Title: Do Global Stocks Outperform US Treasury Bills?

author:US stockS -

Introduction:

Investors often face the age-old debate of whether to invest in global stocks or U.S. Treasury bills. Both have their own set of advantages and risks, and the answer largely depends on an individual's investment goals and risk tolerance. In this article, we will explore the performance of global stocks compared to U.S. Treasury bills and help you make an informed decision.

Understanding Global Stocks

Global stocks refer to shares of companies based in various countries around the world. Investing in global stocks can provide diversification, exposure to different economies, and the potential for higher returns. However, it also comes with increased risk due to political, economic, and currency fluctuations.

Understanding U.S. Treasury Bills

U.S. Treasury bills are short-term government securities with maturities of one year or less. They are considered to be one of the safest investments available, as they are backed by the full faith and credit of the U.S. government. The main advantage of U.S. Treasury bills is their low risk, but they also offer lower returns compared to other investments.

Comparing Performance

When comparing the performance of global stocks to U.S. Treasury bills, it is essential to consider historical data. Over the long term, global stocks have historically outperformed U.S. Treasury bills. This is primarily due to the higher growth potential of stocks, which tend to offer higher returns over time.

For instance, between 1990 and 2020, the MSCI ACWI Index, which tracks global stocks, returned an average of 6.7% annually, while the U.S. 10-year Treasury yield averaged around 2.6%. This indicates that global stocks have the potential to generate higher returns compared to U.S. Treasury bills.

Risks to Consider

While global stocks may offer higher returns, they also come with higher risks. Investors should be aware of the following risks:

- Political and Economic Risks: Global stocks are exposed to political and economic risks in various countries, including political instability, economic downturns, and trade disputes.

- Currency Fluctuations: Investing in foreign stocks can be affected by currency fluctuations, which can impact the returns of the investment.

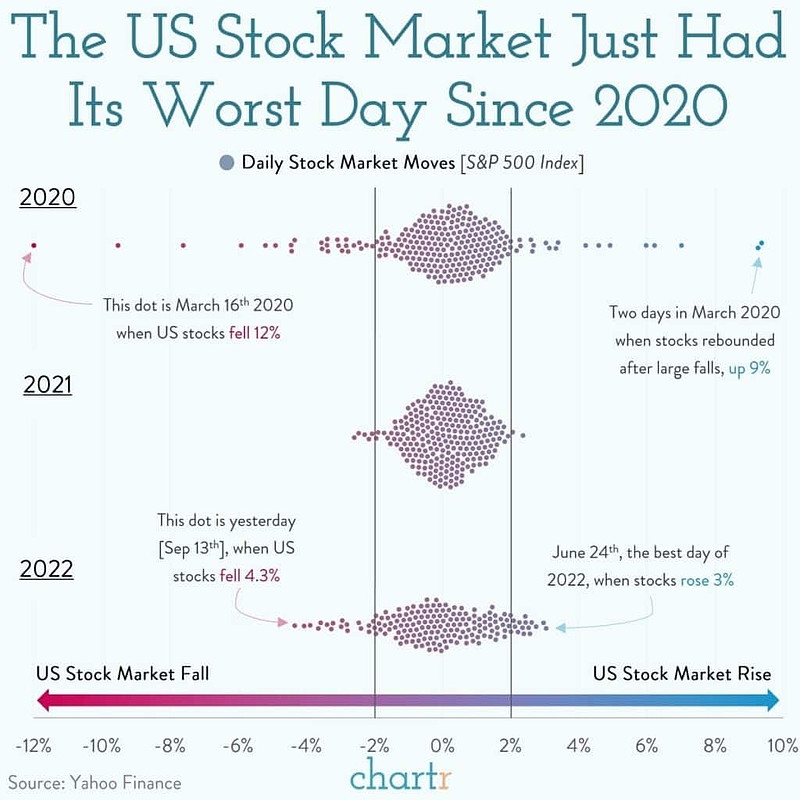

- Market Volatility: Global stocks are subject to market volatility, which can lead to significant price fluctuations.

Conclusion

In conclusion, while U.S. Treasury bills offer a safe and stable investment, global stocks have historically outperformed them in terms of returns. However, it is crucial to consider the risks associated with global stocks, such as political and economic uncertainties and currency fluctuations. Investors should carefully assess their risk tolerance and investment goals before deciding on the appropriate investment strategy.

Remember, diversification is key to managing risk and achieving long-term investment success. By allocating a portion of your portfolio to global stocks, you can potentially enhance your returns while mitigating risk.

new york stock exchange