Undervalued US Stocks: A Treasure Trove for Investors

author:US stockS -

Investing in the stock market can be a rollercoaster ride, filled with ups and downs. However, identifying undervalued stocks can be a game-changer for investors looking to capitalize on market inefficiencies. This article delves into the world of undervalued US stocks, highlighting key strategies to uncover hidden gems and discussing potential opportunities in today's volatile market.

What are Undervalued Stocks?

Undervalued stocks are shares that are trading below their intrinsic value, as determined by fundamental analysis. This discrepancy can arise due to market sentiment, temporary setbacks, or a lack of awareness about a company's true potential. Investors who can spot these opportunities can benefit from significant returns when the market eventually corrects itself.

Strategies to Identify Undervalued Stocks

1. Fundamental Analysis

The cornerstone of identifying undervalued stocks lies in thorough fundamental analysis. This involves evaluating a company's financial statements, business model, management team, and industry position. Key metrics to consider include:

- Price-to-Earnings (P/E) Ratio: A P/E ratio below the industry average can indicate undervaluation.

- Price-to-Book (P/B) Ratio: A P/B ratio below 1 suggests that the market values the company's assets less than their book value.

- Earnings Growth: Companies with strong and consistent earnings growth may be undervalued if the market is underrating their potential.

2. Technical Analysis

In addition to fundamental analysis, technical analysis can provide valuable insights into undervalued stocks. This involves studying stock charts and identifying patterns, trends, and support/resistance levels. Some popular technical indicators include:

- Moving Averages: Overlapping moving averages can indicate a potential undervaluation.

- Bollinger Bands: A stock trading below the lower Bollinger Band may be undervalued.

- Volume: Increased trading volume during price weakness can indicate investor sentiment and potential undervaluation.

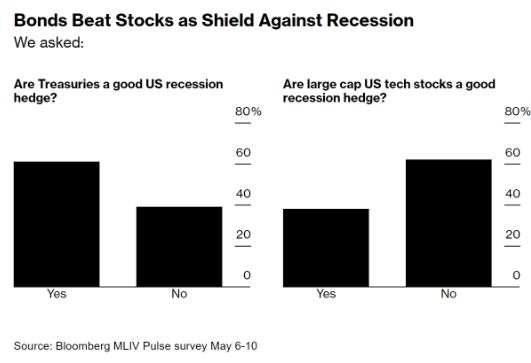

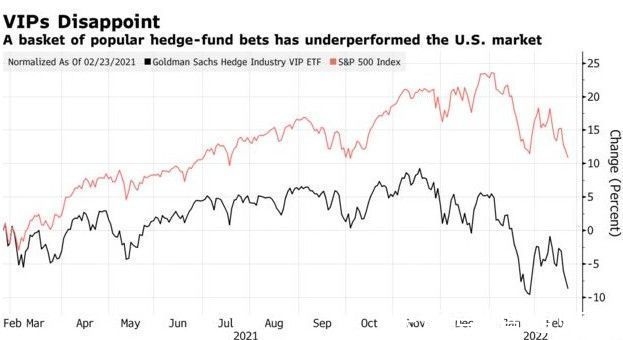

3. Market Sentiment Analysis

Understanding market sentiment is crucial when searching for undervalued stocks. Negative news or market trends can cause stocks to be unfairly priced. By staying informed about market sentiment and identifying potential catalysts for change, investors can uncover undervalued stocks.

Case Studies

Case Study 1: Tesla (TSLA)

Tesla has been a hot topic in the market, with its stock experiencing significant volatility. Despite its high market capitalization, some investors argue that Tesla remains undervalued based on its strong growth prospects and innovation in the electric vehicle (EV) market. Its forward P/E ratio is above 200, which some consider to be a sign of undervaluation, especially considering the company's impressive revenue growth.

Case Study 2: NVIDIA (NVDA)

NVIDIA, a leader in graphics processing units (GPUs), has been a standout performer in the tech industry. Its stock has seen a remarkable rally in recent years, but some investors believe it still has room to grow. With a P/E ratio of around 50, some analysts argue that NVIDIA remains undervalued considering its strong fundamentals and potential for continued growth.

Conclusion

Investing in undervalued US stocks requires patience, research, and a keen understanding of market dynamics. By combining fundamental and technical analysis, and keeping a close eye on market sentiment, investors can uncover hidden gems and potentially reap substantial returns. Whether it's Tesla or NVIDIA, the key is to stay informed and stay disciplined.

can foreigners buy us stocks