Owning Us Stocks in RRSP: A Smart Investment Strategy

author:US stockS -

In today's volatile financial landscape, finding the right investment can be a daunting task. However, owning stocks in a Registered Retirement Savings Plan (RRSP) can be a wise and strategic move for many investors. In this article, we'll explore the benefits of owning US stocks within your RRSP and how it can help you secure a prosperous retirement.

Understanding RRSPs

Firstly, let's clarify what an RRSP is. An RRSP is a tax-advantaged savings account designed to help Canadians save for retirement. Contributions to an RRSP are tax-deductible, meaning you can reduce your taxable income in the year you make the contribution. The funds grow tax-free until you withdraw them, typically in retirement.

The Advantages of Owning US Stocks in RRSP

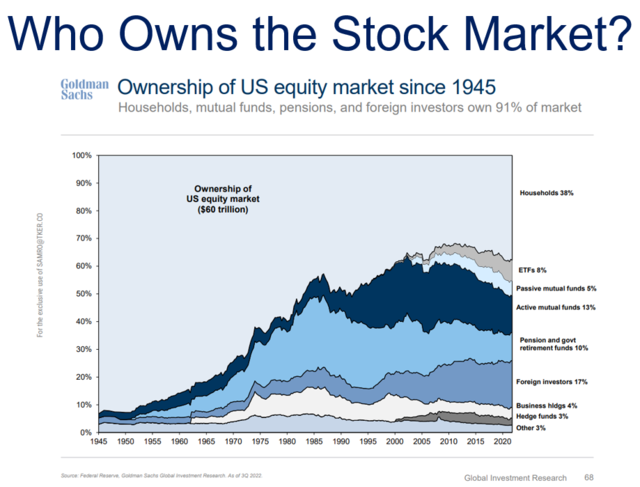

Diversification: One of the key benefits of owning US stocks in your RRSP is diversification. By investing in a variety of companies across different industries and geographical locations, you can reduce your exposure to market volatility. The US stock market, being one of the largest and most robust in the world, offers a wide range of investment opportunities.

Potential for Higher Returns: The US stock market has historically provided higher returns compared to the Canadian market. This is due to several factors, including a larger number of companies, more innovation, and a stronger economy. By investing in US stocks, you can potentially benefit from these higher returns.

Currency Exposure: Investing in US stocks can also offer currency exposure. If the Canadian dollar strengthens against the US dollar, your investments will be worth more in Canadian currency when you convert them back. Conversely, if the Canadian dollar weakens, your investments may be worth less. This can be a double-edged sword, so it's important to consider your risk tolerance.

Tax Benefits: As mentioned earlier, contributions to an RRSP are tax-deductible. This means you can reduce your taxable income, potentially lowering your overall tax burden. Additionally, when you withdraw funds from your RRSP in retirement, the income is taxed at your marginal tax rate, which may be lower than your current rate.

Case Study: XYZ Corporation

Let's consider a hypothetical example. John, a 40-year-old Canadian, decides to invest

Conclusion

Owning US stocks in your RRSP can be a smart investment strategy that offers numerous benefits, including diversification, potential for higher returns, and tax advantages. However, it's important to conduct thorough research and consider your risk tolerance before making any investment decisions. By understanding the advantages and potential risks, you can make informed decisions that align with your retirement goals.

new york stock exchange