Unlocking the Potential of Sym US Stock: A Comprehensive Guide

author:US stockS -

Are you intrigued by the opportunities that the U.S. stock market offers? If so, you've come to the right place. In this article, we'll delve into the world of Sym US stock, exploring its potential, key factors to consider, and how to make informed investment decisions. Whether you're a seasoned investor or just starting out, this guide will equip you with the knowledge you need to navigate the U.S. stock market effectively.

Understanding Sym US Stock

First and foremost, it's crucial to understand what Sym US stock represents. Sym, short for symbol, refers to the unique identifier assigned to a particular stock on the U.S. stock exchange. This symbol helps investors easily identify and track the performance of a specific company's stock.

Key Factors to Consider When Investing in Sym US Stock

When evaluating Sym US stock, there are several key factors to consider:

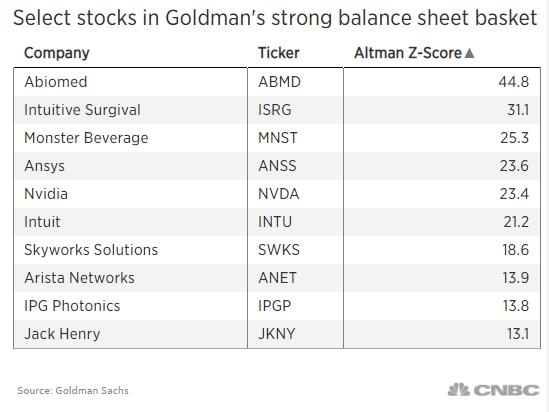

- Company Financials: Analyzing a company's financial statements, including its income statement, balance sheet, and cash flow statement, can provide valuable insights into its financial health and stability.

- Sector and Industry Performance: Understanding the broader sector and industry in which a company operates can help you gauge its potential for growth and profitability.

- Market Trends: Keeping an eye on market trends and economic indicators can provide a broader context for your investment decisions.

- Management and Corporate Governance: Assessing the quality of a company's management team and its corporate governance practices can help you determine the company's long-term viability.

How to Make Informed Investment Decisions

To make informed investment decisions, it's essential to:

- Do Your Research: Conduct thorough research on the company, its industry, and the broader market. This may involve reading financial reports, news articles, and other relevant sources.

- Set Clear Investment Goals: Define your investment goals, whether they are long-term growth, income generation, or capital preservation.

- Diversify Your Portfolio: Diversifying your investments across different sectors, industries, and asset classes can help reduce risk and enhance returns.

- Stay Informed: Keep up-to-date with market trends, economic indicators, and company news that may impact your investments.

Case Study: Sym US Stock Success Story

Consider the case of Company X, a tech company listed on the NASDAQ exchange. Over the past five years, Sym US stock has experienced significant growth, outperforming the broader market. This success can be attributed to several factors:

- Innovative Products: Company X has consistently introduced innovative products that have captured the market's attention.

- Strong Financial Performance: The company has demonstrated robust financial performance, with consistent revenue growth and profitability.

- Effective Management: Company X's management team has proven to be adept at navigating the challenges of the tech industry.

Conclusion

Investing in Sym US stock can be a rewarding endeavor, but it requires careful research and analysis. By understanding the key factors to consider, setting clear investment goals, and staying informed, you can make informed investment decisions and potentially reap the benefits of the U.S. stock market.

can foreigners buy us stocks