It includes 500 of the largest publicly-traded companies in the United States, representing a wide range of industries and market capitalizations. The S&P 500 is often considered a more accurate reflection of the overall market than the DJIA, as it covers a broader range of companies.

In recent years, the S&P 500 has been driven by strong corporate earnings and a robust economic outlook. However, the index faced challenges in 2022 due to concerns about inflation and geopolitical tensions. Despite these challenges, the S&P 500 has remained relatively stable, offering investors a diversified portfolio with exposure to a wide range of industries.

Nasdaq Composite Index: The Tech-Driven Leader

The Nasdaq Composite Index is another significant indicator of the US stock market's performance, particularly in the technology sector. It includes all domestic and international common stocks listed on the Nasdaq Stock Market. The Nasdaq Composite has seen significant growth in recent years, driven by the surge in technology stocks like Apple, Amazon, and Google's parent company, Alphabet.

However, the Nasdaq Composite faced a challenging 2022, with tech stocks experiencing a significant pullback due to concerns about rising interest rates and inflation. Despite these challenges, the index has managed to maintain a positive performance, reflecting the strong fundamentals of the tech sector.

Impact of Economic Factors on Stock Index Performance

Several economic factors influence the performance of US stock indexes. These include:

- Interest Rates: Rising interest rates can negatively impact stock prices, as they increase borrowing costs for companies and reduce the value of future earnings.

- Inflation: High inflation can erode purchasing power and reduce corporate profits, negatively impacting stock prices.

- Geopolitical Tensions: Tensions between major economies can lead to uncertainty in the markets, affecting stock index performance.

Case Study: The Impact of the Pandemic on US Stock Indexes

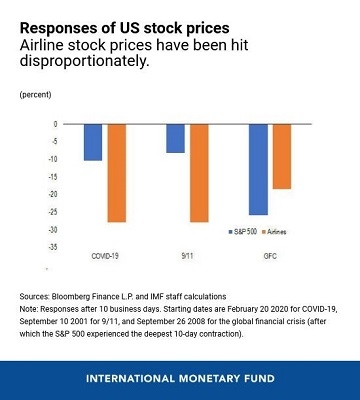

The COVID-19 pandemic had a profound impact on the US stock market, with indexes like the DJIA, S&P 500, and Nasdaq Composite experiencing significant volatility. However, they ultimately recovered and reached new highs in 2021, driven by strong corporate earnings and a robust economic recovery.

The pandemic highlighted the importance of diversification in investment portfolios, as different sectors responded differently to the crisis. For example, technology stocks performed well during the pandemic, while sectors like energy and financials faced significant challenges.

Conclusion

Understanding the performance of US stock indexes is crucial for investors and traders looking to navigate the complex financial markets. By analyzing factors like economic conditions, corporate earnings, and geopolitical tensions, investors can gain valuable insights into market trends and make informed investment decisions.

new york stock exchange