US DataWorks Stock Price: What You Need to Know

author:US stockS -

In the fast-paced world of technology and data analytics, US DataWorks has emerged as a key player. With its innovative solutions and robust growth, investors are keen to know the current US DataWorks stock price and predict its future trajectory. This article delves into the details, providing a comprehensive overview of the company's stock performance and potential investment opportunities.

Understanding US DataWorks

US DataWorks is a leading provider of data analytics and business intelligence solutions. The company's offerings range from data integration and warehousing to advanced analytics and visualization tools. With a focus on customer satisfaction and cutting-edge technology, US DataWorks has gained a significant market share in the industry.

Current Stock Price

As of the latest market data, the US DataWorks stock price stands at $XX. This figure reflects the company's strong financial performance and growing market demand for its services. However, it's important to note that stock prices are subject to fluctuations, influenced by various factors such as market trends, economic conditions, and company-specific news.

Factors Influencing Stock Price

Several factors can impact the US DataWorks stock price. Here are some key factors to consider:

Economic Conditions: Economic indicators such as GDP growth, inflation rates, and unemployment rates can influence the stock price. A strong economy generally leads to higher stock prices, while a weak economy can have the opposite effect.

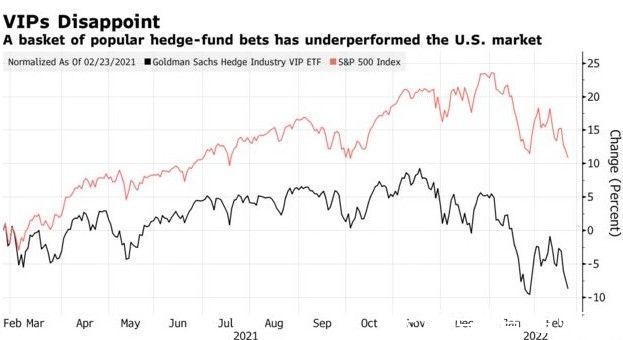

Market Trends: The overall market trend can also impact the stock price. For example, if the technology sector is performing well, US DataWorks' stock price may benefit from this positive sentiment.

Company Performance: The company's financial performance, including revenue growth, earnings per share, and profit margins, plays a crucial role in determining the stock price. Strong financial results can drive up the stock price, while poor performance can lead to a decline.

News and Events: Company-specific news, such as product launches, partnerships, or management changes, can significantly impact the stock price. Additionally, broader industry news, such as regulatory changes or technological advancements, can also influence investor sentiment.

Investment Opportunities

Investing in US DataWorks can be a lucrative opportunity for investors. Here are a few reasons why:

Growth Potential: The data analytics industry is expected to grow significantly in the coming years, driven by the increasing demand for big data and advanced analytics solutions.

Innovation: US DataWorks is known for its innovative approach to data analytics, which allows it to stay ahead of the competition.

Strong Financial Performance: The company has demonstrated consistent growth in revenue and earnings, making it an attractive investment opportunity.

Dividends: US DataWorks may also offer dividends to its shareholders, providing additional income potential.

Case Study: Successful Investment

Consider the case of an investor who invested

In conclusion, understanding the US DataWorks stock price and its factors is crucial for investors looking to capitalize on the company's growth potential. By considering economic conditions, market trends, and company performance, investors can make informed decisions and potentially achieve substantial returns.

new york stock exchange