Current US Stock Market Sentiment: A Deep Dive

author:US stockS -

In the ever-evolving landscape of the financial world, understanding the current US stock market sentiment is crucial for investors and market enthusiasts alike. The sentiment reflects the mood of the market, encompassing both optimism and pessimism, which can significantly impact investment decisions. This article delves into the latest trends, factors influencing the sentiment, and provides insights for those looking to navigate the stock market effectively.

Market Trends and Current Sentiment

The current US stock market sentiment has been shaped by a multitude of factors, including economic data, geopolitical events, and corporate earnings reports. As of the latest updates, the market sentiment is cautiously optimistic. This sentiment is largely driven by strong corporate earnings, low inflation, and the Fed's dovish stance on interest rates.

Economic Data and Corporate Earnings

Economic data, such as GDP growth, unemployment rates, and inflation figures, play a significant role in shaping the current US stock market sentiment. In recent months, the US economy has shown robust growth, with low unemployment rates and moderate inflation. This economic stability has contributed to the positive market sentiment.

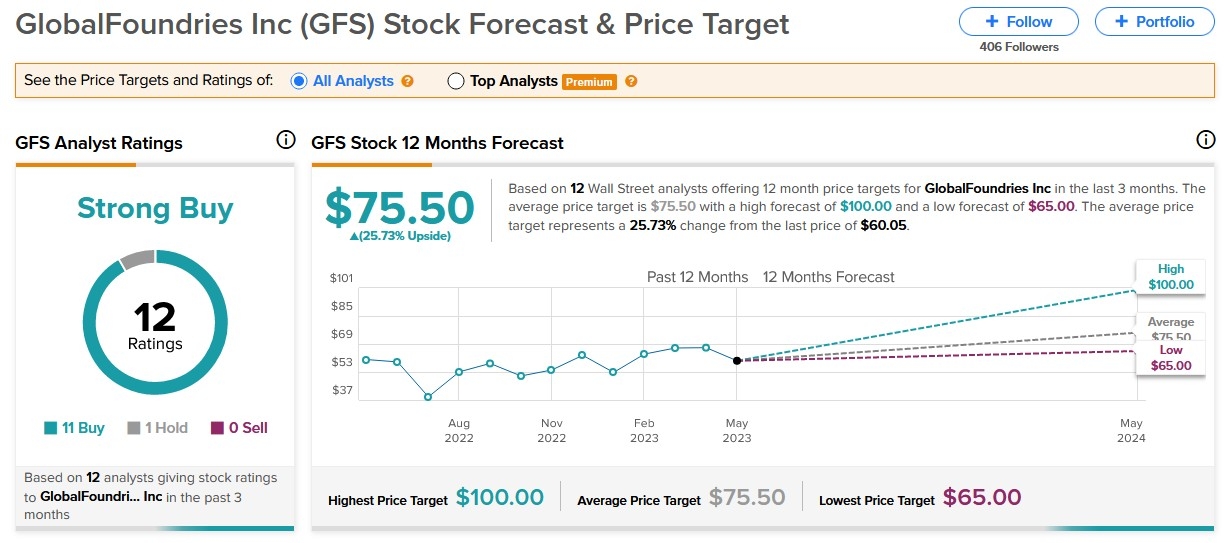

Corporate earnings have also played a pivotal role in shaping the market sentiment. Many companies have reported strong earnings, leading to increased investor confidence. This trend is expected to continue in the coming quarters, further bolstering the positive sentiment.

Geopolitical Events and Global Impact

Geopolitical events, such as trade tensions and political instability, can have a profound impact on the current US stock market sentiment. In recent times, the US-China trade tensions have been a significant source of uncertainty in the market. However, recent negotiations and trade agreements have provided some relief, leading to a more optimistic outlook.

The global impact of these events is also a crucial factor to consider. For instance, the COVID-19 pandemic has caused disruptions across the globe, impacting various sectors of the economy. However, the market has shown resilience, with certain sectors, such as technology and healthcare, performing well.

Inflation and Interest Rates

Inflation and interest rates are key factors that influence the current US stock market sentiment. The Federal Reserve has been closely monitoring inflation and has shown a dovish stance on interest rates. This has provided investors with confidence, as lower interest rates make borrowing cheaper and encourage spending.

Case Studies: Sector Performance

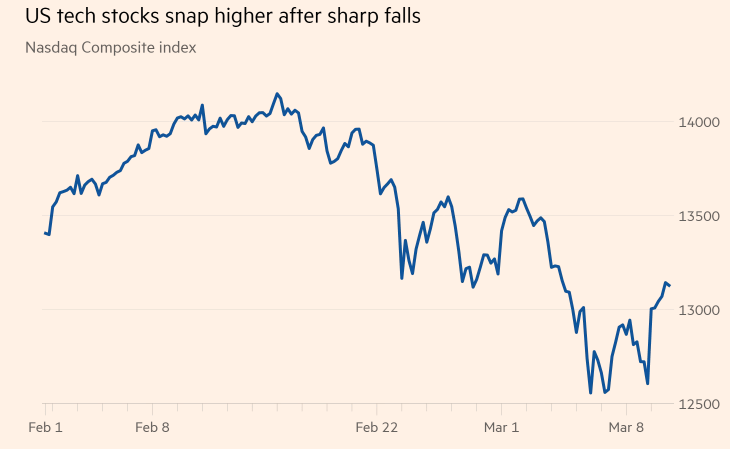

To better understand the current US stock market sentiment, let's take a look at some case studies of sector performance. The technology sector has been a standout performer, driven by strong demand for digital services and increased remote work. Similarly, the healthcare sector has seen significant growth, thanks to the pandemic's impact on the healthcare industry.

On the other hand, sectors like energy and financials have been under pressure, due to the global economic slowdown and trade tensions. However, investors remain optimistic about the long-term prospects of these sectors.

Conclusion

Understanding the current US stock market sentiment is essential for investors looking to make informed decisions. By analyzing the factors influencing the sentiment, investors can better navigate the market and identify potential opportunities. As the market continues to evolve, staying informed and adapting to changing trends will be key to success.

new york stock exchange