Can You Invest in US Stocks from Australia?

author:US stockS -

Investing in US stocks has always been a dream for many Australians. With the global market becoming more accessible, the question of whether you can invest in US stocks from Australia is a common one. The answer is a resounding yes, and in this article, we'll explore how you can do it, the benefits, and the potential risks involved.

Understanding the Basics

To invest in US stocks from Australia, you need to follow a few steps. Firstly, you'll need a brokerage account that allows international trading. Some popular options for Australians include E*TRADE, TD Ameritrade, and Charles Schwab. These platforms offer a range of tools and resources to help you research and manage your investments.

How to Get Started

Open a Brokerage Account: Choose a brokerage that offers international trading and open an account. You'll need to provide personal details, proof of identity, and bank account information.

Fund Your Account: Transfer funds from your Australian bank account to your new brokerage account. The transfer can be done through wire transfer or an international bank transfer.

Research and Select Stocks: Use the research tools provided by your brokerage to identify US stocks that align with your investment goals and risk tolerance.

Place a Trade: Once you've selected a stock, place a buy or sell order through your brokerage platform.

Benefits of Investing in US Stocks from Australia

Diversification: Investing in US stocks allows you to diversify your portfolio beyond Australian markets, reducing your exposure to local economic and market risks.

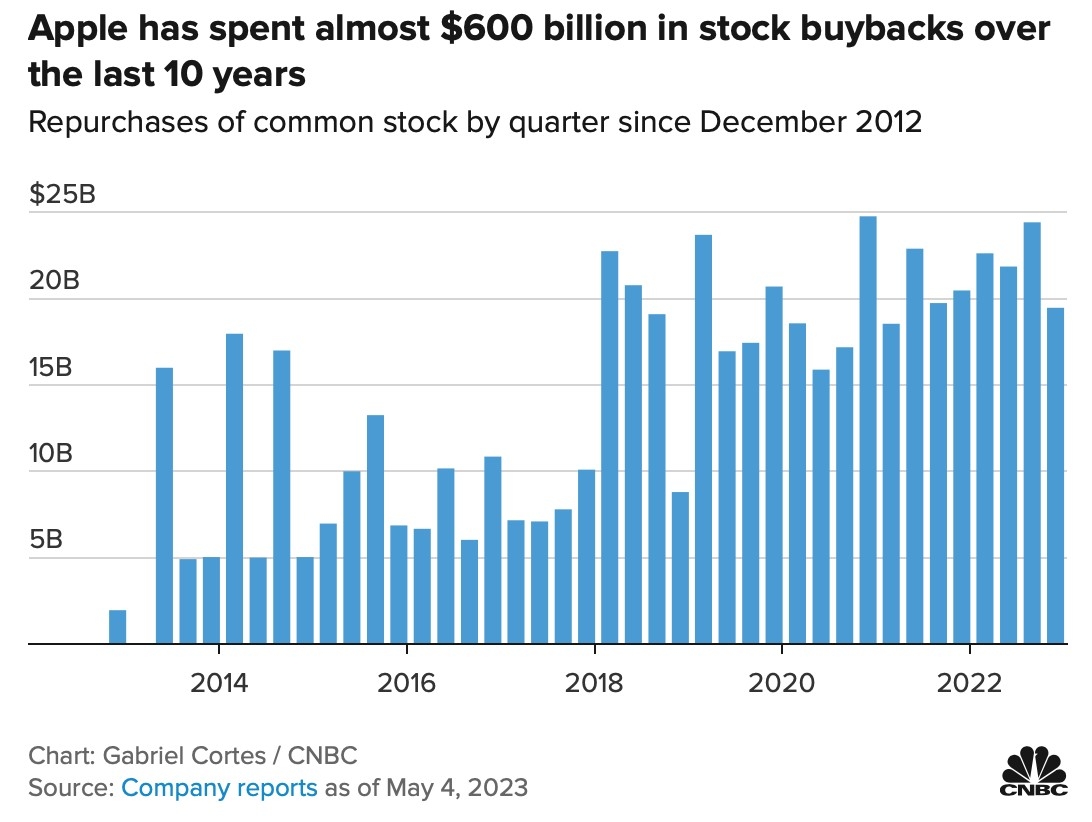

Access to World-Class Companies: The US stock market is home to some of the world's largest and most successful companies, such as Apple, Google, and Microsoft.

Potential for Higher Returns: Over the long term, the US stock market has historically offered higher returns than many other markets.

Tax Advantages: Depending on your tax situation, investing in US stocks from Australia may offer certain tax advantages.

Risks to Consider

Currency Fluctuations: Exchange rate fluctuations can impact the value of your investments when converted back to Australian dollars.

Regulatory Differences: Understanding the regulatory differences between Australia and the US is crucial to avoid any legal issues.

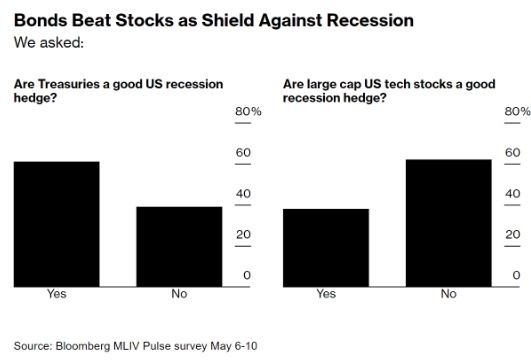

Market Volatility: The US stock market can be highly volatile, and your investments may experience significant fluctuations in value.

Case Study: Investing in US Stocks from Australia

Let's consider the case of Sarah, an Australian investor who opened a brokerage account with E*TRADE to invest in US stocks. She started with a small amount and gradually increased her investment as her confidence grew. By diversifying her portfolio with US stocks, Sarah was able to achieve higher returns than she would have with Australian investments alone.

Conclusion

Investing in US stocks from Australia is a viable option for many investors. By following the right steps and understanding the potential risks, you can build a diversified and potentially profitable investment portfolio. Remember to research thoroughly and consult with a financial advisor before making any investment decisions.

new york stock exchange