US Momentum Stocks Breakout: Unleashing the Power of Growth

author:US stockS -

In the ever-evolving landscape of the stock market, identifying and capitalizing on momentum stocks can be a game-changer for investors. The phrase "US momentum stocks breakout" refers to the surge in share prices of companies that are experiencing rapid growth and are poised to outperform the market. In this article, we'll delve into what drives these stocks, how to spot them, and why they can be a golden opportunity for investors.

Understanding Momentum Stocks

Momentum stocks are typically characterized by their strong upward price movement over a short period. This upward trend is often fueled by positive news, strong earnings reports, or a buzz surrounding the company. These stocks are often in the growth phase, with high expectations of future profits and expansion.

Key Factors Driving Momentum Stocks

Several factors contribute to the rise of momentum stocks:

- Earnings Reports: Companies with impressive earnings reports tend to see a surge in their stock price. This is especially true if the earnings beat market expectations.

- Positive News: Any positive news, such as a major contract win, product launch, or merger announcement, can send a stock's price soaring.

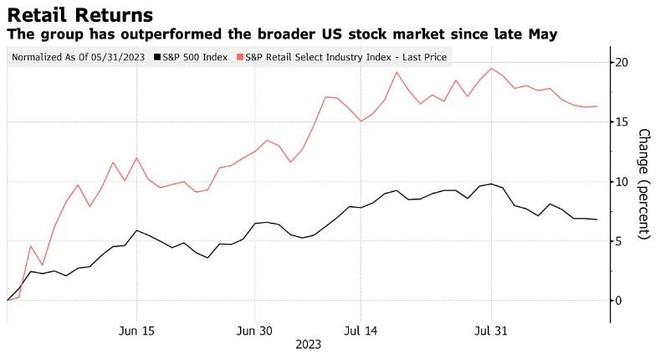

- Sector Outperformance: Stocks from sectors that are outperforming the market can attract momentum traders looking to capitalize on growth trends.

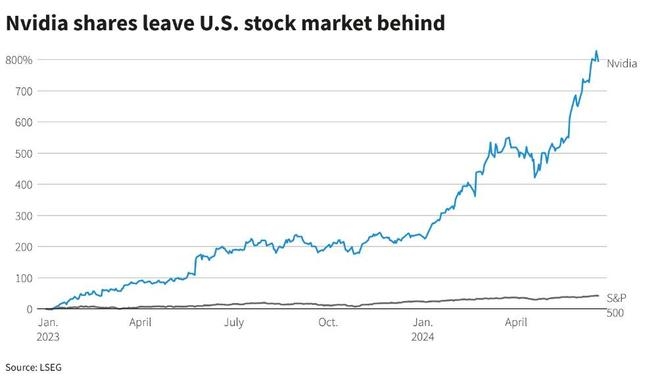

- Technological Advancements: Companies at the forefront of technological innovation often see a significant increase in their stock price.

Spotting a Momentum Stock Breakout

Identifying a momentum stock breakout requires a keen eye and a solid understanding of market trends. Here are some key indicators to look out for:

- Strong Price Momentum: A stock with a consistent upward trend over a short period is a strong candidate for a breakout.

- Volume Spikes: An increase in trading volume often accompanies a stock's breakout, indicating strong interest from investors.

- Technical Analysis: Technical indicators such as moving averages, RSI (Relative Strength Index), and MACD (Moving Average Convergence Divergence) can provide valuable insights into a stock's momentum.

- Fundamental Analysis: Analyzing a company's financial health and growth prospects can help determine if its momentum is sustainable.

Case Study: Tesla (TSLA)

A prime example of a momentum stock breakout is Tesla (TSLA). Over the past few years, Tesla has experienced a meteoric rise in its stock price, driven by factors such as strong earnings reports, positive news, and the company's leadership in the electric vehicle market. Its stock price has surged multiple times, showcasing the power of momentum stocks.

Capitalizing on Momentum Stocks

Investors looking to capitalize on momentum stocks should keep the following in mind:

- Risk Management: It's crucial to manage risk when investing in momentum stocks, as their rapid price movements can be unpredictable.

- Exit Strategy: Have a clear exit strategy in place to avoid holding onto a stock for too long and potentially losing out on gains.

- Diversification: Diversifying your portfolio can help mitigate the risk associated with investing in momentum stocks.

Conclusion

US momentum stocks breakout presents a unique opportunity for investors to capitalize on rapid growth and potentially earn significant returns. By understanding the factors driving these stocks and knowing how to spot a breakout, investors can make informed decisions and maximize their chances of success. However, it's essential to approach these investments with caution and a well-thought-out strategy.

new york stock exchange