Is Today a Good Day to Buy Stocks?

author:US stockS -

In the world of finance, the question "is today a good day to buy stocks" is often met with varying opinions. Whether you're a seasoned investor or just starting out, understanding the market and its trends is crucial. This article delves into the factors you should consider to determine if today is indeed the right time to invest in the stock market.

Market Trends and Indicators

To begin with, it's essential to look at the current market trends and indicators. The stock market is influenced by various factors such as economic data, political events, and global trends. Historical data shows that certain periods are more favorable for investing than others.

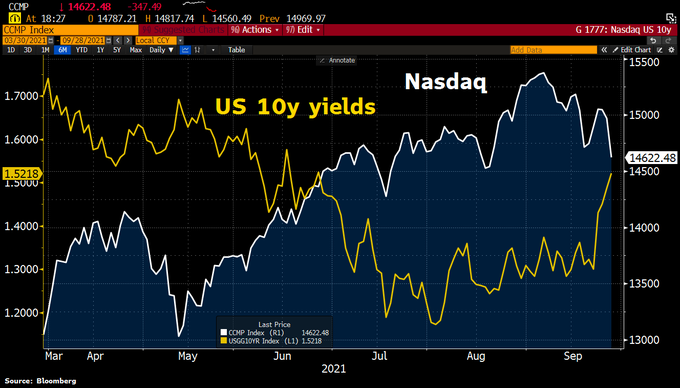

One key indicator is the S&P 500 Index, which tracks the performance of 500 large companies. A rising index suggests a strong market, while a falling index indicates a bearish trend. Additionally, interest rates and inflation can significantly impact the stock market. Higher interest rates can lead to higher borrowing costs, affecting corporate earnings, while inflation can erode purchasing power.

Sector Performance

Another important factor to consider is the performance of different sectors. Some sectors may be outperforming others, indicating potential for higher returns. For instance, technology and healthcare sectors have been known to outperform during certain economic cycles.

Dividend Yields

Investors often look for stocks with high dividend yields, as they provide a steady stream of income. Dividend yields are calculated by dividing the annual dividend per share by the stock's current price. Higher yields can be a sign of a more secure investment, especially in times of market uncertainty.

Company Financials

Analyzing the financials of individual companies is also crucial. Look for companies with strong earnings growth, low debt levels, and good cash flow. Companies with a strong foundation are more likely to weather market downturns and provide long-term returns.

Economic Factors

Economic factors, such as GDP growth, unemployment rates, and inflation, can also influence the stock market. For instance, a strong GDP growth can indicate a healthy economy, which is typically good for stocks. Conversely, high unemployment rates or rising inflation can signal a weak economy and a bearish market.

Market Sentiment

Lastly, market sentiment plays a significant role in determining whether today is a good day to buy stocks. Sentiment can be influenced by various factors, including news, rumors, and investor psychology. It's important to avoid making investment decisions based solely on sentiment, as it can lead to emotional investing.

Case Studies

To illustrate these points, let's consider a few case studies. During the 2008 financial crisis, many investors were hesitant to buy stocks. However, those who did and stayed invested saw significant returns over the long term. Similarly, during the tech boom of the 1990s, investors who invested in technology stocks reaped substantial gains.

Conclusion

In conclusion, determining whether today is a good day to buy stocks requires careful analysis of various factors, including market trends, sector performance, company financials, economic indicators, and market sentiment. By considering these factors, investors can make informed decisions and potentially achieve long-term success in the stock market.

new york stock exchange