Stocks After US Election: Key Insights and Implications

author:US stockS -

The U.S. election results have the potential to significantly impact the stock market. As investors await the final tally, it's essential to understand the potential implications for various sectors and asset classes. This article delves into the key insights and potential outcomes for stocks in the wake of the election.

Impact on Different Sectors

Technology Stocks

Technology stocks have been a major driver of the stock market's growth in recent years. With the election results, there may be mixed implications for this sector. If the incumbent party wins, there is a possibility of continued support for tech innovation and growth. However, if the opposing party secures a victory, there could be increased scrutiny and regulation on tech giants.

Energy Sector

Energy stocks are expected to face a different set of challenges post-election. If the incumbent party wins, there may be continued efforts to support renewable energy and reduce dependence on fossil fuels. Conversely, if the opposing party wins, there could be a push for increased investment in oil and gas, potentially benefiting energy stocks.

Financial Sector

Financial stocks are often sensitive to political changes. If the incumbent party wins, there may be continued support for the current regulatory environment. However, if the opposing party wins, there could be calls for stricter regulations, which could negatively impact financial stocks.

Impact on Asset Classes

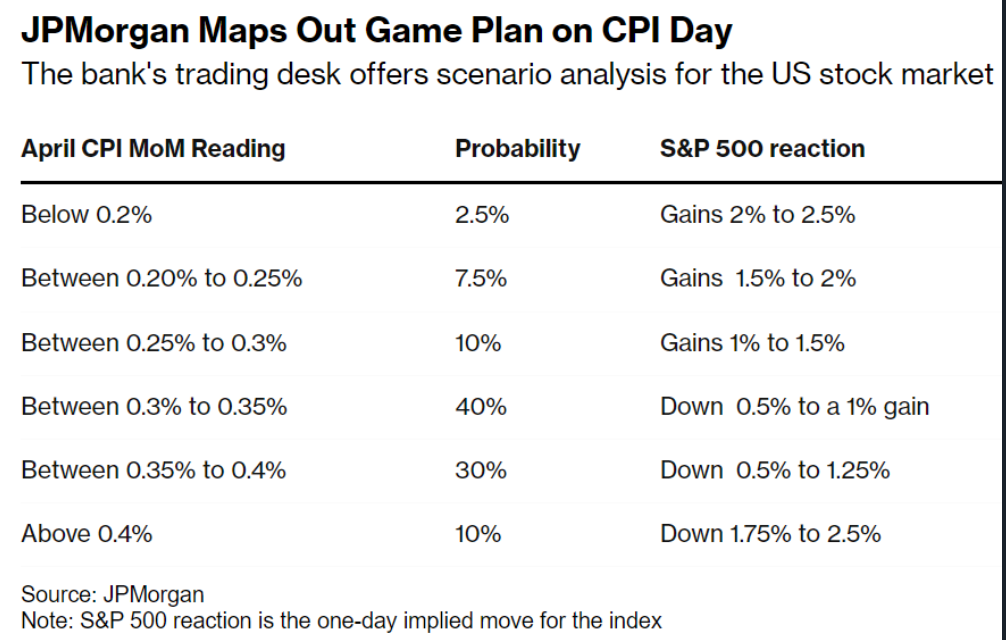

Stock Market Indices

The election results are likely to have a significant impact on stock market indices. If the incumbent party wins, there may be a positive reaction, as investors may expect continued economic growth and stability. However, if the opposing party wins, there could be increased uncertainty and volatility in the market.

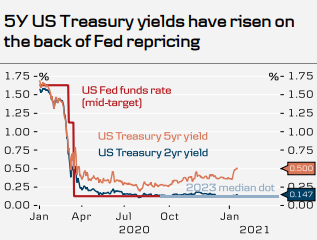

Bonds

Bonds may also be affected by the election results. If the incumbent party wins, there may be a decrease in bond yields, as investors may expect lower interest rates. However, if the opposing party wins, there could be an increase in bond yields, as investors may expect higher interest rates.

Cryptocurrencies

Cryptocurrencies have been a popular investment option in recent years. The election results could have a mixed impact on this asset class. If the incumbent party wins, there may be increased regulation, which could negatively impact cryptocurrencies. However, if the opposing party wins, there could be a push for greater acceptance and innovation in the crypto space.

Case Studies

To illustrate the potential impact of the election results on stocks, let's consider a few case studies:

Case Study 1: Tech Giant

Company X, a leading tech giant, has seen significant growth over the past few years. If the incumbent party wins, investors may expect continued support for tech innovation, leading to further growth in the company's stock price. However, if the opposing party wins, investors may anticipate increased regulation, potentially leading to a decline in the company's stock price.

Case Study 2: Oil and Gas Company

Company Y, an oil and gas company, has faced challenges due to the recent downturn in the energy sector. If the incumbent party wins, investors may expect continued support for renewable energy, potentially leading to a decline in the company's stock price. However, if the opposing party wins, investors may anticipate increased investment in oil and gas, potentially leading to a rise in the company's stock price.

In conclusion, the U.S. election results have the potential to significantly impact the stock market. Understanding the potential implications for different sectors and asset classes is crucial for investors as they navigate the post-election landscape.

new york stock exchange